Bitcoin primed to outpace Ethereum during bull market for first time next cycle

Introduction

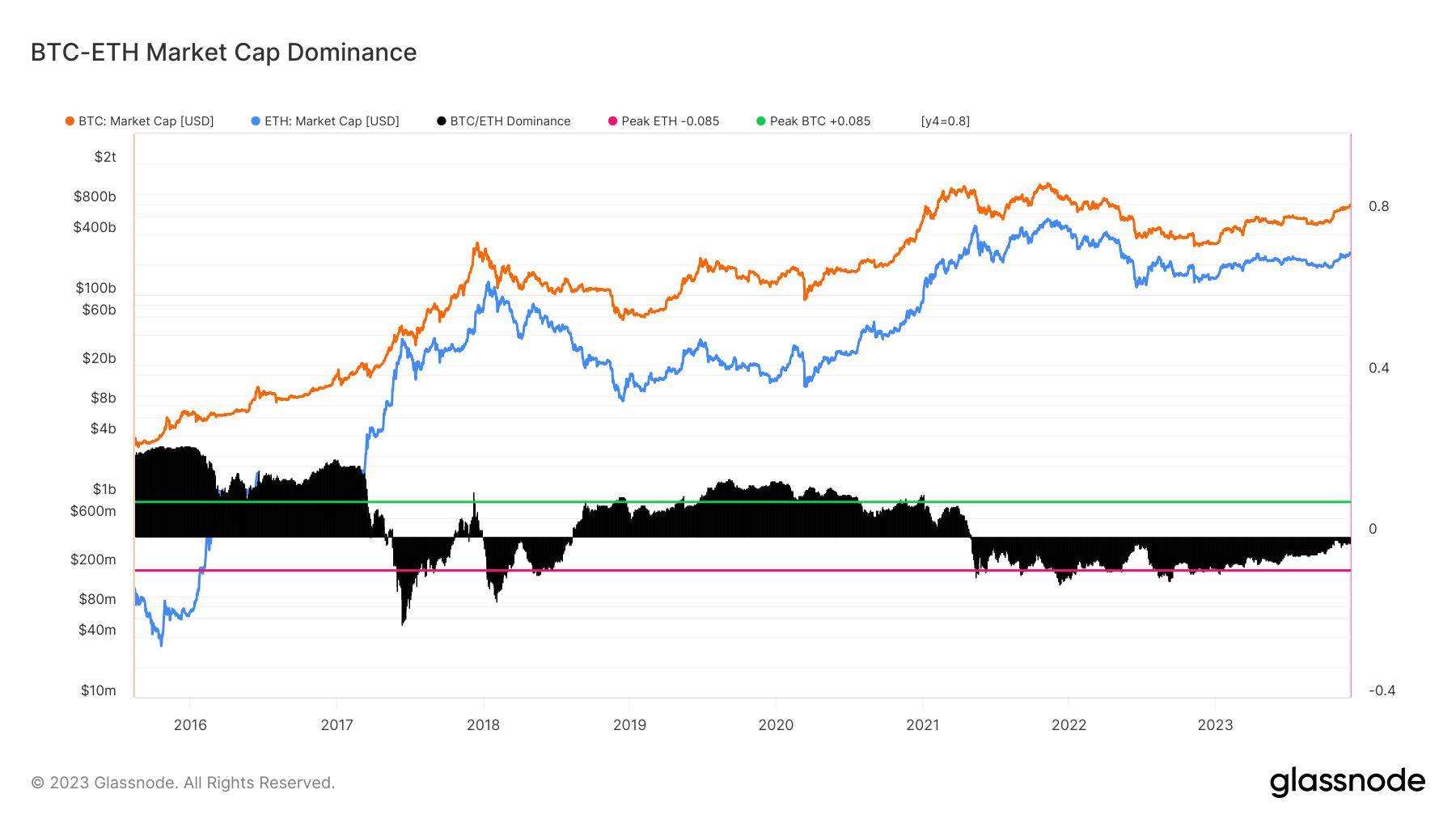

The year 2023 has marked a shift in the Ethereum to Bitcoin ratio. Despite Ethereum’s substantial dollar value growth of 88%, it has significantly underperformed compared to Bitcoin, being down by 25% against the lead digital asset. The ratio currently sits at a precarious 0.053, teetering near year-to-date lows. This trend invites speculation…

Bitcoin vs. Ethereum

Bitcoin and Ethereum are two of the most popular cryptocurrencies in the market, with each having its own unique features and capabilities. While Bitcoin is often seen as a store of value, Ethereum is known for its smart contract functionality and decentralized applications. The recent shift in the Ethereum to Bitcoin ratio indicates that Bitcoin may be primed to outpace Ethereum during the next bull market cycle.

Factors Contributing to Bitcoin’s Outpacing of Ethereum

There are several factors that could contribute to Bitcoin outpacing Ethereum in the next bull market cycle. One possible reason is the growing institutional interest in Bitcoin, with many financial institutions and companies investing in the digital asset as a hedge against inflation. Additionally, the limited supply of Bitcoin, with only 21 million coins ever to be mined, could also contribute to its outperformance compared to Ethereum.

Effects on Individuals

For individual investors, the shift in the Ethereum to Bitcoin ratio could mean reevaluating their investment strategies. Those who have traditionally focused on Ethereum may consider diversifying their portfolio to include more Bitcoin, in order to potentially capitalize on its outperformance during the next bull market cycle.

Effects on the World

On a larger scale, the outpacing of Ethereum by Bitcoin could have implications for the broader cryptocurrency market. It may lead to a reevaluation of the role of Ethereum in the decentralized finance (DeFi) space, with investors and developers potentially shifting their focus towards Bitcoin and other digital assets that demonstrate stronger performance during bull markets.

Conclusion

In conclusion, the recent shift in the Ethereum to Bitcoin ratio suggests that Bitcoin may be primed to outpace Ethereum during the next bull market cycle. This trend could have significant effects on individual investors and the broader cryptocurrency market, prompting a reevaluation of investment strategies and the role of different digital assets in the evolving landscape of decentralized finance.