RBA’s Lack of Hawkishness Weakens Aussie, Yen’s Retreat Continues

In the aftermath of RBA’s decision to maintain interest rates unchanged and the absence of explicit hawkish signals, Australian Dollar weakens mildly. Despite notable upgrades in inflation forecasts, the central bank opted for a cautious approach, refraining from signaling imminent rate hikes and maintaining a stance of “not ruling anything in or out.” Recent stronger-than-expected […]

When the Reserve Bank of Australia (RBA) announced its decision to keep interest rates unchanged, many were expecting a more hawkish stance that could strengthen the Australian Dollar. However, the absence of clear signals of rate hikes caused the Aussie to weaken slightly. This came as a surprise to some, given the recent upgrades in inflation forecasts.

The central bank’s cautious approach has led to speculation about the future direction of monetary policy. By refraining from explicitly signaling rate hikes, the RBA has left the door open for various possibilities. This uncertainty has had a mild weakening effect on the Australian Dollar.

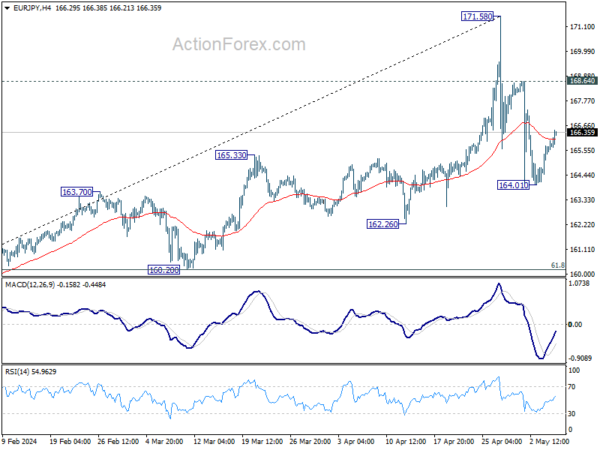

Meanwhile, the Japanese Yen continues its retreat, as the RBA’s lack of hawkishness contrasts with the Bank of Japan’s recent actions. The divergence in monetary policy between the two central banks has contributed to the Yen’s decline against other major currencies.

Effect on Me:

As a consumer or investor in Australia, the RBA’s decision and lack of hawkish signals could have implications for interest rates, borrowing costs, and currency exchange rates. It is important to stay informed about the central bank’s policies and announcements to make informed financial decisions.

Effect on the World:

The weakening of the Australian Dollar and the Yen’s retreat could have broader implications for global markets and trade. Currency movements between major economies like Australia and Japan can impact international trade, investment flows, and financial market volatility. It is important for businesses and investors to monitor these developments to manage risks effectively.

Conclusion:

In conclusion, the RBA’s decision to maintain interest rates unchanged and the absence of explicit hawkish signals have had a mild weakening effect on the Australian Dollar. This contrasts with the ongoing retreat of the Japanese Yen, highlighting the diverging monetary policies of the two central banks. As the world watches these currency movements unfold, it is essential for individuals and businesses to stay informed and adapt to changing market conditions.