Bitcoin’s Rollercoaster Ride

Embracing the Ups and Downs of Cryptocurrency

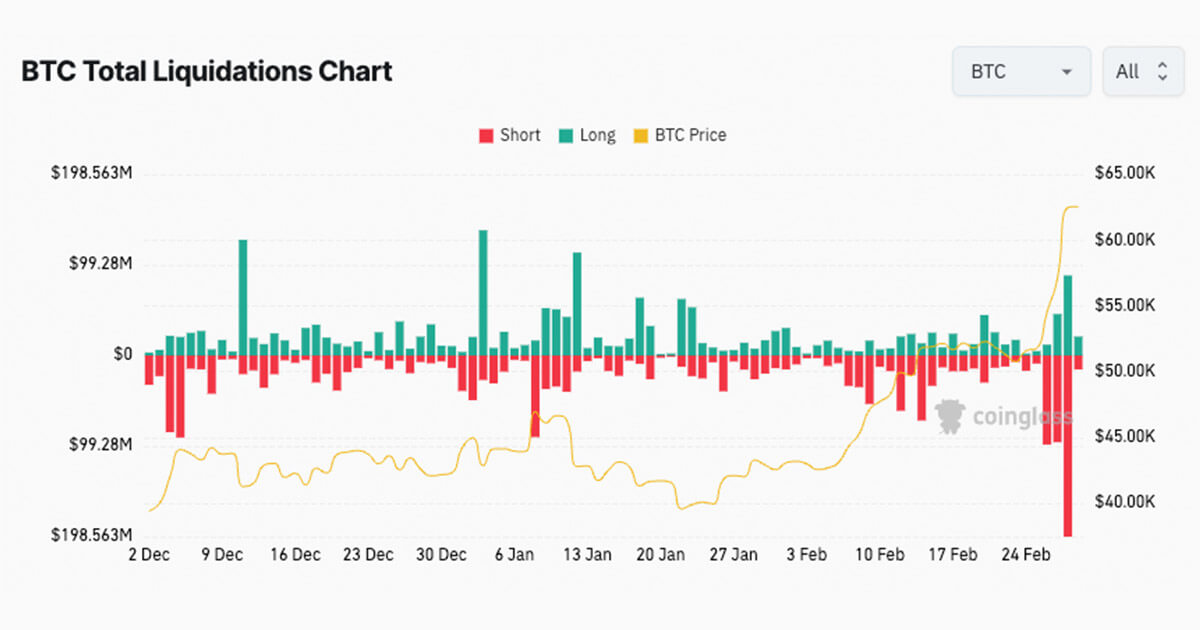

In a wild 24-hour ride, Bitcoin’s value underwent a rollercoaster of fluctuations, skyrocketing to a peak of $64,000, subsequently plunging to $59,000, before making a recovery to above $60,000. This climb triggered a wave of liquidations, totaling roughly $800 million in the digital asset ecosystem, according to Coinglass.

During Bitcoin’s ascent, short positions were liquidated as the price surged, causing panic among investors and traders alike. However, despite the sudden drop in value, Bitcoin managed to hold steady and even saw a recovery back to the $60,000 mark. This resilience in the face of volatility is a testament to the strength and stability of the cryptocurrency market.

The Impact on Individuals

For individuals who are invested in or considering investing in Bitcoin, this rollercoaster ride serves as a reminder of the risks and rewards associated with cryptocurrency. While the sudden fluctuations in value can be unnerving, they also present opportunities for those willing to ride out the storm and take advantage of market movements.

The Impact on the World

On a global scale, the fluctuations in Bitcoin’s value have far-reaching implications for the financial market and economy. The increasing adoption and acceptance of cryptocurrency as a legitimate form of payment and investment are reshaping the way we think about traditional banking and finance. As Bitcoin continues its upward trajectory, it is poised to challenge established financial institutions and revolutionize the way we transact and store value.

In Conclusion

Despite the ups and downs, Bitcoin’s resilience and longevity are undeniable. As we navigate the ever-changing landscape of cryptocurrency, it is crucial to stay informed, vigilant, and adaptable. The future of finance is here, and Bitcoin is leading the way towards a more decentralized and democratized economy.