Novogratz Foresees Bitcoin ETF Battle: Does Fractional Vacation Home Ownership Offer an Alternative?

The recent regulatory green light for 11 Bitcoin spot exchange-traded funds (ETFs) has triggered fierce competition among asset management giants.

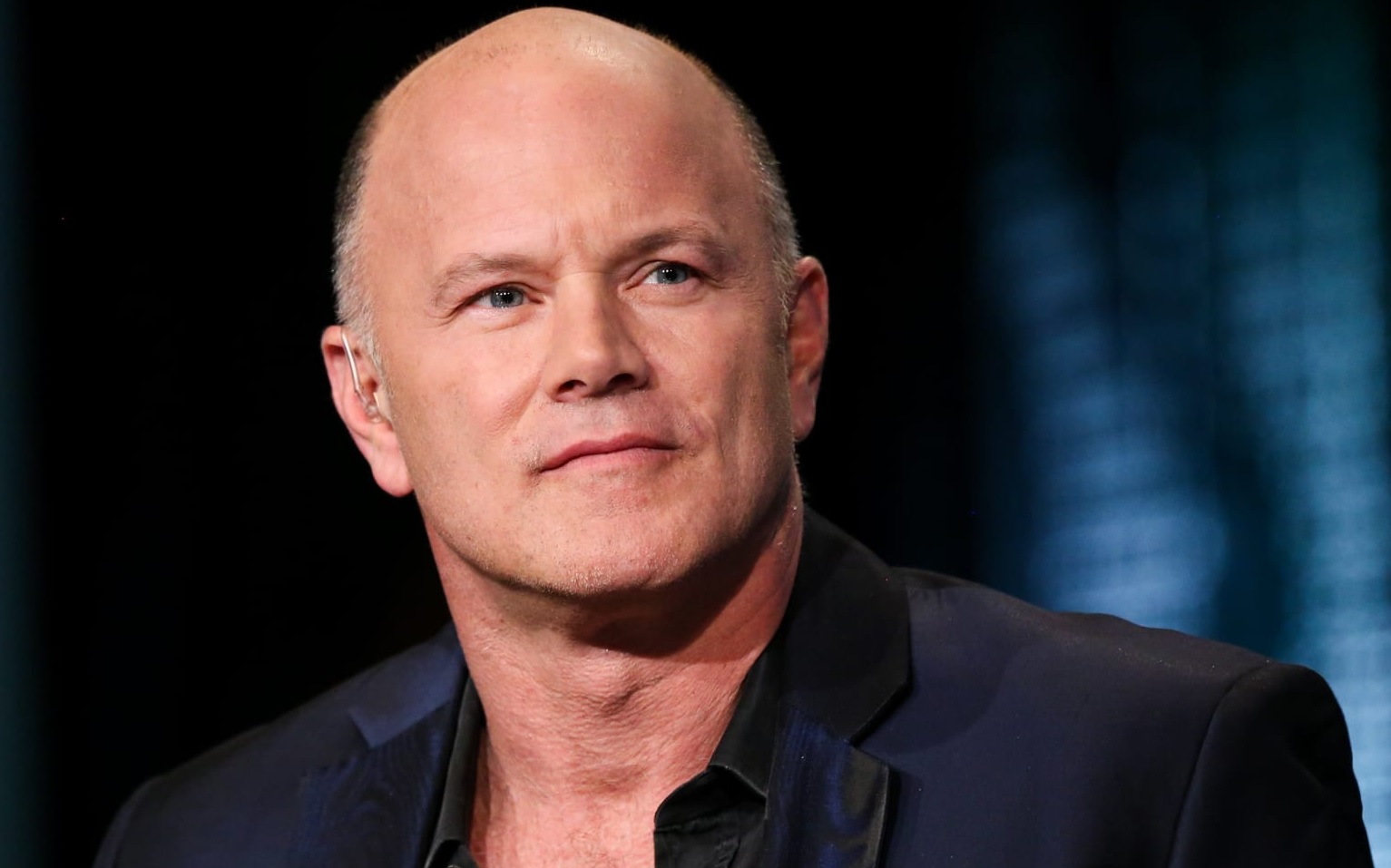

Mike Novogratz, CEO of Galaxy Digital, anticipates a showdown between Invesco, Fidelity, and BlackRock, whose IBIT traded $7.5M shares in the first 10 minutes of the launch.

Amidst this crypto turbulence, Everlodge, a disruptor in fractional vacation home ownership, is gaining traction as an attractive alternative investment option.

With Bitcoin ETFs becoming a hot topic in the finance world, traditional asset managers are looking for ways to differentiate themselves and attract investors. The approval of 11 new Bitcoin ETFs has sparked a race among industry giants like Invesco, Fidelity, and BlackRock to capture a share of the market. Mike Novogratz’s prediction of a fierce battle between these titans highlights the growing importance of cryptocurrencies in the investment landscape.

At the same time, Everlodge is offering a unique proposition for investors looking for alternatives to traditional asset classes. Fractional ownership of vacation homes allows individuals to diversify their portfolios and generate income from rental properties. This disruptor in the real estate industry is tapping into a new market of investors who are seeking innovative ways to grow their wealth.

How Will This Affect Me?

As an individual investor, the proliferation of Bitcoin ETFs and the rise of fractional vacation home ownership present new opportunities to diversify my portfolio and potentially increase my returns. By exploring these alternative investment options, I can adapt to the changing landscape of the financial market and potentially secure better long-term financial outcomes.

How Will This Affect the World?

The competition between asset management giants for a share of the Bitcoin ETF market signifies a broader shift towards digital assets as legitimate investment vehicles. As more traditional financial institutions embrace cryptocurrencies, the global financial landscape is evolving to accommodate this new asset class. The rise of disruptors like Everlodge in the real estate sector further indicates a growing appetite for innovative investment opportunities that offer both financial returns and tangible benefits.

Conclusion

With the approval of 11 Bitcoin ETFs and the emergence of disruptors like Everlodge in fractional vacation home ownership, the investment world is experiencing a significant transformation. As investors, we have the opportunity to explore new avenues for diversification and growth, while traditional asset managers are challenged to adapt to this changing landscape. The future of finance is moving towards a more inclusive and innovative model, where alternative investment options play a key role in shaping our financial futures.