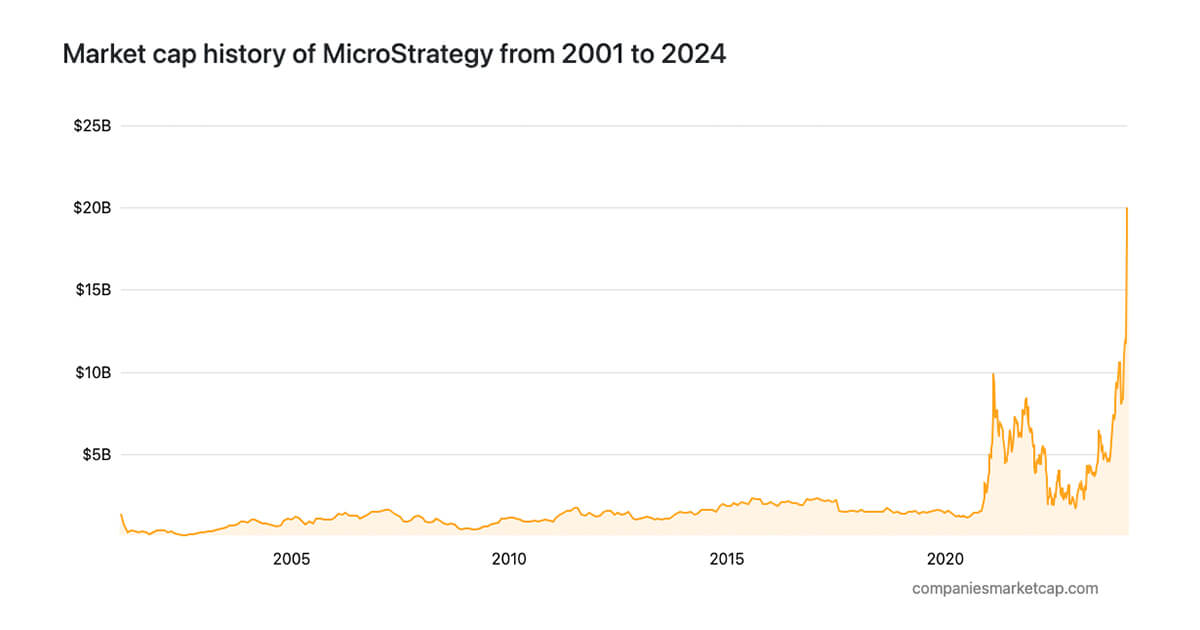

From tech boom to Bitcoin era: MicroStrategy’s journey to a $20 billion market cap

Quick Take on MicroStrategy

MicroStrategy (MSTR), known for its significant bitcoin treasury, has experienced an impressive financial climb, concluding 24% higher after the March 4 close, placing its current trading value at $1,334. MSTR has experienced a remarkable 95% surge year-to-date, outpacing Bitcoin’s 52% appreciation in the same period. This performance, as reported by CompaniesMarketCap, escalates MSTR’s…

MicroStrategy’s Rise in the Tech Industry

MicroStrategy, a leading business intelligence firm, has been making headlines with its strategic move into the world of cryptocurrencies, specifically Bitcoin. With its CEO, Michael Saylor, at the helm, the company has been a trailblazer in adopting digital assets as part of its treasury strategy.

Significance of Bitcoin Treasury

The decision to invest heavily in Bitcoin has paid off for MicroStrategy, as the recent surge in the cryptocurrency market has propelled the company’s stock price to new heights. This move has not only showcased the potential for companies to diversify their treasury holdings but has also set a new standard for corporate financial strategy.

Impact on the Tech and Financial Markets

MicroStrategy’s success story highlights the growing intersection between technology and finance. As digital assets continue to gain traction in mainstream markets, companies like MicroStrategy are paving the way for others to follow suit. This shift towards embracing cryptocurrencies could reshape the traditional financial landscape and open up new opportunities for businesses globally.

How Does This Affect Me?

As an individual investor, the rise of companies like MicroStrategy in the cryptocurrency space could present new investment opportunities. By diversifying your portfolio to include digital assets, you may be able to capitalize on the potential upside of this emerging market trend.

Global Implications

MicroStrategy’s success in leveraging Bitcoin as part of its treasury strategy signals a broader trend towards mainstream adoption of cryptocurrencies. This could have far-reaching effects on the global economy, as more companies explore digital assets as a viable alternative to traditional financial instruments.

Conclusion

In conclusion, MicroStrategy’s journey from the tech boom to the Bitcoin era has been nothing short of extraordinary. By recognizing the potential of digital assets early on, the company has positioned itself as a leader in the evolving financial landscape. As cryptocurrency continues to gain momentum, we can expect to see more companies embracing this new paradigm and reaping the benefits of diversifying their treasury holdings.