Get Ready for a Wild Ride: The Bitcoin ETF Craze Sends the Market into a Frenzy Before a Sudden Drop

Description:

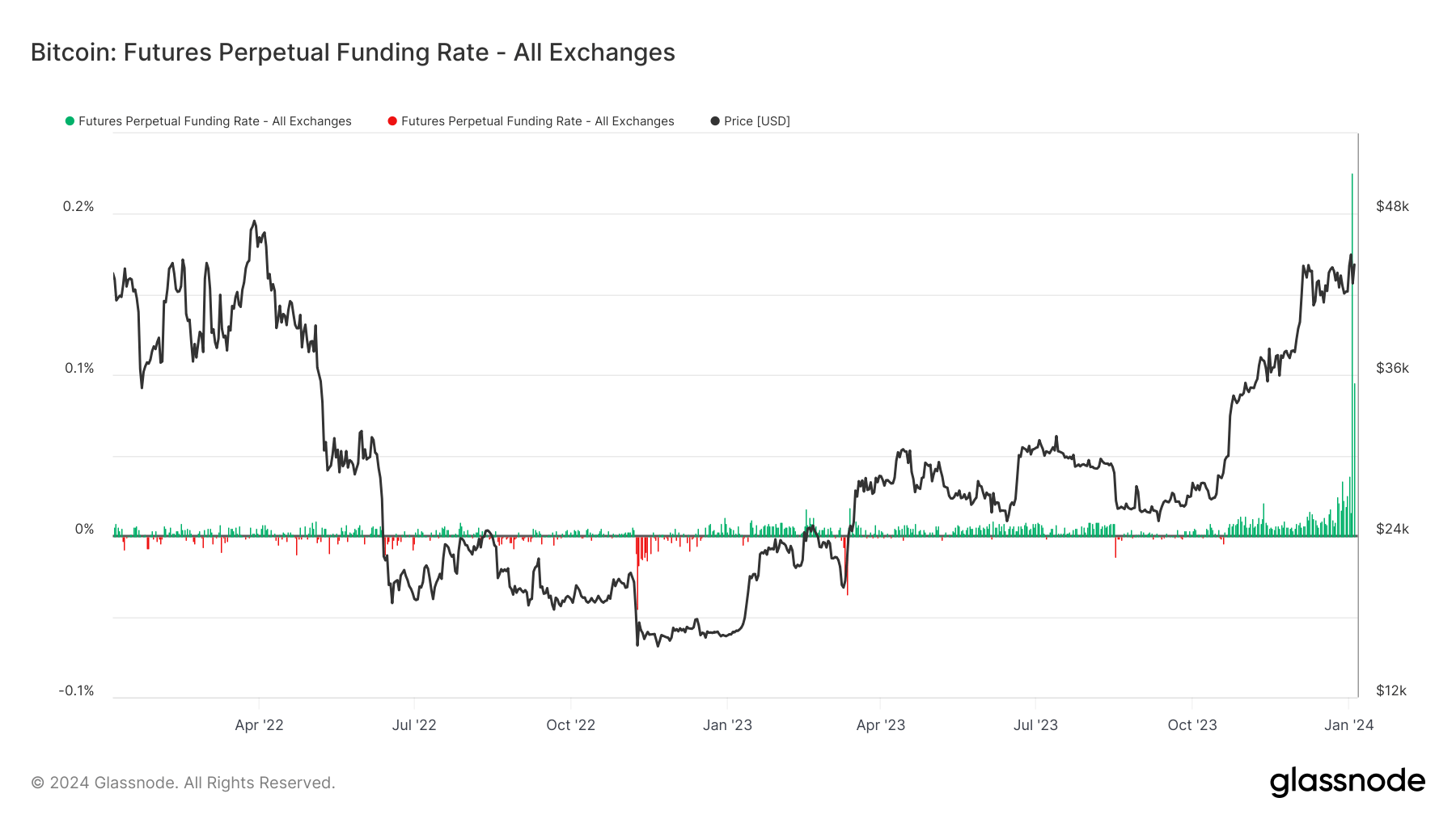

Between Oct. 2023 and Jan. 2024, Bitcoin’s market saw significant price appreciation, heavily influenced by anticipation around the approval of a Bitcoin spot ETF. The market’s spot prices surged from roughly $25,000 to $45,000. This potential catalyst for institutional adoption was predicted to enhance the digital assets market’s liquidity and maturity. Meanwhile, the Bitcoin ETF hype drove futures market to fever pitch before correction.

Get on Board!

Are you ready for a wild ride in the world of cryptocurrency? Well, get ready because the Bitcoin ETF craze has sent the market into a frenzy like never before. Between October 2023 and January 2024, Bitcoin experienced a surge in its market value, jumping from $25,000 to $45,000. What caused this sudden spike? The anticipation and hype surrounding the approval of a Bitcoin spot ETF.

Investors and traders alike were buzzing with excitement as they awaited the decision on the Bitcoin ETF. The potential approval of this ETF was seen as a game-changer for the market, with predictions of increased liquidity and maturity for digital assets. Institutional adoption of Bitcoin was on the horizon, and everyone wanted to be a part of the action.

As the hype continued to build, the futures market also felt the effects of the Bitcoin ETF craze. Prices were soaring, and everyone was on edge waiting for the next big move. It seemed like the perfect storm was brewing, with Bitcoin’s price reaching new heights and the potential for even more growth on the horizon.

How Will This Affect You?

For individual investors, the Bitcoin ETF craze can present both opportunities and risks. The surge in Bitcoin’s price may have some investors feeling like they missed out on potential gains. However, it’s important to remember that the market is always changing, and there may still be opportunities to profit from the volatility that comes with new developments like the approval of a Bitcoin spot ETF.

On the flip side, the sudden drop in Bitcoin’s price following the frenzy around the ETF approval serves as a reminder of the risks involved in investing in cryptocurrency. It’s essential to approach these situations with caution and to do your research before making any investment decisions.

How Will This Affect the World?

The Bitcoin ETF craze and subsequent market frenzy have broader implications for the world of finance and investment. The growing interest in cryptocurrencies and digital assets signals a shift in the way we think about traditional forms of currency and investment vehicles.

With the potential approval of a Bitcoin spot ETF, institutional adoption of digital assets could accelerate, leading to increased mainstream acceptance and integration of cryptocurrencies into the global financial system. This could have far-reaching effects on how we conduct transactions, invest our money, and even how we view the concept of money itself.

Conclusion:

In conclusion, the Bitcoin ETF craze has sent the market into a frenzy, with prices surging before a sudden drop that left investors reeling. Whether you’re an individual investor looking to capitalize on the volatility or someone observing the broader implications for the world, one thing is clear – the world of cryptocurrency is a wild ride, and it’s only just beginning.