Technical Analysis: EURNZD Elliott Wave Charts

Introduction

Welcome to our technical blog where we will be analyzing the Elliott Wave charts of EURNZD that have been published in the members’ area of our website. As many of our members are aware, we have been bullish on EURNZD ever since it broke above the May 12, 2022 high. This break in the high created an incomplete bullish sequence, leading us to believe that there may be more upside potential.

Analysis

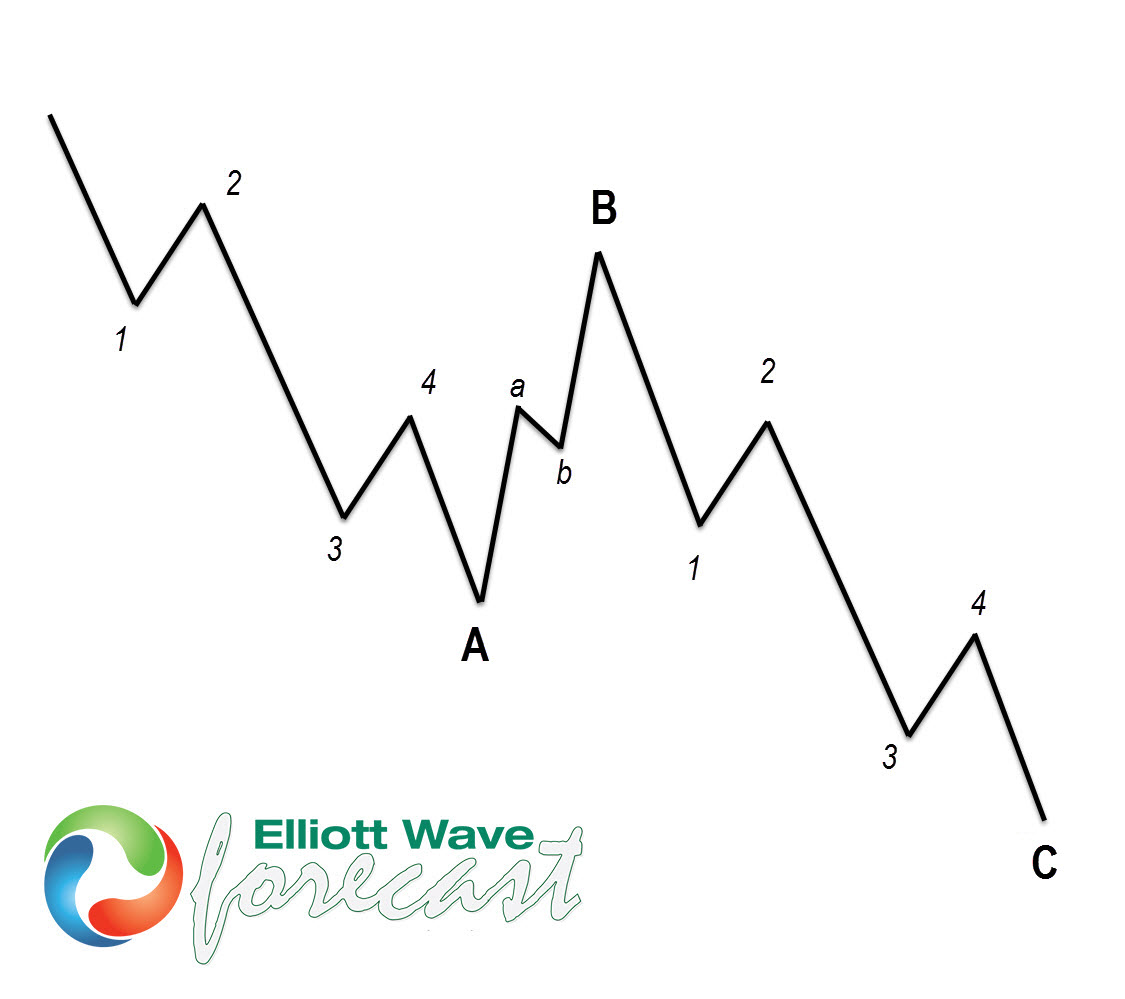

As we can see from the Elliott Wave charts, EURNZD has been following a clear uptrend since breaking above the key resistance level in May. The recent pullbacks have provided opportunities for investors to buy the dips, with the blue box area representing a particularly attractive buying opportunity. This area has acted as a strong support level in the past and is likely to continue to do so in the future.

Furthermore, the bullish sequence that has been forming suggests that there is still room for further growth in EURNZD. The market sentiment remains positive, with investors showing confidence in the long side of the trade. Overall, the technical analysis indicates that buying the dips at the blue box area could be a profitable strategy for traders.

Impact on Individuals

For individual traders and investors, the bullish outlook on EURNZD could present an opportunity to capitalize on the potential upside. By carefully monitoring the Elliott Wave charts and identifying key support levels, individuals may be able to make informed trading decisions that lead to positive returns.

Impact on the World

On a larger scale, the bullish trend in EURNZD could have implications for the global economy. A strengthening euro against the New Zealand dollar could impact international trade and investment flows between the Eurozone and New Zealand. This shift in currency dynamics may influence market sentiment and overall economic stability.

Conclusion

In conclusion, the Elliott Wave charts of EURNZD point towards a favorable buying opportunity at the blue box area. The bullish sequence and positive market sentiment suggest that there is potential for further growth in the pair. Individual traders may benefit from taking advantage of the uptrend, while the broader implications of this trend could have effects on the global economy. It is important for investors to remain vigilant and make informed decisions based on thorough analysis of the market.