Unlocking the Power of Bitcoin: A Heartfelt Look at its 280% Surge from Cycle Lows, Mirroring Past Bull Cycles

Quick Take

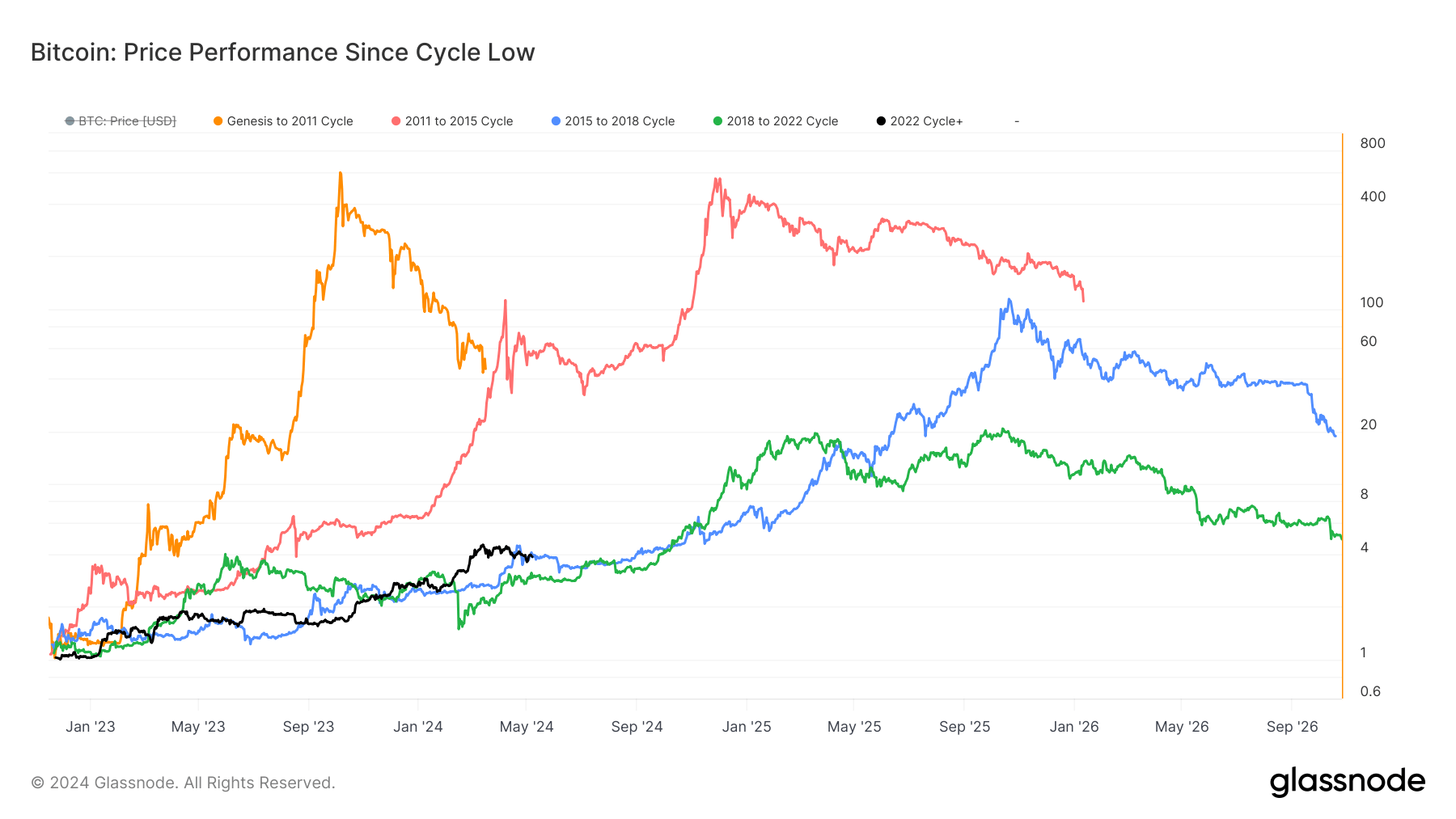

Since bottoming out around $15,500 in November 2022, Bitcoin’s performance has been on a consistently upward trajectory. This growth culminated in new all-time highs in March 2024, marking a staggering 280% surge from its cycle low. However, the market has experienced several healthy corrections during this bullish trend. In March 2023, Bitcoin saw […]

My Personal Reflection

As someone who has been following the cryptocurrency market for quite some time, witnessing Bitcoin’s impressive surge from its cycle lows is truly a testament to the power and resilience of this digital asset. The journey that Bitcoin has taken, from facing skepticism and doubt to now reaching new heights, is nothing short of inspirational.

This surge not only proves the strength of Bitcoin as a financial instrument but also highlights the growing acceptance and adoption of cryptocurrencies in mainstream finance. The fact that Bitcoin has been able to mirror past bull cycles and surpass previous all-time highs is a clear indication of the maturation of the cryptocurrency market.

It is important to acknowledge that along with this significant growth, there have been challenges and corrections along the way. These fluctuations are a normal part of the volatile nature of the cryptocurrency market and serve as a reminder of the risks involved in investing in digital assets. However, for those who believe in the long-term potential of Bitcoin, these ups and downs are just part of the journey towards a brighter future.

How This Will Affect Me

As an individual investor in Bitcoin, the 280% surge from its cycle lows is a clear indication of the potential for significant gains in the cryptocurrency market. This growth not only boosts my confidence in the asset’s ability to generate returns but also reinforces my belief in the future of Bitcoin as a key player in the financial landscape.

How This Will Affect the World

The continuous rise of Bitcoin and its ability to mirror past bull cycles will have a ripple effect on the global financial system. As cryptocurrencies become more mainstream and widely accepted, traditional financial institutions will need to adapt to the changing landscape. This shift towards digital assets could potentially revolutionize the way we transact, invest, and store value in the future.

Conclusion

In conclusion, Bitcoin’s remarkable surge from its cycle lows is a testament to the resilience and potential of this groundbreaking digital asset. As we continue to witness the evolution of the cryptocurrency market, it is clear that Bitcoin is here to stay and will play a significant role in shaping the future of finance. It is essential for investors to stay informed, remain patient during market fluctuations, and embrace the opportunities that Bitcoin and other cryptocurrencies bring to the table.