Well, well, well…

EVgo and the rollercoaster ride of investing

Let’s talk about EVgo (EVGO -0.29%)

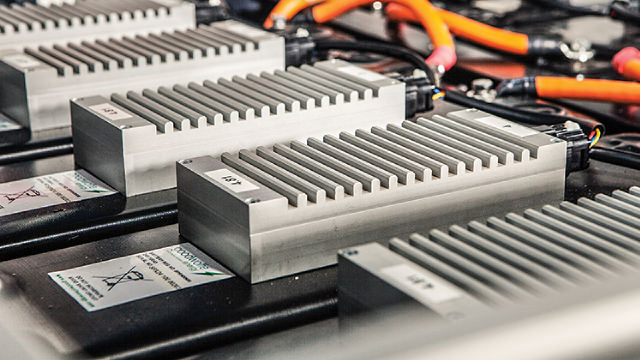

EVgo, the leading builder of electric vehicle (EV) charging stations, has certainly been a wild ride for investors. It made its debut on the stock market by merging with a special purpose acquisition company (SPAC) in July 2021. The stock opened at $15.05 on the first day, and boy, has it been a bumpy journey since then.

Investing in EVgo seemed like a promising opportunity for many. After all, with the current push towards sustainability and the rise of electric vehicles, it’s easy to see why EV charging stations would be a hot commodity. However, as with any investment, there are no guarantees.

For many investors, the initial excitement quickly turned into disappointment as EVgo’s stock price took a tumble. The ups and downs of the market can be unpredictable, and EVgo’s performance has been no exception.

But hey, investing is all about taking risks, right? Sometimes you win big, and other times you learn valuable lessons. The important thing is to stay informed, stay diversified, and keep a sense of humor along the way.

How will this affect me?

As an individual investor, the ups and downs of EVgo’s stock price may not have a huge impact on your overall portfolio. However, it serves as a reminder of the risks involved in the market and the importance of doing your due diligence before making investment decisions.

How will this affect the world?

On a larger scale, the performance of EVgo as a company could have implications for the electric vehicle industry as a whole. As one of the leaders in EV charging infrastructure, EVgo plays a crucial role in supporting the growth of electric vehicles and the transition to a more sustainable transportation system.

In conclusion…

So, what’s the takeaway from all of this? Investing can be a wild ride, with plenty of twists and turns along the way. Whether you’re cheering for EVgo to bounce back or reevaluating your investment strategy, remember to approach the market with a mix of caution and optimism. And who knows, maybe the next big opportunity is just around the corner!