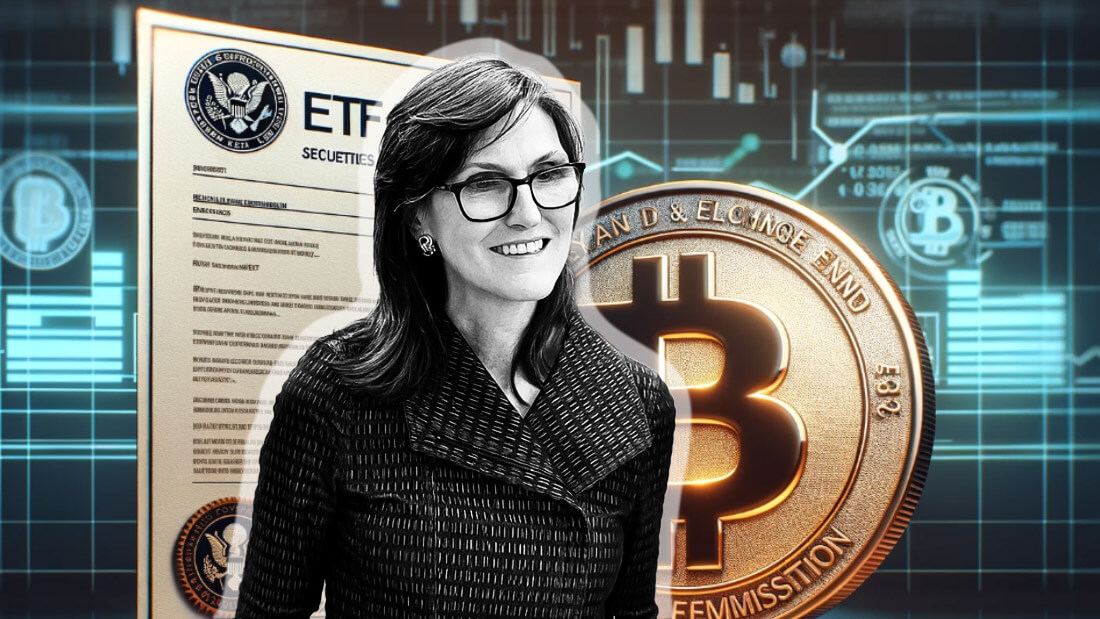

ARK Raises Concern Over Coinbase’s Dominance in Bitcoin ETF Filings Just Days Before Potential Approval: A Heartfelt Analysis

Introduction

As the anticipation of the approval of a spot Bitcoin ETF finally comes to a head, the Ark 21Shares Bitcoin Trust has made 16 significant clarifications and additions to its S1 filing across several areas, ranging from operational processes to financial responsibilities and regulatory aspects, providing a more explicit, more detailed framework for the ETF’s…

The Emotional Impact

The news of Ark raising concerns over Coinbase’s dominance in Bitcoin ETF filings just days before a potential approval has brought about mixed emotions in the cryptocurrency community. Investors who have been eagerly waiting for the approval of a spot Bitcoin ETF are feeling both hopeful and nervous about the implications of Coinbase’s involvement in the process. The uncertainty surrounding the situation has left many feeling anxious about the future of Bitcoin ETFs and their potential impact on the market.

Insightful Analysis

Ark’s decision to raise concerns over Coinbase’s concentration in Bitcoin ETF filings sheds light on the potential risks and challenges that could arise from a single entity holding a dominant position in the approval process. The added clarifications and additions to the S1 filing indicate a more thorough and comprehensive approach to addressing key operational and regulatory aspects of the ETF, which is crucial for gaining regulatory approval. However, the fact that these concerns are being raised just days before a potential approval suggests that there may be underlying issues that need to be addressed before moving forward.

Reader Friendly Content

For readers who are new to the world of cryptocurrency ETFs, the current situation may seem complex and overwhelming. However, it is important to stay informed and engaged with the latest developments in order to make informed decisions about investment opportunities. By providing a heartfelt analysis of Ark’s concerns over Coinbase’s dominance in Bitcoin ETF filings, we hope to offer readers a comprehensive and reader-friendly overview of the issue at hand.

How This Will Affect Me

As an individual investor, the dominance of Coinbase in Bitcoin ETF filings could potentially have a significant impact on the approval process and the overall performance of the ETF. If regulatory concerns are not addressed adequately, it may lead to delays or rejections of ETF applications, affecting the availability of investment opportunities in the cryptocurrency market. It is important to stay informed and monitor the situation closely to make well-informed decisions about potential investments in Bitcoin ETFs.

How This Will Affect the World

The concentration of Coinbase in Bitcoin ETF filings raises broader concerns about the decentralization and diversification of the cryptocurrency market. A single entity holding a dominant position in the approval process could potentially have far-reaching implications for the regulatory landscape and the overall stability of the market. It is essential for regulatory authorities and market participants to address these concerns proactively to ensure a more balanced and sustainable ecosystem for cryptocurrency investors worldwide.

Conclusion

In conclusion, the news of Ark raising concerns over Coinbase’s dominance in Bitcoin ETF filings just days before a potential approval has sparked discussions and debates within the cryptocurrency community. While the added clarifications and additions to the S1 filing provide a more detailed framework for the ETF, the underlying issues surrounding Coinbase’s concentration in the approval process warrant further attention and analysis. It is essential for investors and regulatory authorities to work together to address these concerns and promote a more transparent and secure environment for cryptocurrency investments.