Welcome to our Blog!

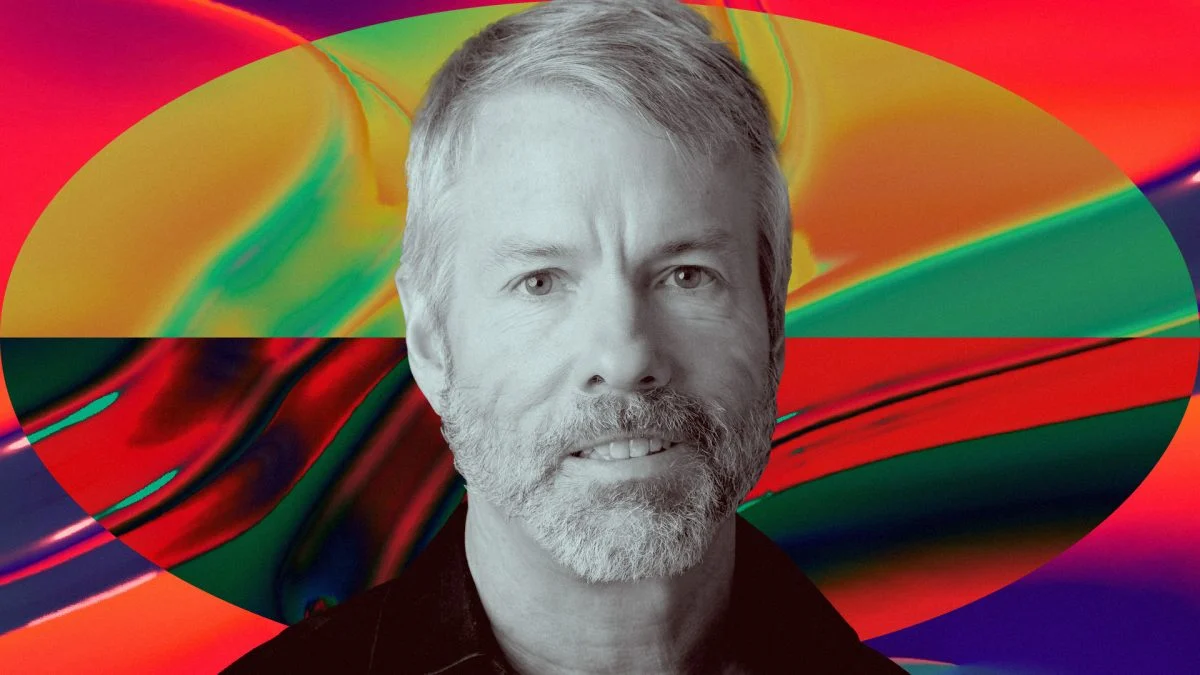

The Company fka MicroStrategy’s Revenue Decline

Recently, the company formerly known as MicroStrategy reported total revenues of $120.7 million, which represented a 3% decrease from the previous year and fell short of estimates by about $3 million. This news has sparked discussions and speculation among investors and industry analysts alike.

Impact on the Company

The decline in revenue for the company fka MicroStrategy is certainly cause for concern. It may indicate underlying issues such as decreased demand for their products or services, increased competition in the market, or inefficiencies in their operations. The company will need to carefully assess the factors contributing to this decline and take proactive steps to address them in order to return to a path of growth and profitability.

Effect on Shareholders

Shareholders of the company fka MicroStrategy may be understandably disappointed by this news, as a decrease in revenue could potentially lead to lower stock prices and diminished returns on their investments. It is important for shareholders to closely monitor the company’s response to this revenue decline and consider their own investment strategies moving forward.

How this will affect individuals:

For individuals who have invested in the company formerly known as MicroStrategy, the decline in revenue may result in decreased stock prices and potentially lower returns on their investments. It is important for investors to stay informed about the company’s performance and consider adjusting their investment strategies accordingly.

Impact on the World

While the revenue decline of the company fka MicroStrategy may seem like a small blip in the grand scheme of things, it is important to recognize the ripple effects that such events can have on the broader economy. Companies play a significant role in driving economic growth and innovation, and any challenges they face can have implications for consumers, suppliers, and the overall market.

Conclusion

In conclusion, the revenue decline reported by the company formerly known as MicroStrategy serves as a reminder of the importance of staying vigilant in monitoring business performance and making strategic decisions to address challenges. While the impact of this decline may be felt by shareholders and the broader market, it also presents an opportunity for the company to reassess its strategies and position itself for future success.