Bitcoin passes $65,000 as liquidations surge and halving approaches

Bitcoin’s Resurgence

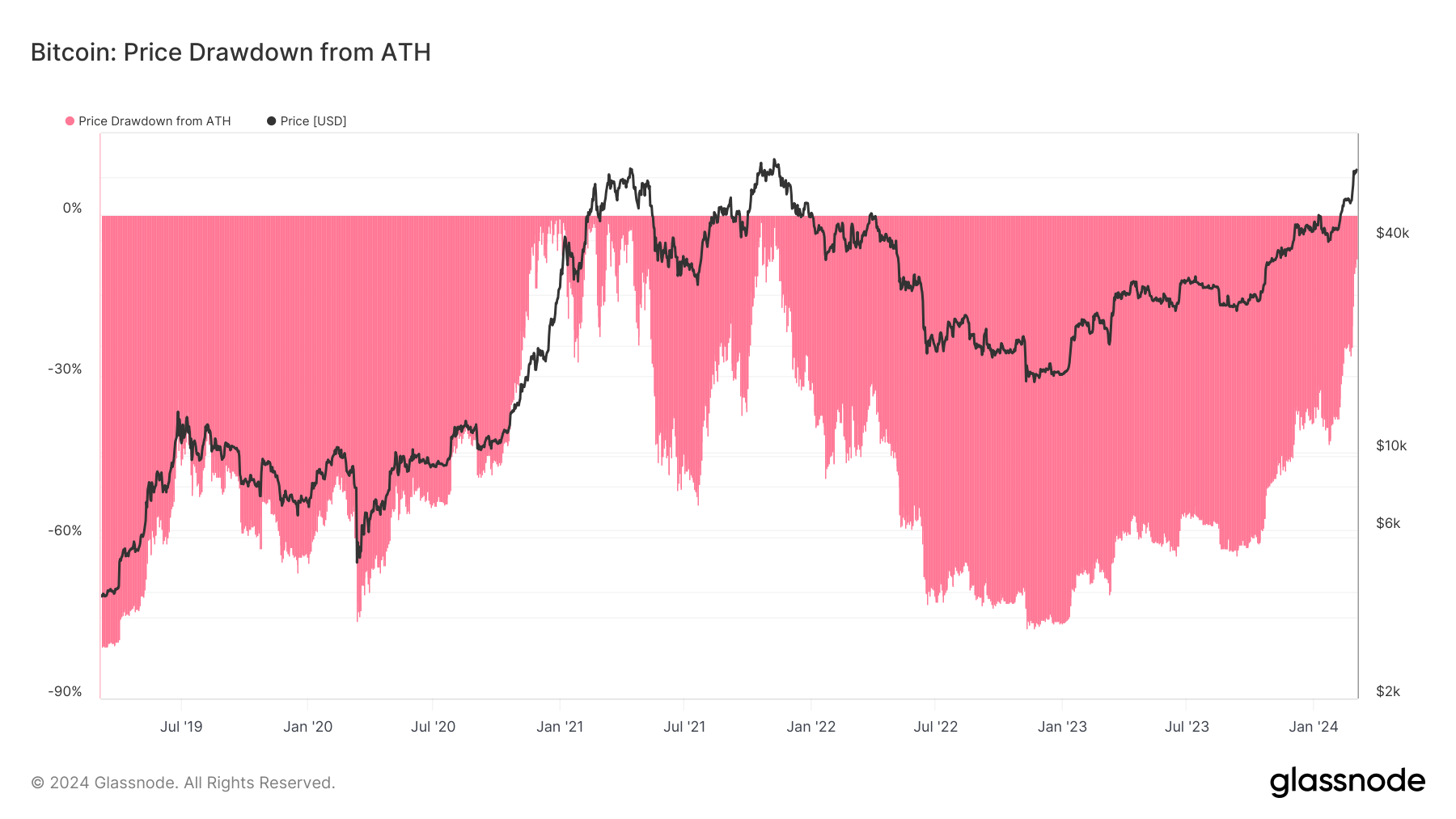

Bitcoin recently reached a year-to-date high of approximately $65,500 during European trading hours. This resurgence brings Bitcoin within 8% of its all-time fiat value high of around $69,000, reached back in November 2021 (around 844 days ago).

Volatility in the Market

However, the journey upward has not been devoid of turbulence. Recent data from Coinglass reveals a surge in liquidations as Bitcoin’s price continues to fluctuate. This volatility has caused uncertainty among investors and traders, with some taking advantage of the situation to capitalize on the market movements.

Halving Approaches

As Bitcoin approaches its halving event, scheduled to occur in the near future, there is speculation about the potential impact on the cryptocurrency’s price. The halving, which reduces the reward for mining new blocks in half, has historically been associated with significant price movements in Bitcoin. Traders and analysts are closely monitoring the situation to gauge the impact on the market.

Effects on Individuals

The recent surge in Bitcoin’s price and increased market activity could have both positive and negative effects on individual investors. Those who have invested in Bitcoin may see an increase in the value of their holdings, potentially leading to significant profits. However, the volatile nature of the market also poses risks, as sharp price fluctuations could result in substantial losses for investors.

Global Impact

Bitcoin’s price movements and market trends have a far-reaching impact on the global economy. As one of the most widely traded cryptocurrencies, Bitcoin plays a significant role in shaping the overall market sentiment and investor behavior. A surge in Bitcoin’s price could signal growing interest in digital assets and blockchain technology, potentially attracting more institutional investors and mainstream adoption.

Conclusion

Bitcoin’s recent price surge to $65,000 amid increased liquidations and approaching halving event reflects the ongoing volatility in the cryptocurrency market. While the surge in price may present opportunities for investors, it also highlights the inherent risks of investing in a highly volatile asset. As Bitcoin continues to capture the attention of investors and traders worldwide, the implications of its price movements extend beyond individual portfolios to impact the broader global economy.