Whales, Holders, and ETF Pressures: A Deep Dive into Bitcoin Behaviors

Introduction

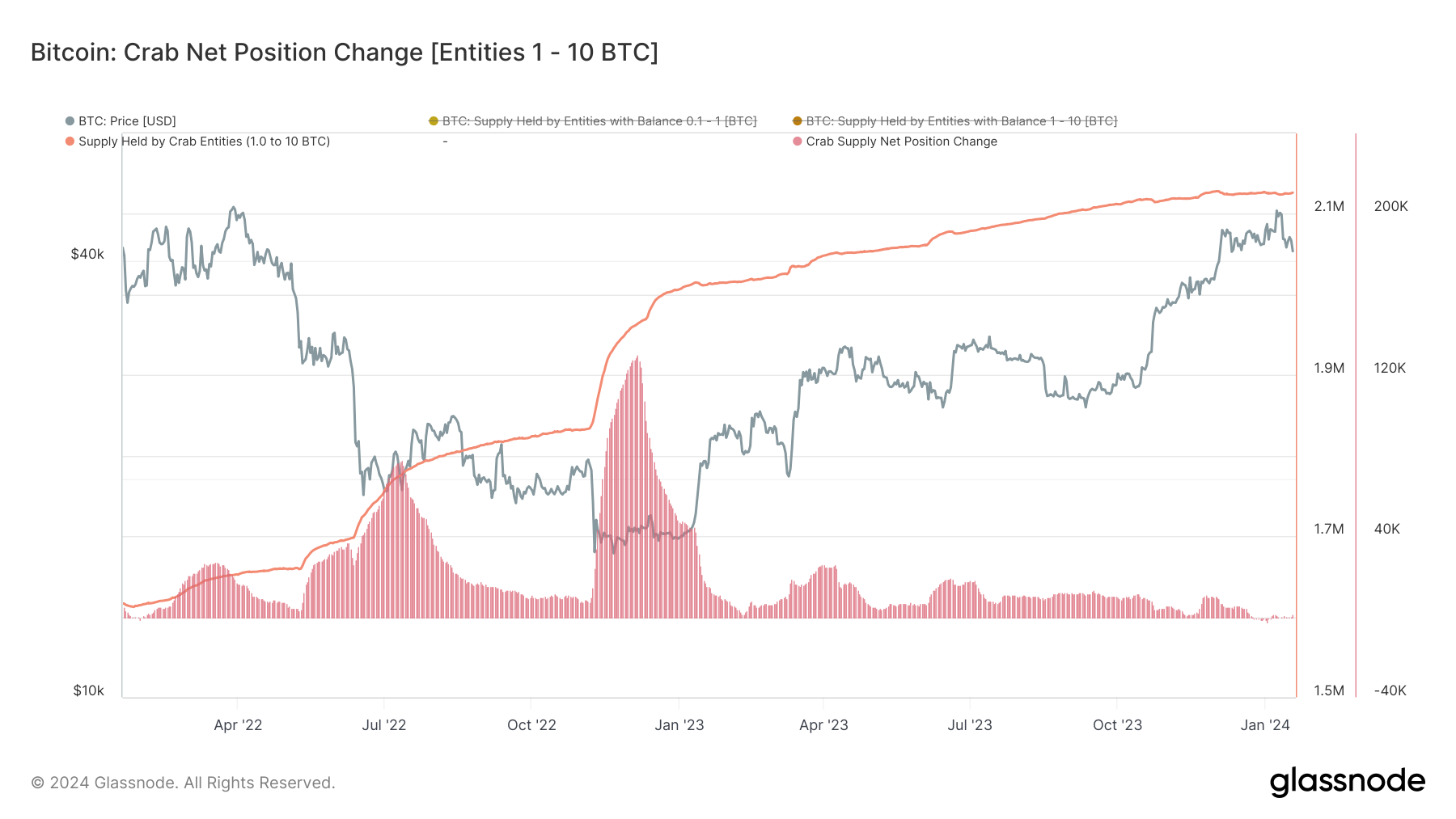

Amidst the accelerated pace of GBTC outflows contributing to downward pressure on Bitcoin’s price, two divergent behavioral patterns are becoming evident among older cohorts. Data demonstrates a growing preference among more oversized Bitcoin holders or ‘whales’ to accumulate more Bitcoins, while smaller cohorts appear to be more inclined towards selling. Specifically, holders identified as ‘whales’ are diving deeper into Bitcoin, while smaller holders are retreating amid ETF pressures.

Whales Dive Deeper

It seems that as the price of Bitcoin fluctuates, the whales of the crypto world are seizing the opportunity to accumulate even more. These larger holders, with their deep pockets and appetite for risk, are not deterred by the market volatility. In fact, they see it as a chance to buy low and potentially reap the benefits when the price inevitably rises again.

Smaller Holders Retreat

On the other hand, smaller holders are feeling the pressure of the ETF market. With the introduction of Bitcoin ETFs, these holders may be feeling the need to cash out and secure their profits before potentially turbulent times ahead. It’s understandable that they would want to take a step back and assess the situation, especially with the uncertainty brought about by the ETF landscape.

The Impact on Me

As a regular investor in Bitcoin, this shift in behavior among whales and smaller holders could potentially impact my own investment strategy. It’s important to stay informed and adapt to the changing dynamics of the market to make the most out of my investments.

The Impact on the World

On a global scale, the behavior of whales and smaller holders in the Bitcoin market can have far-reaching consequences. The actions of these key players can influence market trends, prices, and the overall stability of the cryptocurrency world. It’s a reminder of how interconnected and impactful individual behaviors can be in the grand scheme of things.

Conclusion

In conclusion, the divergent behaviors of whales and smaller holders in the Bitcoin market offer a fascinating glimpse into the complexities of cryptocurrency investing. Whether you’re swimming with the whales or paddling in the shallow end, it’s essential to keep afloat in the ever-changing sea of digital currencies.