The Unveiling of China’s AI DeepSeek Causes Market Turmoil

Investors Shift Focus to REITs and Utilities

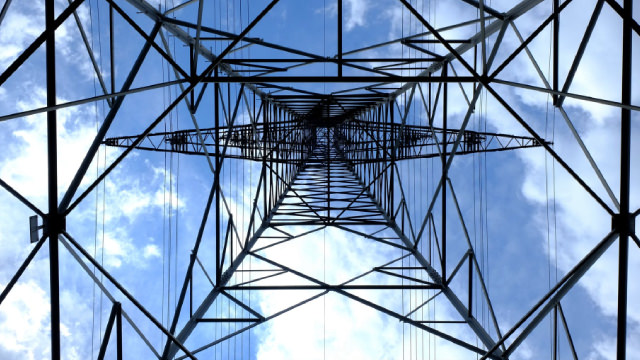

The recent announcement of China’s AI DeepSeek has sent shockwaves through the market, triggering a sharp decline in AI stocks while causing a surge in REITs and utilities. This shift in investor behavior can be attributed to the uncertainty surrounding the profitability of AI, prompting many to seek out more stable and predictable returns offered by REITs and regulated utilities.

With expected returns of 8%-10%, REITs and utilities are proving to be increasingly attractive options for investors looking for steady cash flows amidst the unpredictable landscape of AI. The allure of AI’s rapid growth is fading as concerns about its long-term profitability start to surface, making the more traditional investments of REITs and utilities seem like a safer bet.

How Will This Affect Me?

As an individual investor, the market shift towards REITs and utilities could present you with an opportunity to diversify your portfolio and potentially earn more stable returns. By taking advantage of the current trend, you may be able to mitigate some of the risks associated with investing in volatile AI stocks.

How Will This Affect the World?

The impact of China’s AI DeepSeek on the global market suggests a broader shift in investor sentiment towards more conservative investment options. This could lead to a reevaluation of the priorities and expectations of investors worldwide, as they pivot towards investments that offer reliability and sustainability over flashy but uncertain growth prospects.

Conclusion

The unveiling of China’s AI DeepSeek has caused a ripple effect in the market, prompting investors to rethink their strategies and consider more stable investment options such as REITs and utilities. While the future of AI remains uncertain, the appeal of steady cash flows provided by traditional investments is becoming increasingly apparent. As the market continues to evolve, it will be interesting to see how investor preferences shift and how this will impact the global economy as a whole.