Bitcoin’s March madness: Short-term holders bear the brunt of volatility

Quick Take

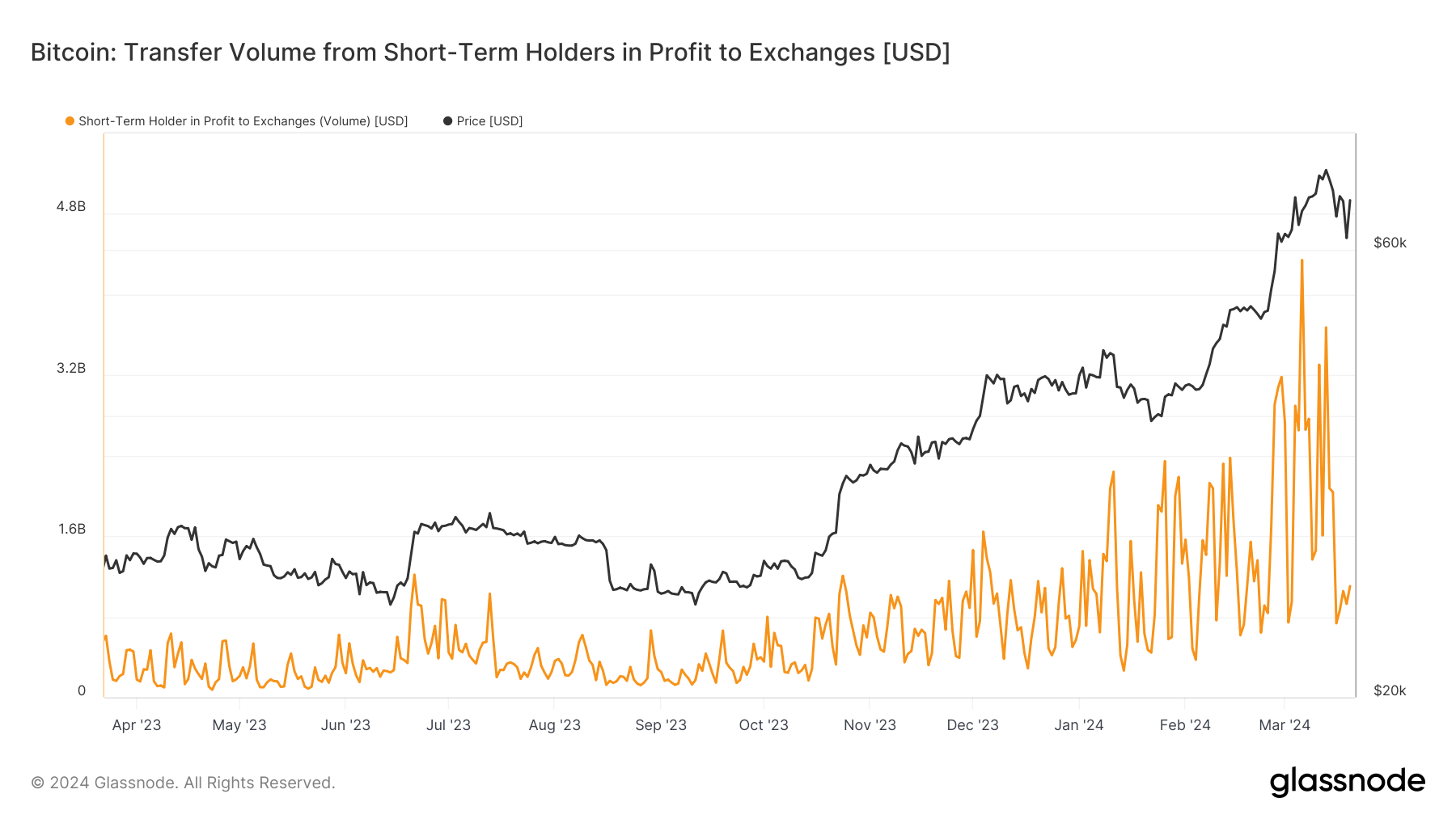

March has proven to be a tumultuous month for Bitcoin, showcasing fluctuations from an opening at roughly $61,000 to a steady rise above $67,000. Despite this progress, the path was not without its challenges. On March 20, Bitcoin experienced a notable decline to $60,700, marking an 18% fall from its peak above $73,000.

The Rollercoaster Ride

Bitcoin, the world’s leading cryptocurrency, has always been known for its volatile nature. March was no exception, as the digital asset saw sharp swings in its price over the course of the month. The beginning of the month seemed promising, with Bitcoin climbing above $67,000. However, this bullish trend was short-lived, as the cryptocurrency took a sudden nosedive on March 20, dropping to $60,700 in a matter of hours.

Short-term holders of Bitcoin were undoubtedly the most affected by this rollercoaster ride. Those who bought in at the peak of over $73,000 found themselves facing significant losses in a matter of days. The sudden price drop took many by surprise, highlighting the unpredictable nature of the cryptocurrency market.

The Aftermath

As Bitcoin continues to navigate through its volatile journey, one thing remains certain – uncertainty. The cryptocurrency market is notoriously unpredictable, with prices fluctuating rapidly based on a variety of factors. Short-term holders are particularly vulnerable to these fluctuations, as they often lack the patience and long-term view needed to weather the storm.

It is essential for investors to have a clear strategy in place when dealing with volatile assets like Bitcoin. Short-term trading can be lucrative, but it also comes with a high level of risk. Those looking to invest in cryptocurrency should do their research, set realistic expectations, and be prepared for the ups and downs that come with it.

Impact on Individuals

For individual investors in Bitcoin, the recent volatility serves as a harsh reminder of the risks involved in the cryptocurrency market. Short-term holders, in particular, may have experienced significant losses during the March madness. It is crucial for individuals to assess their risk tolerance and investment goals before diving into the world of cryptocurrency.

Global Implications

Bitcoin’s March madness not only affects individual investors but also has broader implications on the global financial landscape. The cryptocurrency market plays a significant role in the world economy, with Bitcoin often serving as a barometer for market sentiment. The volatile nature of Bitcoin can have ripple effects on other asset classes and markets worldwide, highlighting the interconnectedness of the global financial system.

Conclusion

In conclusion, Bitcoin’s March madness has been a stark reminder of the risks and rewards of investing in cryptocurrency. Short-term holders bore the brunt of the volatility, highlighting the importance of having a clear investment strategy and risk management plan. As Bitcoin continues on its volatile journey, it is crucial for investors to remain vigilant and informed to navigate the unpredictable waters of the cryptocurrency market.