Insights: Profitable Bitcoin Supply Nears Cycle Peak, Potentially Preceding Market Correction

Quick Take

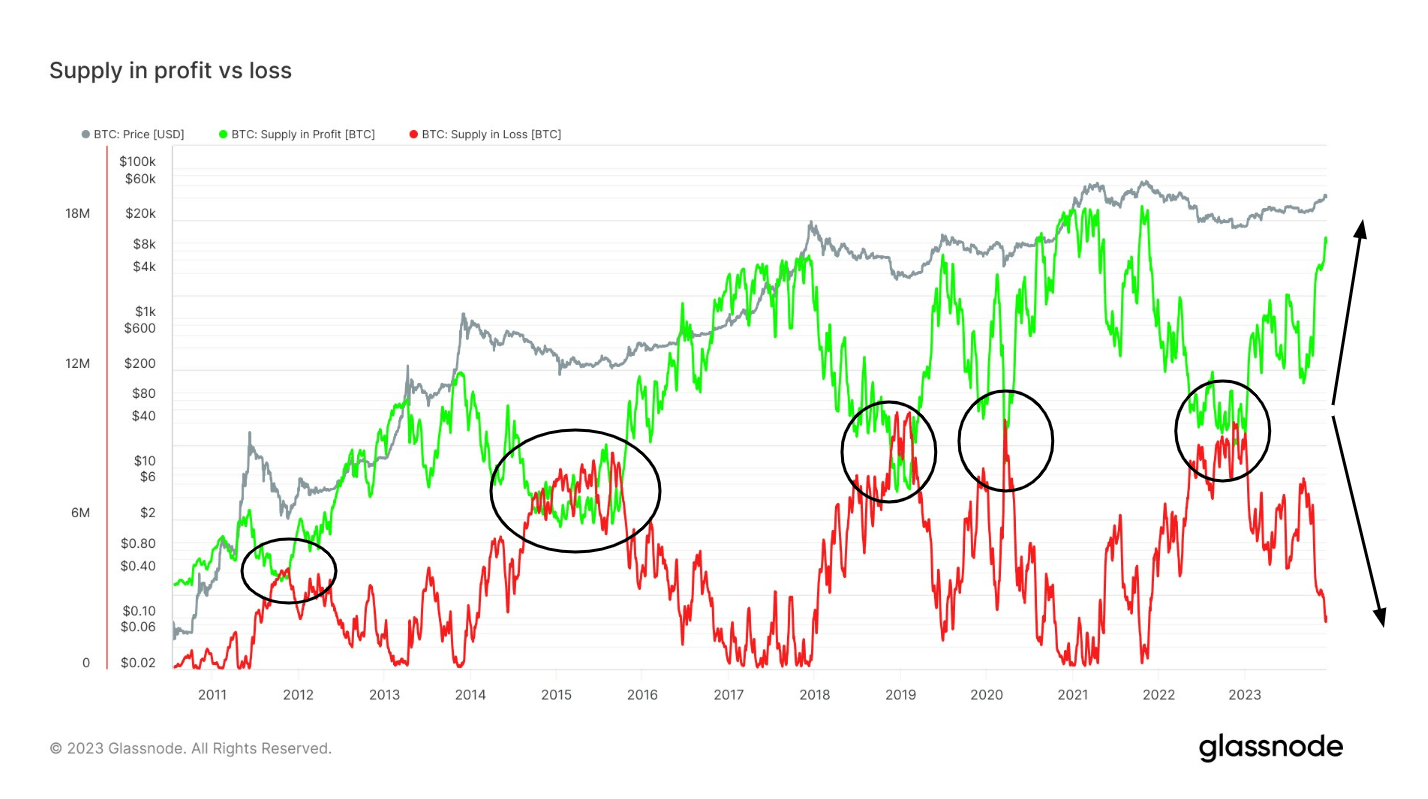

Analyzing the supply dynamics of Bitcoin reveals a telling story of profit and loss convergence, a significant indicator of market fluctuations. Of the approximately 19.3 million Bitcoin in circulation, an estimated 17.3 million are in profit, leaving 1.9 million at a loss. The convergence of supply in profit and loss – where losses outweigh profits – could potentially precede a market correction in the near future.

Educational Analysis

As Bitcoin reaches its peak in profitability, investors and traders must pay close attention to the balance between profit and loss in the market. When the number of Bitcoins in profit starts to decline while the number of Bitcoins in loss increases, it could indicate a shift in market sentiment and potential price correction. Understanding these supply dynamics is crucial for making informed decisions in the volatile world of cryptocurrency trading.

Investment Strategy

For profit-focused individuals involved in Bitcoin trading, the nearing cycle peak of profitable Bitcoin supply serves as a warning sign to reassess investment strategies. It may be prudent to consider taking profits or implementing risk management strategies to protect gains in case of a market downturn. By staying informed and proactive, investors can better navigate the ups and downs of the cryptocurrency market.

Global Implications

On a larger scale, the convergence of profitable Bitcoin supply nearing its peak could have ripple effects on the global economy. Cryptocurrency markets are interconnected with traditional financial systems, and a significant market correction in Bitcoin could impact investor confidence and overall market stability. It is essential for regulators and policymakers to monitor these developments and take appropriate actions to mitigate potential risks to the financial system.

Conclusion

In conclusion, the analysis of profitable Bitcoin supply nearing its cycle peak is a critical factor to consider for both individual investors and the broader financial ecosystem. By understanding the dynamics of profit and loss in the market, stakeholders can better prepare for potential market corrections and navigate the ever-changing landscape of cryptocurrencies. Staying informed, proactive, and adaptable is key to success in the fast-paced world of Bitcoin trading.