Embracing a New Era of Investor Sentiment

The Shift in Grayscale Bitcoin Trust (GBTC) Outflows

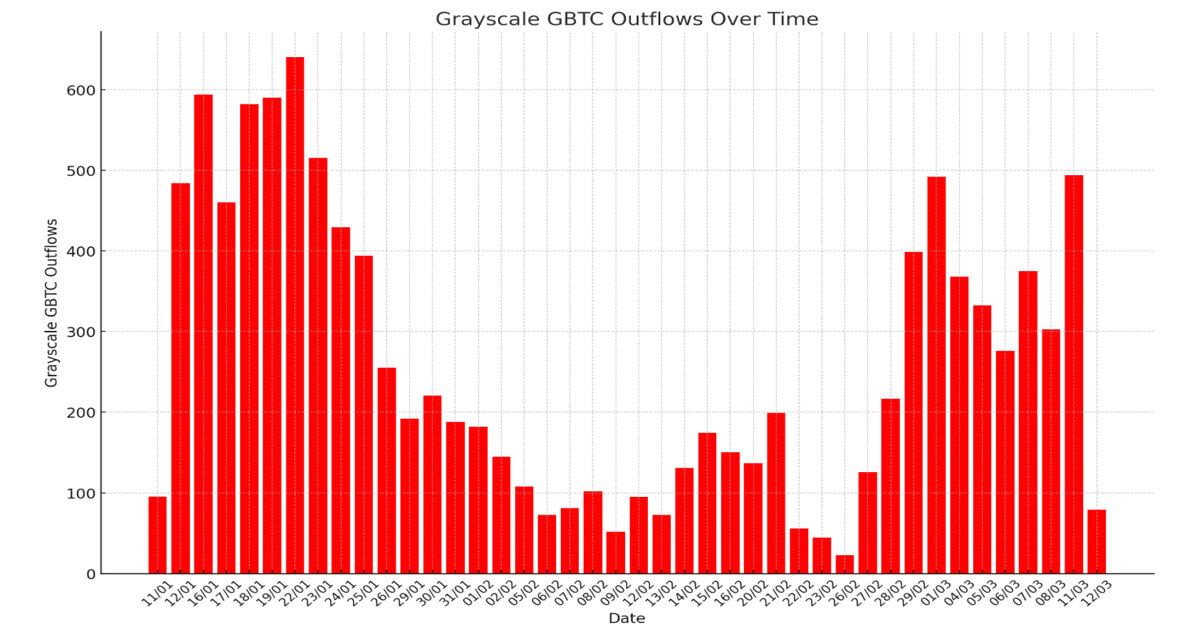

Grayscale Bitcoin Trust (GBTC) has recently experienced a potential shift in investor sentiment, marking a significant turning point in the world of cryptocurrency investment. On March 12, outflows from GBTC plummeted to just $79 million, a stark contrast to the substantial outflows seen in previous weeks and months. This sudden change in behavior suggests a newfound confidence and optimism among investors, as they navigate the volatile landscape of digital assets.

Understanding the Data

For months, investors have been closely monitoring the movements of GBTC, a popular investment vehicle that tracks the price of Bitcoin. The consistent outflows from the trust signaled a lack of conviction among investors, who were hesitant to commit to the volatile cryptocurrency market. However, the recent decrease in outflows points to a potential shift in sentiment, as investors become more comfortable with the idea of holding onto their assets for the long term.

The Impact of Mini BTC ETF Filing

One possible explanation for this shift in investor behavior could be the filing for a mini Bitcoin exchange-traded fund (ETF), which has garnered significant attention in the market. This new development has provided investors with an alternative way to invest in Bitcoin, potentially alleviating some of the concerns surrounding GBTC. As a result, we are seeing a more positive outlook among investors, as they explore new opportunities in the cryptocurrency space.

Looking Ahead

As we continue to monitor the evolving landscape of cryptocurrency investment, it is clear that investor sentiment plays a crucial role in shaping market dynamics. The recent decrease in GBTC outflows serves as a reminder that market conditions can change quickly, and that staying informed is essential for making sound investment decisions. With optimism on the rise, we can expect to see a renewed sense of enthusiasm and confidence among investors, as they navigate the exciting and unpredictable world of digital assets.

How This Will Affect Me

As an individual investor, the shift in sentiment surrounding GBTC could potentially impact your investment strategy and decision-making process. With a more positive outlook from the market, you may feel more confident in holding onto your assets and exploring new opportunities in the cryptocurrency space. It is important to stay informed and educated about market developments, to ensure that you are making informed decisions that align with your financial goals.

How This Will Affect the World

The changing investor sentiment around GBTC reflects a broader shift in the cryptocurrency market, as investors become more comfortable with the idea of holding digital assets for the long term. This positive outlook could have ripple effects across the financial world, as more individuals and institutions embrace the potential of cryptocurrencies as a viable investment option. As the market continues to evolve, we can expect to see a greater integration of digital assets into traditional financial systems, paving the way for a new era of economic growth and innovation.

Conclusion

As we witness a significant decrease in outflows from Grayscale Bitcoin Trust (GBTC), we are entering a new era of investor sentiment that promises to reshape the world of cryptocurrency investment. With optimism on the rise and new opportunities emerging in the market, it is essential for investors to stay informed and adaptable in order to navigate this ever-changing landscape successfully.