Record highs, sharp drops, and rapid recovery trigger $1 billion market liquidation

An unprecedented rollercoaster ride for Bitcoin

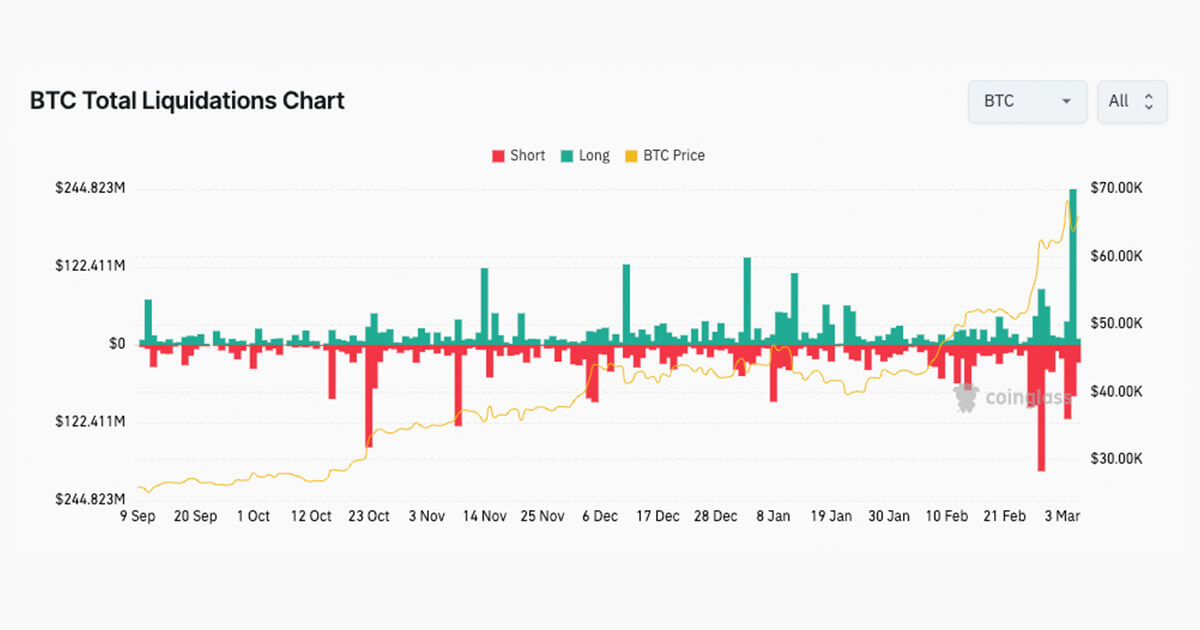

In an extraordinary 24-hour period, Bitcoin soared to a new all-time peak of around $69,200, then experienced a rapid sell-off, dropping the price to near $59,500. Following this tumultuous drop, Bitcoin has since rebounded and is now stabilizing at approximately $67,000. This precarious and sudden market volatility triggered a widespread liquidation event within the cryptocurrency market.

Market reactions and implications

The sudden drop in Bitcoin price to near $59,500 led to a cascade of liquidations, totaling over $1 billion. Traders who took highly leveraged positions faced margin calls and were forced to sell their assets at a loss, further exacerbating the price decline. This chain reaction highlighted the risks associated with high leverage trading and brought into question the stability of the cryptocurrency market.

Despite the initial shock, Bitcoin’s ability to bounce back and stabilize around $67,000 showcases the resilience of the cryptocurrency. This rapid recovery may indicate that the market is becoming more mature and capable of withstanding extreme volatility.

Impact on individuals

For individual investors and traders, the recent market turmoil serves as a stark reminder of the risks involved in the cryptocurrency market. Those who engage in high leverage trading need to be especially cautious and be prepared for sudden price fluctuations. It is crucial to have a solid risk management strategy in place to protect your investments from extreme market conditions.

Global implications

On a global scale, the $1 billion market liquidation event triggered by Bitcoin’s sharp drop highlights the interconnectedness of the cryptocurrency market with the broader financial system. The rapid recovery and stabilization of Bitcoin price signal to investors and regulators that the market is evolving and adapting to extreme conditions.

Conclusion

The recent record highs, sharp drops, and rapid recovery of Bitcoin have shaken the cryptocurrency market, leading to a $1 billion liquidation event. Individual investors need to exercise caution and implement risk management strategies to navigate the volatile market conditions. Globally, the resilience of Bitcoin in the face of extreme volatility indicates a maturing market that is capable of weathering sudden price fluctuations.