The Changing Landscape of Long-Term Bitcoin Holders

Bitcoin’s long-term holders (LTHs), those who have held for more than 155 days, have traditionally been seen as the ‘smart money’ in the cryptocurrency space. These experienced individuals have weathered the storms of Bitcoin volatility and have implemented a strategy of buying during price slumps and selling during market euphoria.

A Shift in Strategy

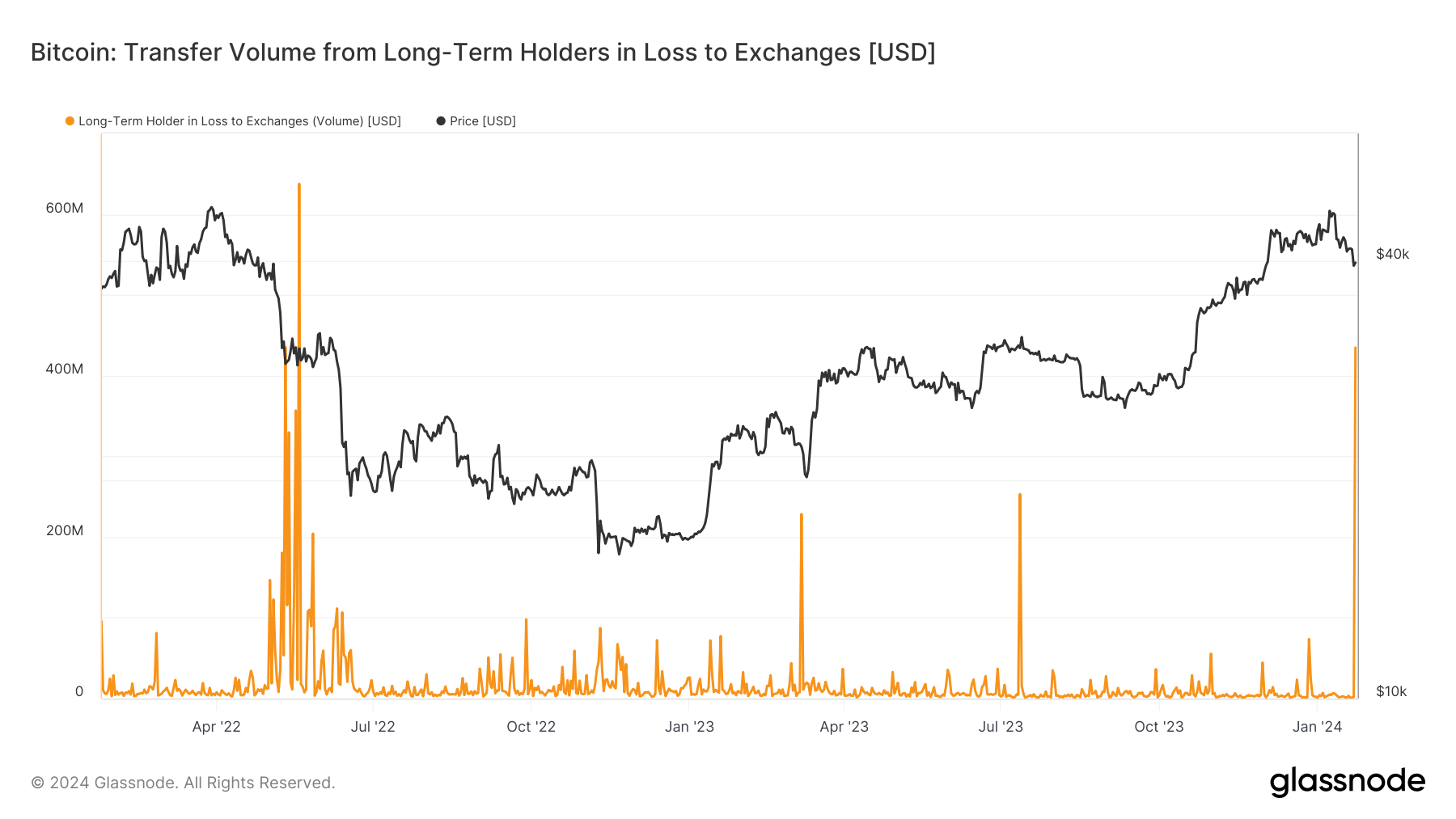

However, recent trends in the market suggest a potential shift in the strategy of long-term Bitcoin holders. Data analysis has revealed a recent sell-off by many of these holders, raising concerns and bringing back memories of past capitulations in the cryptocurrency market.

The Ripple Effect

This shift in behavior among long-term Bitcoin holders could have significant implications for the overall market. As these experienced individuals begin to offload their holdings, it could lead to increased selling pressure and potentially trigger a broader market correction.

The Impact on Individuals

For individual investors, this changing landscape could mean increased volatility and uncertainty in the Bitcoin market. It is important for investors to stay informed and be prepared for potential market swings resulting from the actions of long-term holders.

The Global Ramifications

On a larger scale, the sell-off by long-term Bitcoin holders could impact the global perception of cryptocurrencies and their role in the financial markets. Increased volatility and market corrections could lead to a reevaluation of the long-term viability and stability of Bitcoin as an asset.

Conclusion

The recent sell-off by long-term Bitcoin holders serves as a reminder of the ever-changing nature of the cryptocurrency market. As investors navigate through these uncertain times, it is crucial to stay informed and adapt to the evolving landscape to make informed decisions for the future.