Charmingly Eccentric: A Look into Bitcoin’s Recent Price Trends

Market Speculation

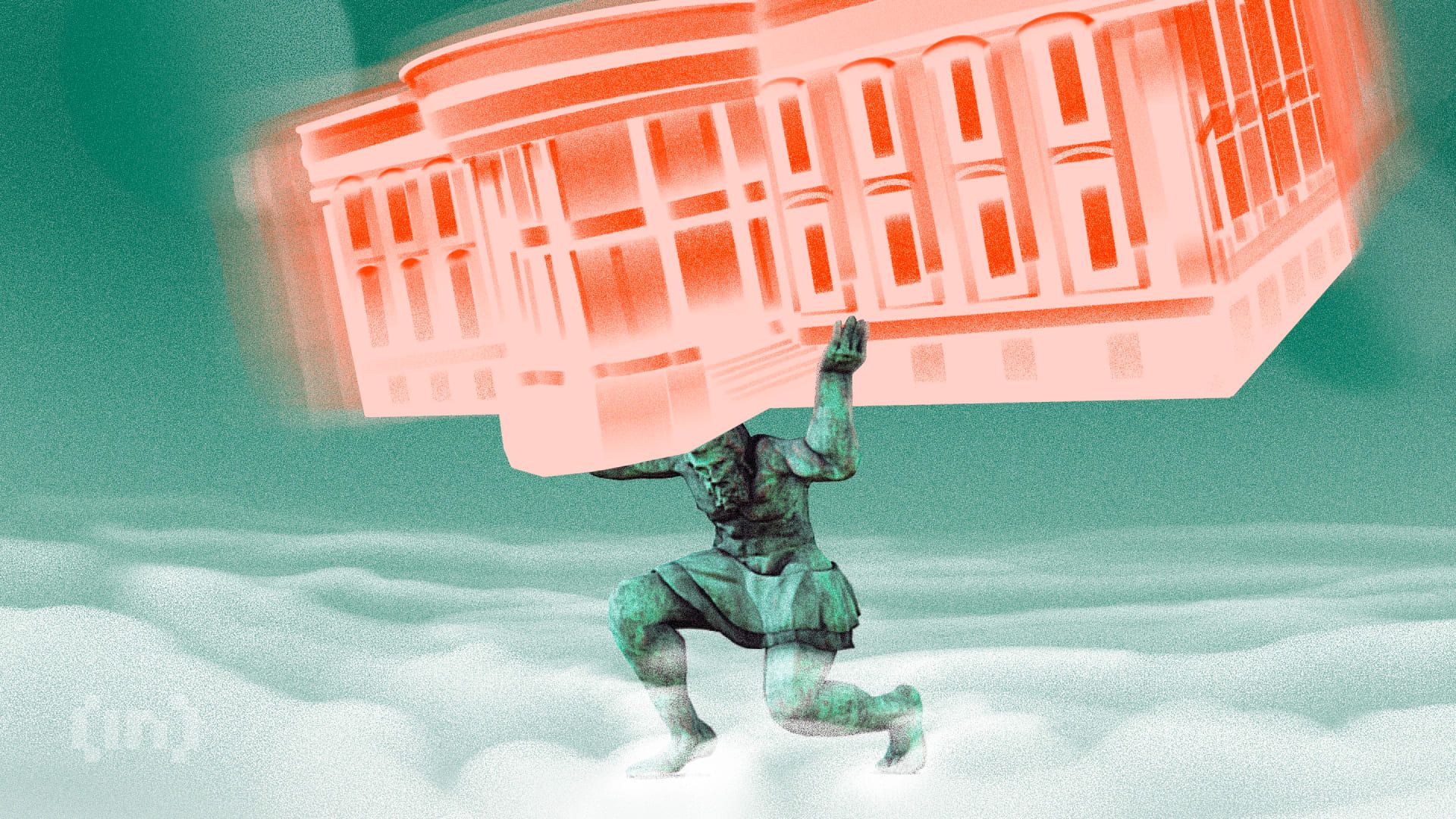

A crypto analyst hinted at a potential price decline if bearish factors remain in the market. As bulls lose steam, Bitcoin (BTC) traders have faced consistent sell pressure in the last 72 hours.

The Current Landscape

Bitcoin’s price has been a rollercoaster in recent weeks, with highs and lows that have left many investors on edge. The recent sell pressure has only added to the uncertainty surrounding the cryptocurrency market.

Many analysts believe that if bearish factors continue to dominate the market, we could see a further decline in Bitcoin’s price. This has led to increased caution among traders, who are closely monitoring market trends and looking for potential signals of a turnaround.

It’s important for investors to stay informed and be prepared for all possible outcomes in such a volatile market. Whether you are a seasoned trader or a newcomer to the crypto space, keeping a close eye on market developments is key to making informed decisions.

How This Could Impact You

Depending on your current holdings in Bitcoin or other cryptocurrencies, a potential price decline could have a significant impact on your portfolio. It’s important to assess your risk tolerance and consider diversifying your investments to mitigate potential losses in a changing market.

Global Implications

The cryptocurrency market is closely watched by investors around the world, and any significant price movements in Bitcoin can have ripple effects on other digital assets. A prolonged downturn in Bitcoin’s price could shake investor confidence in the broader market, leading to increased volatility and uncertainty.

Conclusion

In conclusion, the recent sell pressure in the Bitcoin market is a reminder of the volatility and unpredictability of the cryptocurrency space. It’s important for investors to stay informed, exercise caution, and be prepared for all possible outcomes. By staying vigilant and making informed decisions, you can navigate market uncertainties and protect your investments in the long run.