Candlestick Patterns Cheatsheet

In today’s post, you will learn a simple method to read candlestick patterns like a pro: without memorizing a single pattern, without getting confused by the sheer number of patterns, without getting overwhelmed with information if you just follow this simple procedure. Sounds good? So, let’s kick things off by knowing the basics.

Understanding Candlestick Patterns

Candlestick patterns are a popular tool used by traders to analyze price movements in the financial markets. Each candlestick represents a specific time period and provides valuable information about the psychology of market participants. By learning how to interpret candlestick patterns, traders can make better-informed decisions and improve their trading results.

The Simple Method

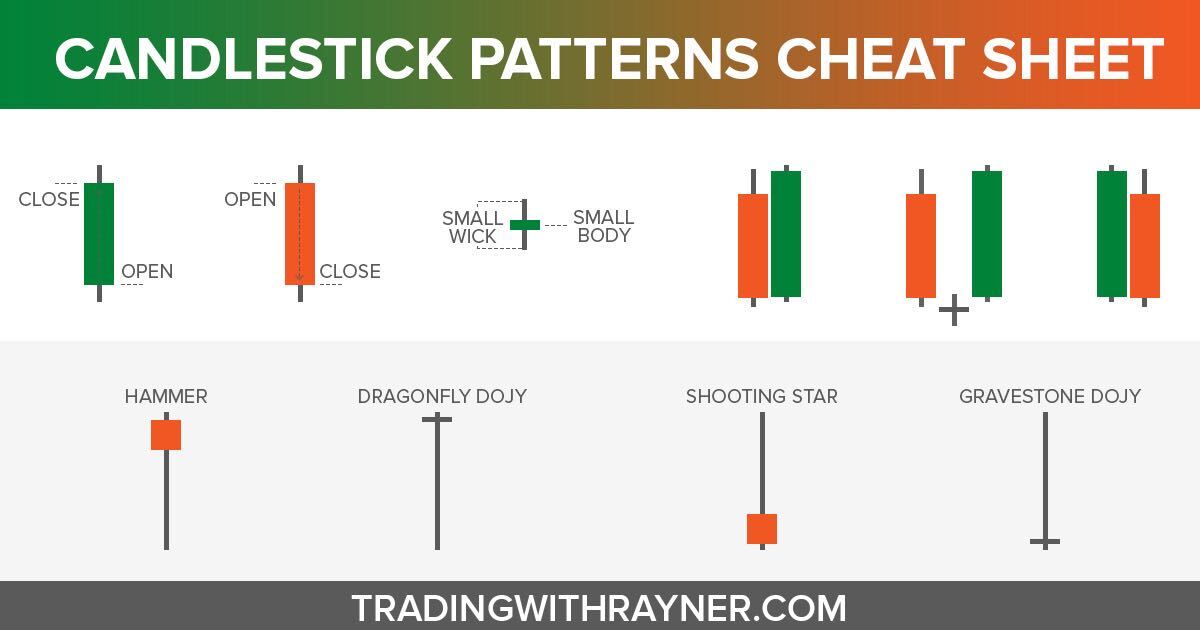

Instead of trying to memorize every single candlestick pattern out there, focus on understanding the basic components of a candlestick. These include the open, high, low, and close prices. By analyzing the relationship between these prices, you can gain valuable insights into market sentiment and potential price direction.

Applying the Method

Start by looking at the relationship between the open and close prices of a candlestick. A bullish candlestick, where the close price is higher than the open price, indicates buying pressure. Conversely, a bearish candlestick, where the close price is lower than the open price, indicates selling pressure. By analyzing consecutive candlesticks, you can identify patterns and trends in price movements.

By focusing on the basics and analyzing price action, you can simplify the process of reading candlestick patterns and make more informed trading decisions. Remember, the key is to understand the underlying psychology of market participants and use that knowledge to your advantage.

Conclusion

By following this simple method, you can become a more confident and successful trader. Instead of getting overwhelmed by the sheer number of candlestick patterns, focus on understanding the basics and applying them to your trading strategy. With practice and experience, you will be able to interpret candlestick patterns like a pro and take your trading to the next level.

How This Will Affect Me

By learning how to read candlestick patterns effectively, traders can improve their decision-making process and potentially increase their profitability. This can help me make more informed trades and potentially achieve better results in my trading activities.

How This Will Affect the World

As more traders learn how to interpret candlestick patterns accurately, the overall efficiency and transparency of the financial markets can improve. This can lead to more accurate price discovery and potentially reduce market manipulation. Ultimately, a better understanding of candlestick patterns can benefit the global financial system as a whole.