The Timken Company: A Strong Long-Term Investment

Recent Challenges

Despite recent underperformance and reduced profitability, The Timken Company remains a strong long-term investment. Recent financial results have shown declines in revenue and profits, but the company is taking proactive steps to strengthen its position for 2025 and beyond.

Strengths

One of the key strengths of The Timken Company is its diverse customer base and global reach. This allows the company to weather short-term challenges and position itself for long-term success. Shares of the company are attractively priced on both an absolute basis and relative to similar firms, making it a compelling buy for investors looking to capitalize on future growth.

Future Outlook

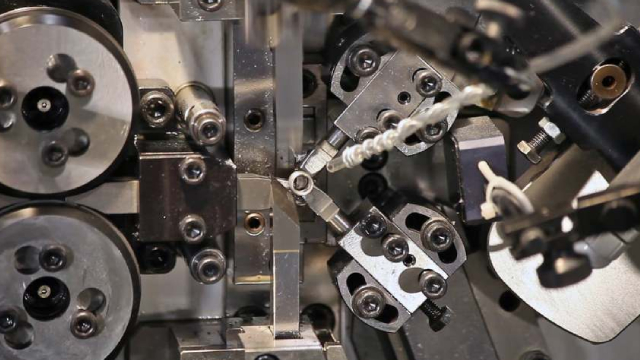

Looking ahead to 2025 and beyond, The Timken Company is focused on innovation and adaptation to changing market conditions. By investing in new technologies and expanding its product offerings, the company aims to drive revenue and profitability growth in the coming years.

Impact on Investors

For investors, The Timken Company’s resilience in the face of recent challenges bodes well for future returns. By staying the course and holding onto shares in the company, investors stand to benefit from potential long-term gains as the company rebounds and capitalizes on new opportunities.

Global Implications

On a global scale, The Timken Company’s strategic positioning and commitment to long-term success have the potential to drive innovation and growth in the industrial sector. By continuing to expand its global reach and invest in new technologies, the company can play a key role in shaping the future of the global economy.

Conclusion

In conclusion, The Timken Company may be facing short-term challenges, but its strong fundamentals and long-term outlook make it a strong investment opportunity. By weathering recent storms and positioning itself for future growth, the company is well-positioned to deliver value for investors and drive innovation on a global scale.