The Impact of Nvidia’s Downturn on the Semiconductor Market

Market Volatility Strikes Again

After appearing to recover from Monday’s DeepSeek market sell-off, semiconductor giant Nvidia (NASDAQ: NVDA) is once again experiencing a downturn as jitters over artificial intelligence (AI) spending set in amid the earning season. Many investors had hoped that the worst was behind them, but recent trends indicate that the market remains fragile and susceptible to external factors.

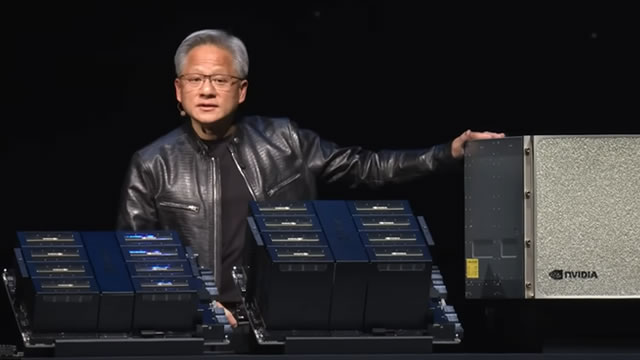

The Importance of Nvidia in the Semiconductor Industry

Nvidia is a major player in the semiconductor industry, known for its cutting-edge graphics processing units (GPUs) that are essential for AI, gaming, and data processing applications. The company’s performance often serves as a barometer for the overall health of the tech sector, making its ups and downs closely watched by industry analysts and investors alike.

Concerns Over AI Spending

One of the key reasons behind Nvidia’s current downturn is the growing concern over AI spending. As companies reassess their budgets and priorities in light of economic uncertainties, investments in AI technologies are coming under scrutiny. This has led to a decrease in demand for Nvidia’s products, as customers hold off on making new purchases in the short term.

The Ripple Effect on the Semiconductor Market

Nvidia’s struggles are not limited to the company itself, but are also having a ripple effect on the semiconductor market as a whole. Other players in the industry, such as AMD and Intel, are also feeling the impact of reduced AI spending and market volatility. This could lead to a slowdown in innovation and growth across the sector, affecting not just individual companies but the industry as a whole.

How This Affects Me

As a tech investor, the downturn in Nvidia’s stock price may have a direct impact on my portfolio. It is important to stay informed about market trends and company performance to make informed decisions about buying or selling semiconductor stocks. Diversifying my investments and staying patient during market fluctuations can help mitigate potential losses.

How This Affects the World

On a broader scale, Nvidia’s downturn could have implications for the future of AI development and innovation. If companies scale back on AI investments, it could slow down progress in AI technologies and limit their potential applications in various industries such as healthcare, finance, and autonomous vehicles. This could have far-reaching consequences for society as a whole, affecting everything from job growth to technological advancement.

Conclusion

In conclusion, Nvidia’s current downturn is a reminder of the fragility of the semiconductor market and the importance of staying informed and adaptable in the face of uncertainty. As investors, it is crucial to monitor market trends and company performance closely, while also considering the wider implications of industry shifts on innovation and progress. By staying agile and well-informed, we can navigate through market ups and downs with resilience and confidence.