Welcome to the Bitcoin Rollercoaster Ride!

Hold on tight, Short-term Holders!

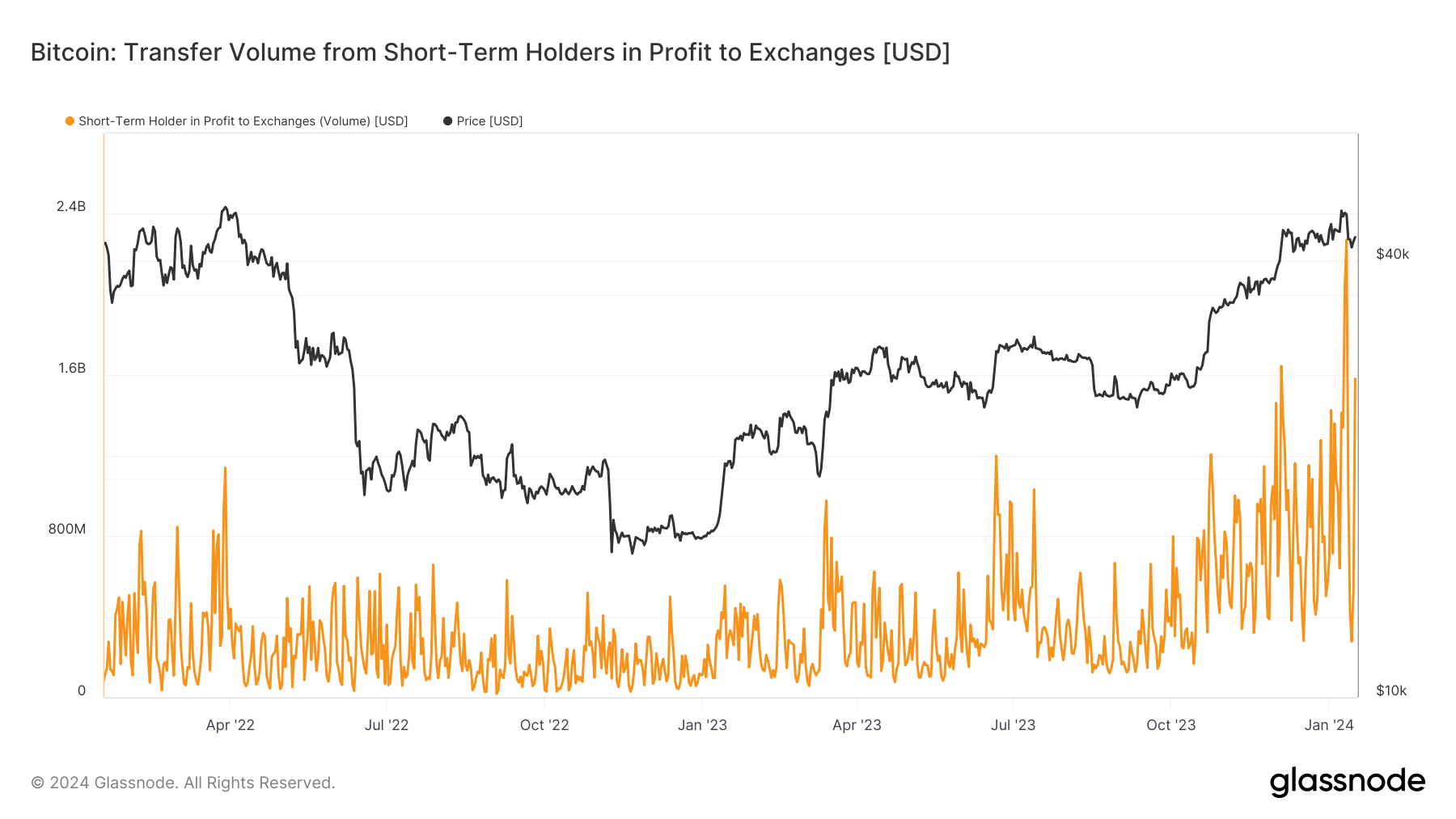

Recently, there’s been a notable surge in activities from short-term holders (STHs), defined as investors who held Bitcoin for less than 155 days. On Jan. 12, CryptoSlate reported the most significant short-term holder activity since May 2021, with $6.1 billion in Bitcoin transferred. This massive transfer is primarily attributed to profit-taking as Bitcoin’s price continues to soar.

What does this mean for Bitcoin?

The surge in short-term holder activity indicates a high level of volatility in the Bitcoin market. Investors who have been holding onto their Bitcoin for a short period of time are cashing out, potentially causing fluctuations in the price of Bitcoin. This could lead to increased buying and selling activity, further driving the price of Bitcoin up or down.

How will this affect me?

As a regular investor in Bitcoin, the surge in short-term holder activity could mean increased market volatility and potential fluctuations in the price of Bitcoin. It’s important to stay informed and monitor the market closely to make informed investment decisions.

How will this affect the world?

The surge in short-term holder activity in Bitcoin could have broader implications for the global economy. Bitcoin’s price has a significant impact on the overall market sentiment and could potentially influence other asset classes. Investors and policymakers around the world will be closely watching the developments in the Bitcoin market.

Conclusion:

In conclusion, the $6.1 billion surge in short-term holder activity in Bitcoin signals a period of increased volatility and potential price fluctuations. As an investor, it’s important to stay informed and monitor the market closely to navigate the ups and downs of the Bitcoin rollercoaster ride. Stay tuned for more updates on this exciting development!