Examining Tether’s impact on Bitcoin’s price performance

A Surprising Connection

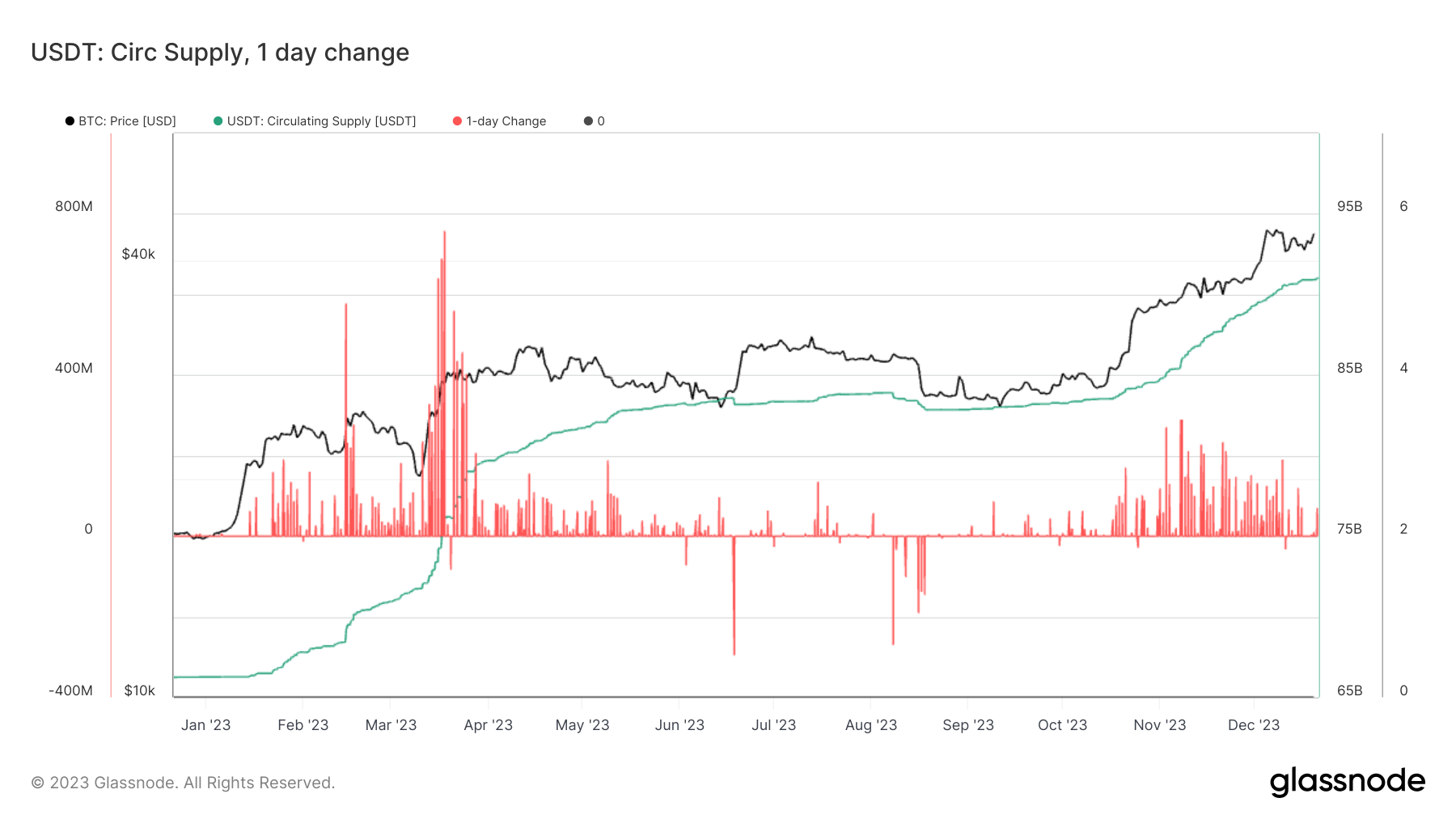

Let’s talk about Tether (USDT) and how its circulating supply seems to be influencing Bitcoin’s price. According to CryptoSlate’s data analysis, there’s an intriguing correlation between the two. At the start of 2023, the USDT supply was around 66 billion, but by the end of the year, it had skyrocketed to 91 billion. That’s a pretty substantial leap, right?

More Than Just a Coincidence

It’s fascinating to see how the growth in USDT supply isn’t happening in isolation. Instead, it seems to be closely tied to some exciting developments in the crypto world. Could this be a sign of things to come? Is there a deeper connection between Tether’s supply and Bitcoin’s price performance? It’s like watching a suspenseful movie unfold, with twists and turns that keep us on the edge of our seats.

But what does this mean for us, the average crypto enthusiasts just trying to navigate this wild ride? How will it impact our investments, our portfolios, and our future in the crypto market?

How Will This Affect Me?

As an individual investor, the correlation between Tether’s supply and Bitcoin’s price could have significant implications for your portfolio. It’s essential to stay informed and aware of these trends to make well-informed decisions about your investments. Keep a close eye on how these developments unfold and adjust your strategy accordingly to maximize your gains and minimize your risks.

How Will This Affect the World?

The impact of this correlation extends beyond individual investors to the broader crypto market and even the global economy. As Tether’s supply continues to grow and influence Bitcoin’s price performance, we may see ripple effects throughout the financial world. It’s a reminder that the crypto market is interconnected with traditional finance in ways we’re only beginning to understand.

In Conclusion

So, as we delve deeper into the connection between Tether’s supply and Bitcoin’s price performance, it’s clear that there’s more to this relationship than meets the eye. The crypto world is full of surprises, and it’s up to us to stay curious, vigilant, and ready to adapt to whatever comes our way. Buckle up, fellow crypto enthusiasts – we’re in for a wild ride!