Bitcoin long traders still leveraged at over $40 billion notional value above $50k

The Current State of Bitcoin Derivatives Trading

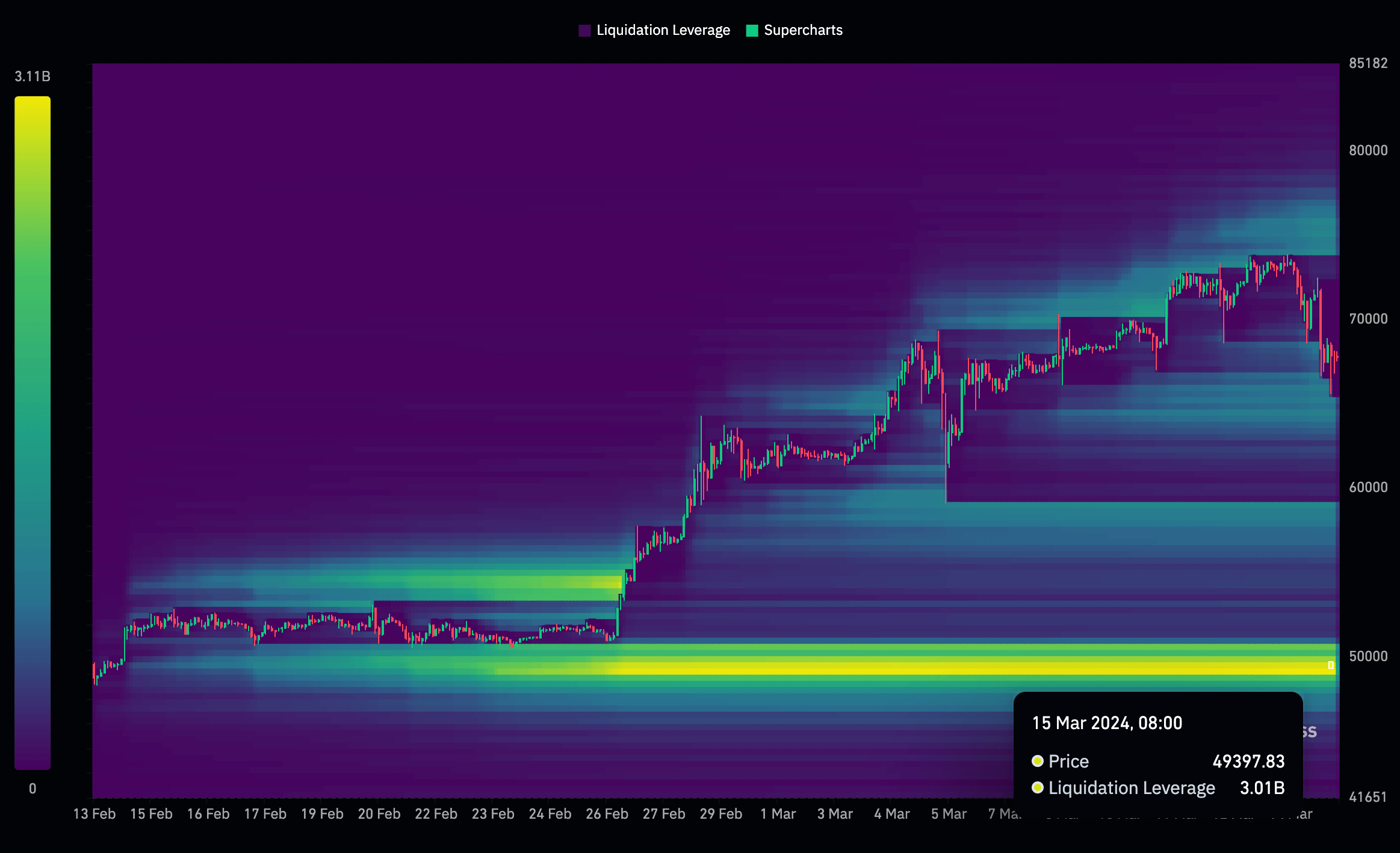

Recent data from Coinglass has revealed that the total notional value of leveraged long Bitcoin derivatives traders remains above $40 billion, despite a series of liquidations that have occurred in the market. Short positions are primarily concentrated above $71,000, with a total notional value of approximately $12 billion. The overall open interest in futures contracts stands at $35 billion, while options contracts hold $31 billion.

Market Insights and Implications

These figures provide valuable insights into the current state of the Bitcoin derivatives market. The concentration of short positions above $71,000 suggests that traders are expecting a downward movement in the price of Bitcoin. However, the fact that long traders are still heavily leveraged above $50,000 indicates a strong belief in the potential for the price of Bitcoin to surpass this key level.

Despite the recent liquidations that have occurred in the market, traders continue to maintain significant leverage in their positions. This could result in increased volatility and potential price swings in the Bitcoin market in the coming days.

How This Will Affect Me

As a trader or investor in the cryptocurrency market, the high levels of leverage seen in Bitcoin derivatives trading could have a direct impact on your portfolio. Increased volatility and price swings in the market could lead to unexpected losses or gains, depending on the direction of the price movement.

How This Will Affect the World

The continuation of high leverage in Bitcoin derivatives trading not only affects individual traders but also has broader implications for the cryptocurrency market as a whole. Increased volatility and large liquidations could potentially impact market sentiment and lead to a more cautious approach from institutional investors and regulators.

Conclusion

In conclusion, the latest data on Bitcoin derivatives trading reveals the significant levels of leverage still present in the market. Traders’ positions above key price levels indicate diverging views on the future direction of Bitcoin’s price. As this trend continues, it is important for traders and investors to closely monitor market developments and adjust their strategies accordingly to mitigate potential risks.