U.S. leads in Bitcoin price surge as Asia sees decline

Unlocking the mysteries of Bitcoin transactions and working hours

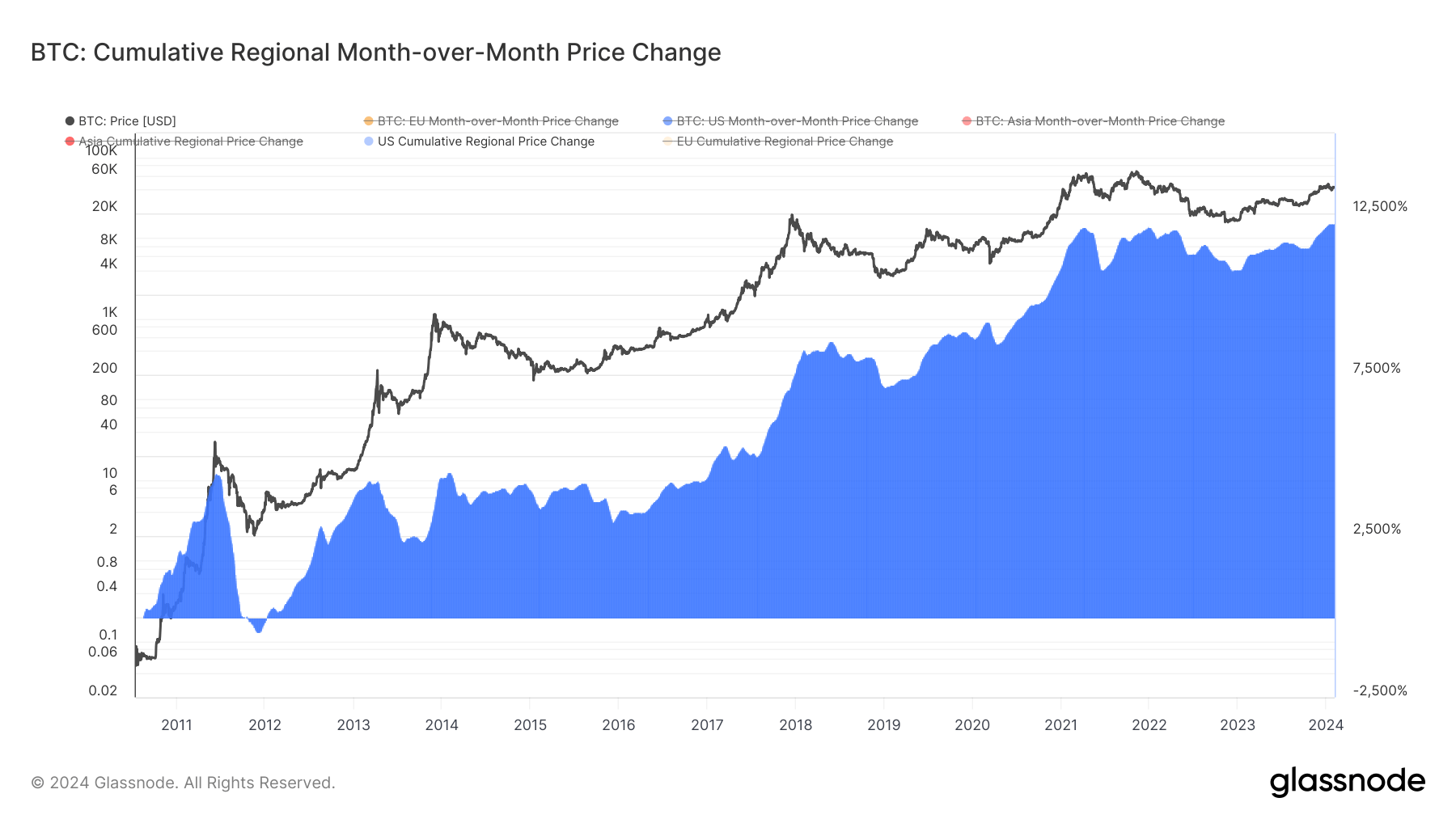

Have you ever wondered how the price of Bitcoin fluctuates during different working hours across major geographical regions? Well, buckle up because we’re about to take a deep dive into this fascinating topic. By analyzing Bitcoin transactions from 8 am to 8 pm Eastern Time, Central European Time, and China Standard Time for the U.S., Europe, and Asia, we can uncover some surprising correlations that may just blow your mind.

The Great Price Disparity

What we discovered through our analysis was truly eye-opening. The U.S. emerged as the leader in Bitcoin price surges during working hours, while Asia experienced a decline in price performance. This stark contrast in price movements between different regions sheds light on the global nature of cryptocurrency markets and the impact of working hours on investor behavior.

As traders in the U.S. start their day and kick off the Bitcoin buying frenzy, prices skyrocket in response to the increased demand. Meanwhile, in Asia, where the working day is coming to a close, we see a decline in Bitcoin prices as traders begin to sell off their assets. This tug-of-war between bullish and bearish sentiment creates a dynamic marketplace where prices are in a constant state of flux.

But what does this all mean for the average investor? How will these price disparities affect individuals and the world at large?

How will this affect me?

For the individual investor, understanding the connection between Bitcoin prices and working hours can provide valuable insights into the best times to buy or sell. By keeping an eye on price trends during different time zones, investors can capitalize on opportunities to maximize their returns.

Additionally, being aware of these price disparities can help investors navigate the volatile nature of cryptocurrency markets and make informed decisions based on market behavior. By staying informed and adapting to changing market conditions, investors can position themselves for success in the world of Bitcoin trading.

How will this affect the world?

On a larger scale, the disparity in Bitcoin price performance across different geographical regions highlights the interconnected nature of global markets. The rise of Bitcoin as a popular investment asset has transcended borders and time zones, creating a truly international marketplace where price movements in one region can have ripple effects around the world.

As the U.S. takes the lead in Bitcoin price surges, it signals a growing interest in cryptocurrency investment among American traders. This increased adoption of Bitcoin in the U.S. could have far-reaching implications for the future of digital currency and its role in the global economy.

In conclusion

So, there you have it – a quirky and humorous take on the fascinating world of Bitcoin transactions and their correlation with working hours. The U.S. may be leading the charge in Bitcoin price surges, but the impact of these price disparities extends far beyond individual investors to the world at large. By understanding these trends and their implications, we can all be better prepared to navigate the ever-changing landscape of cryptocurrency markets.