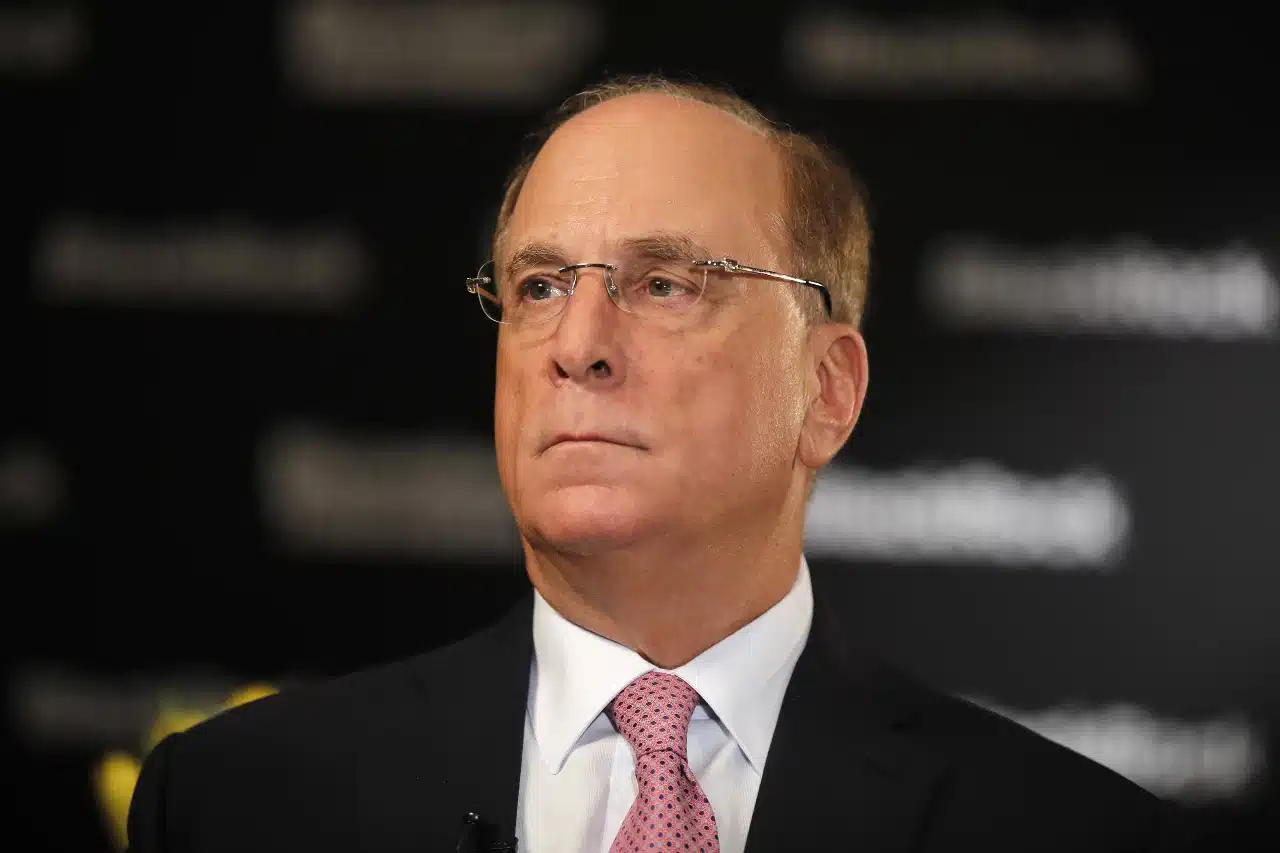

BlackRock’s CEO Larry Fink Makes Bold Bitcoin Prediction

Bitcoin to the Moon?

Well, well, well…looks like the Bitcoin rollercoaster just got a major turbo boost! BlackRock’s CEO Larry Fink dropped a bombshell at the World Economic Forum in Davos, predicting that Bitcoin’s price could skyrocket to $700,000 if sovereign wealth funds decide to allocate 2-5% of their portfolios to the digital currency. Now, that’s one spicy meatball!

So, What’s the Deal?

During his discussion at Davos, Fink spilled the beans on his talks with sovereign wealth fund managers about the possibility of them jumping on the Bitcoin bandwagon. He hinted at the idea of these funds investing a small percentage of their hefty portfolios into the volatile world of cryptocurrency. Talk about shaking things up!

Now, we all know that Bitcoin has been a wild ride so far, with its price soaring to dizzying heights and plummeting to gut-wrenching lows. But if these sovereign wealth funds do decide to take the plunge, we could be looking at a whole new ball game. With billions of dollars potentially flowing into Bitcoin, the price could be pushed to unimaginable levels.

How This Could Affect Me

So, you’re probably thinking, how does all this Bitcoin craziness affect little ol’ me? Well, if you’re one of the savvy investors who already dabbles in cryptocurrency, this news could mean big bucks for you. A surge in demand from sovereign wealth funds could drive up the price of Bitcoin, making your digital wallet a whole lot fatter.

On the flip side, if you’re a crypto skeptic, you might want to keep a close eye on this situation. A sudden influx of big players into the market could lead to increased volatility, making those Bitcoin price swings even more intense. Buckle up, buttercup!

How This Could Affect the World

Now, let’s zoom out and take a look at the bigger picture. If sovereign wealth funds do start pouring money into Bitcoin, it could have ripple effects across the global economy. The cryptocurrency market could become even more intertwined with traditional financial systems, blurring the lines between old and new ways of investing.

Furthermore, a surge in Bitcoin’s price could attract even more attention from regulators and policymakers. They might scramble to keep up with the rapidly evolving landscape of digital currency, potentially laying down new rules and regulations that could shape the future of finance.

Conclusion

So, there you have it, folks. BlackRock’s CEO Larry Fink has stirred the pot with his bold Bitcoin prediction, and the ripple effects could be felt far and wide. Whether you’re a crypto enthusiast or a cautious observer, one thing’s for sure – the future of Bitcoin is looking more exciting than ever. Hold onto your hats, because the ride is about to get wild!