Disrupting the Future of Banking: Key Insights from the Finance Magnates London Summit 2023

A Glimpse into the Future

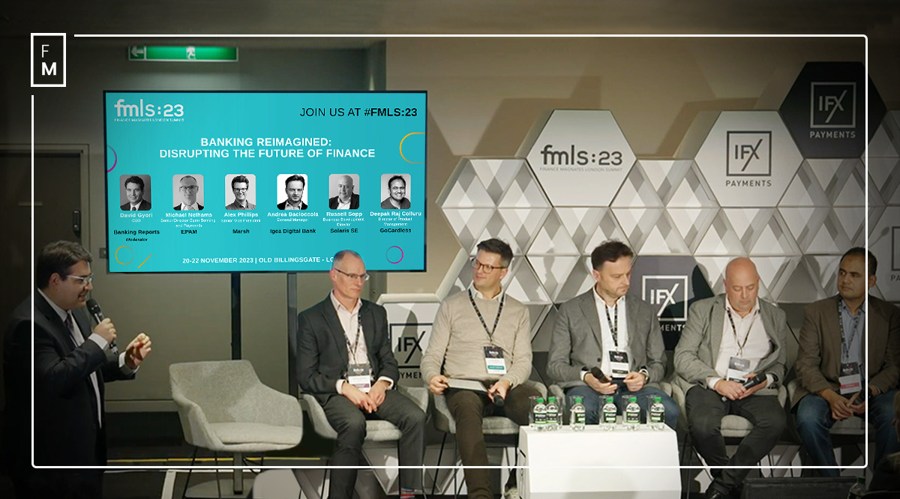

In a panel discussion at the Finance Magnates London Summit 2023, industry titans convened to dissect the evolving contours of finance under the theme “Banking Reimagined: Disrupting the Future.” Moderated by David Gyori, the CEO at Banking Reports, the discourse delved into innovative strategies poised to shape the future of banking and payments.

The discussion unfolded with insights from luminaries representing diverse sectors of the finance realm. Michael Nelhams, the Senior Director of Open Banking Strategies at a leading fintech company, emphasized the importance of customer-centric solutions in driving industry transformation. He highlighted the increasing demand for personalized banking experiences and the role of technology in meeting these expectations.

Redefining Traditional Banking

As the financial landscape continues to evolve, traditional banks are facing mounting pressure to adapt to changing consumer preferences and technological advancements. The rise of digital banking solutions and fintech disruptors has challenged legacy institutions to innovate and streamline their operations.

One of the key takeaways from the panel discussion was the need for banks to embrace open banking initiatives and collaborative partnerships to stay competitive in the digital age. By leveraging data-driven insights and customer feedback, financial institutions can develop tailored products and services that meet the evolving needs of their clients.

Overall, the Finance Magnates London Summit 2023 offered a glimpse into the future of banking, highlighting the need for industry players to embrace innovation and disruption to stay ahead of the curve.

How This Will Impact Me

The evolving landscape of finance and banking will have a direct impact on consumers, as they can expect more personalized and efficient services tailored to their individual needs. With the advent of digital banking solutions, customers can enjoy greater convenience and accessibility to financial products and services.

How This Will Impact the World

The disruption in the banking industry will have far-reaching implications for the global economy, as financial institutions adapt to new technologies and changing consumer behaviors. The shift towards open banking and collaboration between traditional banks and fintech companies will foster innovation and drive economic growth on a global scale.

Conclusion

In conclusion, the Finance Magnates London Summit 2023 provided valuable insights into the future of banking and payments, highlighting the need for industry stakeholders to embrace innovation and collaboration to thrive in an increasingly digital landscape. As traditional banking paradigms evolve, consumers can look forward to more personalized and efficient financial services, while the global economy stands to benefit from increased innovation and economic growth. It is evident that the future of banking is being reimagined, and industry players must be proactive in adapting to these changes to stay relevant and competitive in the digital age.