Forex News

Get Ready to Ride the Wave: Buffett Dives into Japanese Companies While US Tech Sector Feels the Heat – Here’s What You Need to Know!

Market Fluctuations: A Rollercoaster Ride Ups and Downs in the US Stock Market The US stock market traded yesterday without a single trend. At the close of trading, Dow Jones Index (US30) increased by 0.30%, S&P 500 (US500) added 0.10%. But NASDAQ Technology Index (US100) was down by 0.03%. It seems like the market is…

Get Ready for a Rate Hike: US March CPI and Fed Minutes Unveil the Future

US March CPI And Fed Minutes Set Up Next Rate Hike The Latest Scoop on Fed Rate Hike Expectations Hey there fellow traders! If you’ve been keeping an eye on the Fed’s moves, you probably already know that the next rate hike is in the cards. Just under three quarters of traders are currently expecting…

Get Ready to Squawk with Jasper’s Market Update – 11/04/2023

Heading Subheading Sub-subheading Last Friday’s employment data indicated that the jobs market remained hot in March, raising the likelihood of a Fed hike. Dollar got a lift following the long holiday weekend, weighing on counterparts. Chart: XAUUSD Key Factors for Today Dollar receives lift from strong employment data, gold back under $2k threshold US inflation…

Uncovering the Potential of EUR/AUD: A Short-Term Forecast and Analysis by Vladimir Ribakov

Riding the Waves: EURAUD Technical Analysis and Short Term Forecast The Importance of Multi-Timeframe Confirmations Hey Traders! Today we are diving into the world of EURAUD technical analysis and short term forecast. When it comes to analyzing the charts for potential setups, I always rely on multi-timeframe confirmations. In my opinion, having evidence from different…

Clever and Personable: AUD/USD Aims to Reclaim 0.6700 Amid Positive Aussie Data and Barley Agreement, Alongside Weakening US Dollar

Are AUD/USD Bulls Back in Action? What’s Happening in the Market? After a week-long absence, AUD/USD bulls seem to be back in motion. The upbeat Aussie catalysts surrounding foreign trade and sentiment have underpinned the quote’s latest recovery from a three-week low to 0.6670 as we head into Tuesday’s European session. Reasons for the Rebound…

USD/CAD Price Analysis: Despite BOC’s Unchanged Policy, the Last Prayer Above 1.3500 Sings a Promising Tune

The USD/CAD Pair Sideways After Perpendicular Decline The USD/CAD pair has turned sideways after a perpendicular decline move above the psychological resistance of 1.3500 in the early Tokyo session. This movement has created a sense of uncertainty in the market as traders await the interest rate decision by the Bank of Canada (BoC) and the…

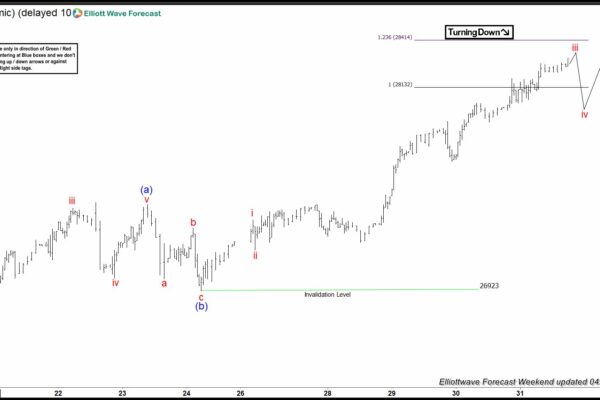

Sayonara, Nikkei: How This Trader’s Equal Legs Strategy Went Downhill

Hello Traders, Let’s Talk About the NIKKEI (JAPAN225) Index! Reactions Lower From Equal Legs Area Hey there fellow traders! Today, we’re diving into the exciting world of the NIKKEI (JAPAN225) index and its recent reaction lower from the equal legs area. Here at Elliott Wave Forecast, we’ve developed a system that allows us to pinpoint…

Gold Price Holds Strong: Why You Should Keep an Eye on US Inflation Figures

Gold Price Retaining Bullishness Ahead of US Inflation Figures Why XAU/USD is Bullish The XAU/USD pair is currently bullish as long as it remains above the uptrend line. The upper median line (uml) is seen as a potential target for the pair, indicating further upward movement. The recent drop in gold price is viewed as…