Deutsche Bank’s Response to the FOMC Meeting

December FOMC: Powell Breaks Out Punchbowl Early at the Holiday Party

Deutsche Bank’s note following the recent FOMC meeting, titled “December FOMC: Powell Breaks Out Punchbowl Early at the Holiday Party,” highlights Chairman Jerome Powell’s dovish tone and the implications for future rate cuts. Despite the new developments, Deutsche Bank maintains its base case for rate cuts next year.

Impact on Rate Cuts

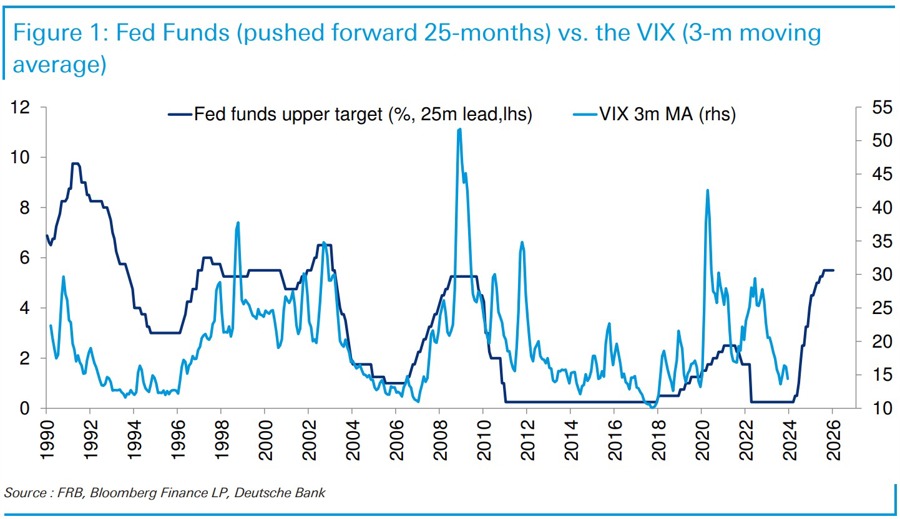

Powell’s dovish tone on Wednesday has increased the probability of rate cuts happening sooner than expected. This development also raises the chances of a soft landing if inflation continues to ease. Deutsche Bank’s baseline forecast suggests that the first rate cut is likely to occur in June 2024.

How Will This Affect You?

As an individual consumer, the potential for earlier rate cuts could mean lower borrowing costs on loans such as mortgages and credit cards. This could lead to increased spending and investment, ultimately impacting your personal financial decisions.

Global Impact

On a global scale, the dovish tone from the FOMC could impact international markets and currencies. Lower interest rates in the US may influence the decisions of other central banks around the world, creating a ripple effect on global economic conditions.

Conclusion

In conclusion, Deutsche Bank’s response to the FOMC meeting highlights the potential impact of Powell’s statements on future rate cuts. While the specifics of the timing are uncertain, the overall tone suggests a cautious approach to monetary policy. As the situation continues to evolve, it is important to stay informed and consider the implications for your own financial well-being.