Bitcoin Accumulation Trend Hits Lowest Point Since October

Understanding the Accumulation Trend Score

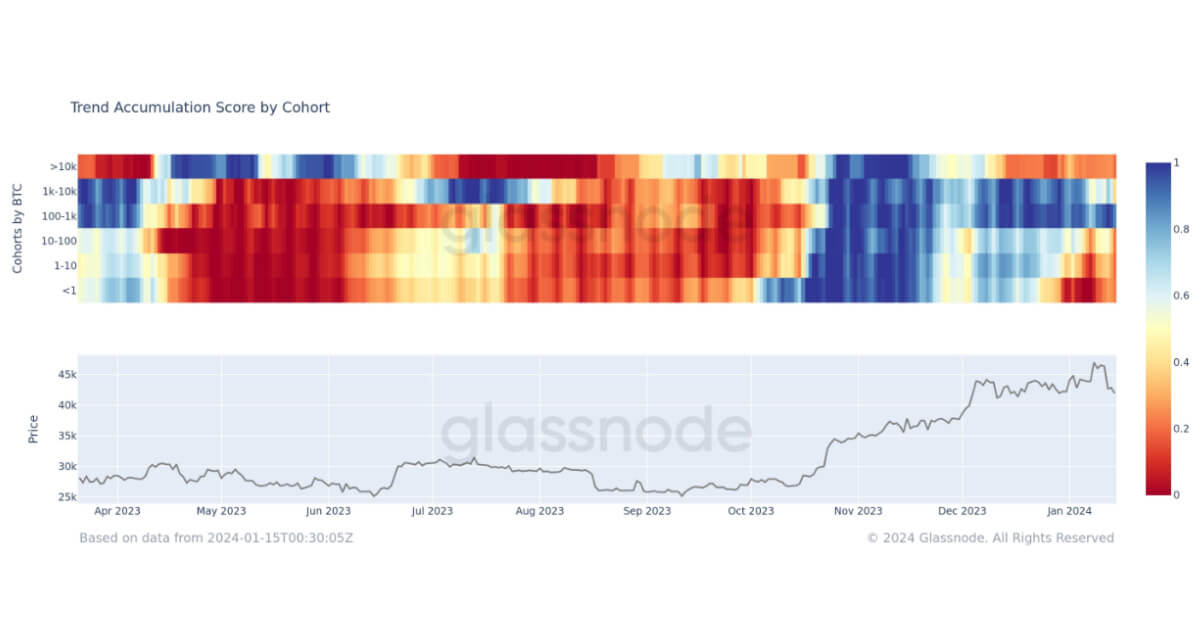

The Accumulation Trend Score is a metric that measures the relative strength of Bitcoin accumulation by different entity wallet cohorts. A lower trend score indicates a decrease in accumulation, while a higher trend score suggests increased accumulation. Recently, the trend score has plummeted to 0.5, the lowest level since October 2023.

Implications of the Shift

This significant shift in the accumulation trend score could signal widespread distribution shifts within the Bitcoin market. Historically, similar dips in accumulation have preceded major price movements in Bitcoin.

Back in October 2023, Bitcoin experienced a monumental rise from $25,000 to $49,000 following a period of low accumulation. Could history be repeating itself? Only time will tell.

How This Trend Will Impact Individuals

For individual investors in Bitcoin, the decreasing accumulation trend could mean increased volatility in the market. Traders will need to stay vigilant and be prepared for potential price swings as distribution shifts occur.

How This Trend Will Impact the World

On a larger scale, the decreasing accumulation trend could have ripple effects throughout the global economy. Bitcoin’s price movements have been known to influence other financial markets, so a significant shift in accumulation could impact a wide range of industries and sectors.

Conclusion

As the Bitcoin accumulation trend hits its lowest point since October, it’s important for investors to closely monitor market developments and be prepared for potential volatility. The widespread distribution shifts indicated by the trend score could have both individual and global implications, making it a key metric to watch in the coming months.