Bitcoin Boom: A Potential $150-500 Billion Influx

What Could Trump’s Executive Order Mean for Bitcoin?

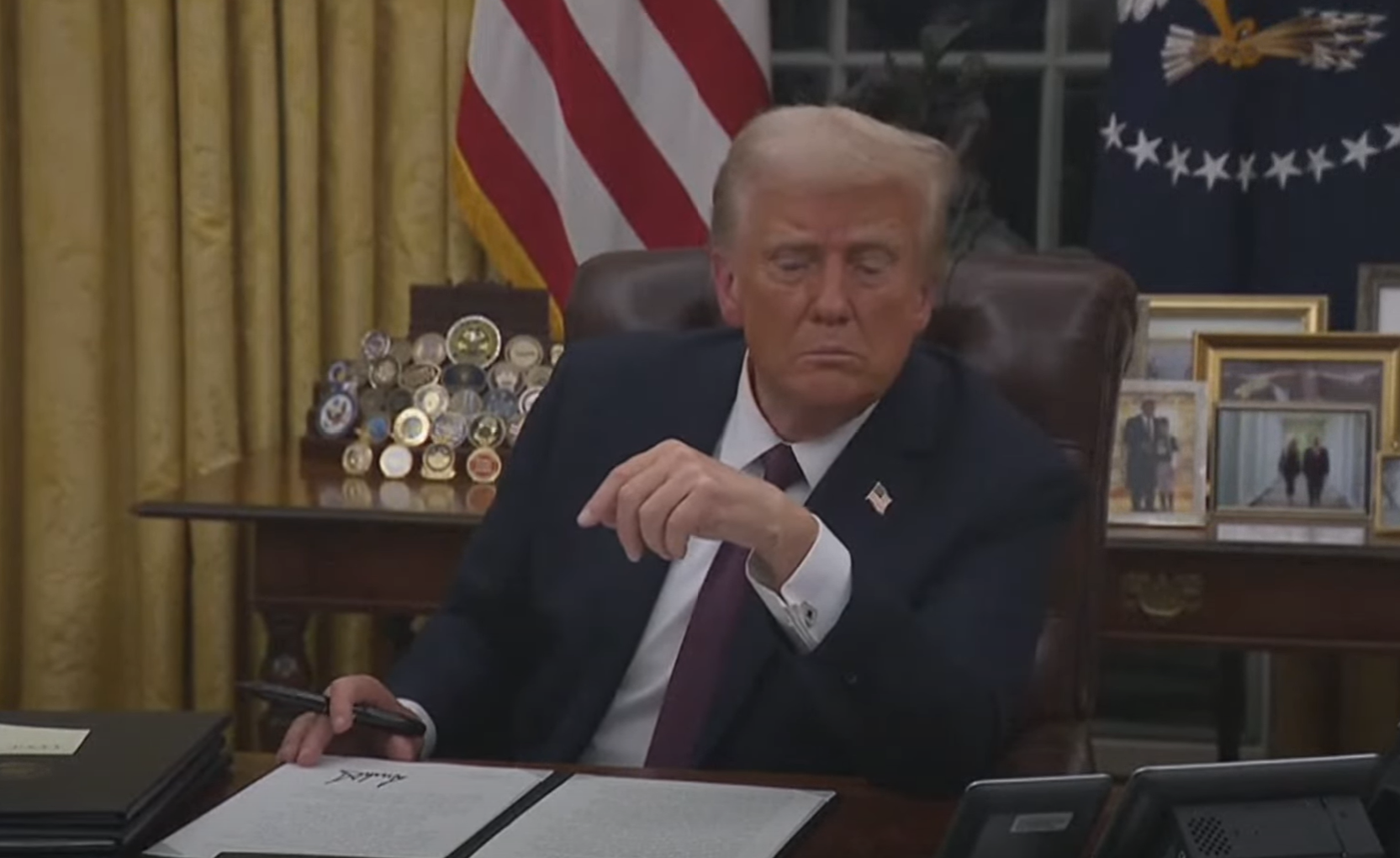

Picture this: Bitcoin, the digital darling of the finance world, could be on the verge of a major boom thanks to an unexpected source – US President Donald Trump. On Monday, President Trump signed an executive order that could pave the way for a massive influx of capital into the cryptocurrency space. With estimates ranging from $150 billion to a staggering $500 billion, the implications for Bitcoin investors and enthusiasts are nothing short of mind-boggling.

The Trump Effect on Bitcoin

So, what exactly does this executive order entail? Essentially, President Trump has mandated the creation of a new sovereign wealth fund, which could potentially pump billions of dollars into various assets, including Bitcoin. This move could signal a shift in the traditional financial landscape, as institutional investors and governments alike start to take cryptocurrencies more seriously.

For Bitcoin, this influx of capital could mean a surge in demand and value. With more money flowing into the market, the price of Bitcoin could skyrocket, opening up new opportunities for investors and holders. The increased legitimacy and recognition from the government could also help to solidify Bitcoin’s place as a mainstream asset class.

How Will This Impact Me?

For the average investor or Bitcoin enthusiast, this news could have a significant impact on your portfolio. If Bitcoin experiences a surge in value as a result of the capital influx, your investments could see substantial gains. Additionally, the increased attention and legitimacy from the government could attract more institutional investors to the space, further driving up the price of Bitcoin.

However, as with any investment, there are risks involved. The volatile nature of Bitcoin means that prices can fluctuate wildly, so it’s important to approach this potential boom with caution and do thorough research before making any investment decisions.

How Will This Impact the World?

On a global scale, the implications of this potential Bitcoin boom are vast. The increased recognition and legitimacy of cryptocurrencies by a major world government could signal a significant shift in the financial landscape. As more governments and institutions start to embrace cryptocurrencies, we could see a fundamental reshaping of the traditional financial system.

Additionally, the influx of capital into the cryptocurrency space could drive innovation and growth in the industry, leading to new opportunities for businesses and entrepreneurs. This could potentially pave the way for a more inclusive and accessible financial system that is not tied to traditional banking institutions.

Conclusion

In conclusion, the implications of President Trump’s executive order for Bitcoin are nothing short of extraordinary. With the potential for a $150-500 billion influx of capital into the cryptocurrency space, Bitcoin could be on the cusp of a major boom that could revolutionize the financial industry. As investors and enthusiasts alike eagerly await the impact of this news, one thing is certain – the world of finance may never be the same again.