Bitcoin falls 20% from YTH high with further 5% daily drawdown in cascading liquidation event

Introduction

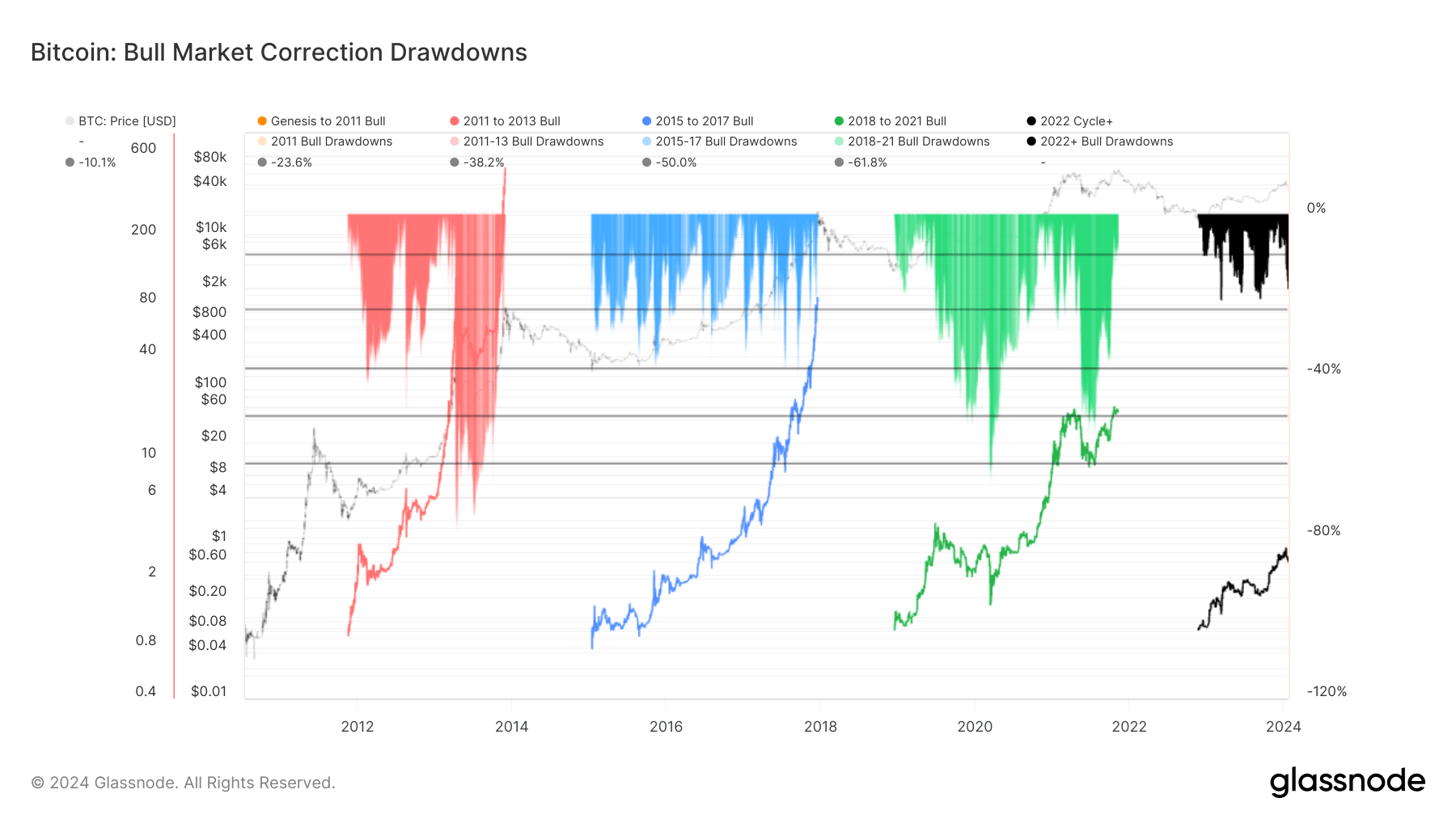

Quick Take: Recently, Bitcoin’s price broke below the $39,000 threshold, marking a noteworthy 20% reduction from its yearly high of $49,000. This event signified one of the most significant drawdowns in the current cycle, illustrating the inherent turbulence of this asset class. Historical data shows during bull market corrections, drawdowns can reach as much as…

Analysis

The recent drop in Bitcoin’s price has sparked concerns among investors and traders alike. The 20% reduction from its yearly high has led to a cascade of liquidation events, further pushing the price down by 5% daily. This significant drawdown highlights the volatility of the cryptocurrency market and the risks involved in investing in digital assets.

During bull market corrections, it is not uncommon to see sharp declines in prices as investors take profits and market sentiment shifts. However, the magnitude of the recent drop has caught many off guard, raising questions about the sustainability of Bitcoin’s previous price levels.

Impact on Individuals

For individual investors holding Bitcoin, the recent plunge in price may have resulted in significant losses. Those who bought at higher price levels are now facing the dilemma of whether to sell at a loss or hold on to their investments in hopes of a recovery. The volatility in the market has made it challenging for retail investors to navigate and make informed decisions.

Impact on the World

Bitcoin’s price movements have broader implications for the world economy. As one of the most widely traded cryptocurrencies, its performance often serves as a barometer for investor sentiment and risk appetite. The recent drawdown in Bitcoin’s price could signal a shift in market dynamics and impact other asset classes as well.

Conclusion

In conclusion, the recent 20% drop in Bitcoin’s price has sent shockwaves through the cryptocurrency market, reminding investors of the volatile nature of digital assets. While the exact cause of the drawdown remains uncertain, it is clear that market participants must exercise caution and stay informed to navigate these turbulent times.