What’s Happening with Nvidia?

Let’s Talk About DeepSeek and Trump’s Tariffs

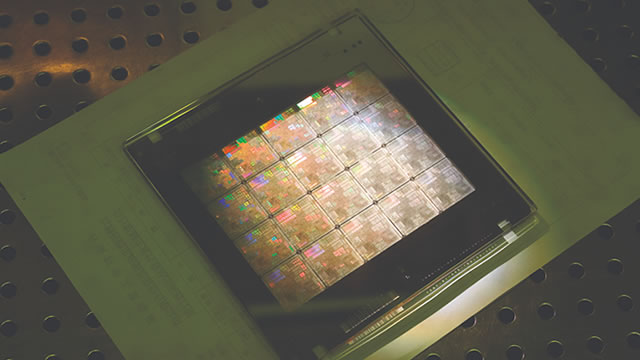

So, you might have heard that Nvidia Corporation is going through a bit of a rough patch lately. The stock has declined almost 22% from its recent highs in early January, and there are a couple of reasons for this. One of them is DeepSeek, a new technology that is threatening Nvidia’s market share. Another factor at play is Trump’s tariffs, which are causing some uncertainty in the market.

Striving for Growth

In order to justify its current valuation, Nvidia needs to achieve growth rates of 25% per annum. That’s no small feat, especially considering the challenges the company is facing. However, when we take into account the underlying market growth rate of Nvidia’s business segments, it seems that the company’s stock could currently be undervalued by up to 40%. This might come as a surprise to some investors, but it’s worth considering the potential for future growth.

How Does This Impact You?

As an investor, the recent decline in Nvidia’s stock price might have you feeling a bit uneasy. It’s never fun to see your investments take a hit, but it’s important to remember that fluctuations in the market are normal. If you believe in Nvidia’s potential for growth and innovation, this could be a good time to consider buying more stock while it’s undervalued.

What About the World?

On a larger scale, the performance of Nvidia has implications for the tech industry as a whole. As a major player in the market, Nvidia’s success (or lack thereof) can have ripple effects across various sectors. If Nvidia is able to bounce back and meet its growth targets, it could signal positive things for the industry as a whole. On the other hand, continued struggles for Nvidia could lead to increased competition and shifts in the market landscape.

In Conclusion

While Nvidia is currently facing some challenges, it’s important to remember that setbacks are a natural part of the business world. By staying informed and keeping an eye on market trends, investors can make educated decisions about their investments. So, whether you’re a shareholder or simply interested in the tech industry, it’s worth keeping an eye on Nvidia and how it navigates the road ahead.