Welcome to the World of Bitcoin HODLing!

The Trend of Long-Term Bitcoin Holding

What’s the Deal with HODLing?

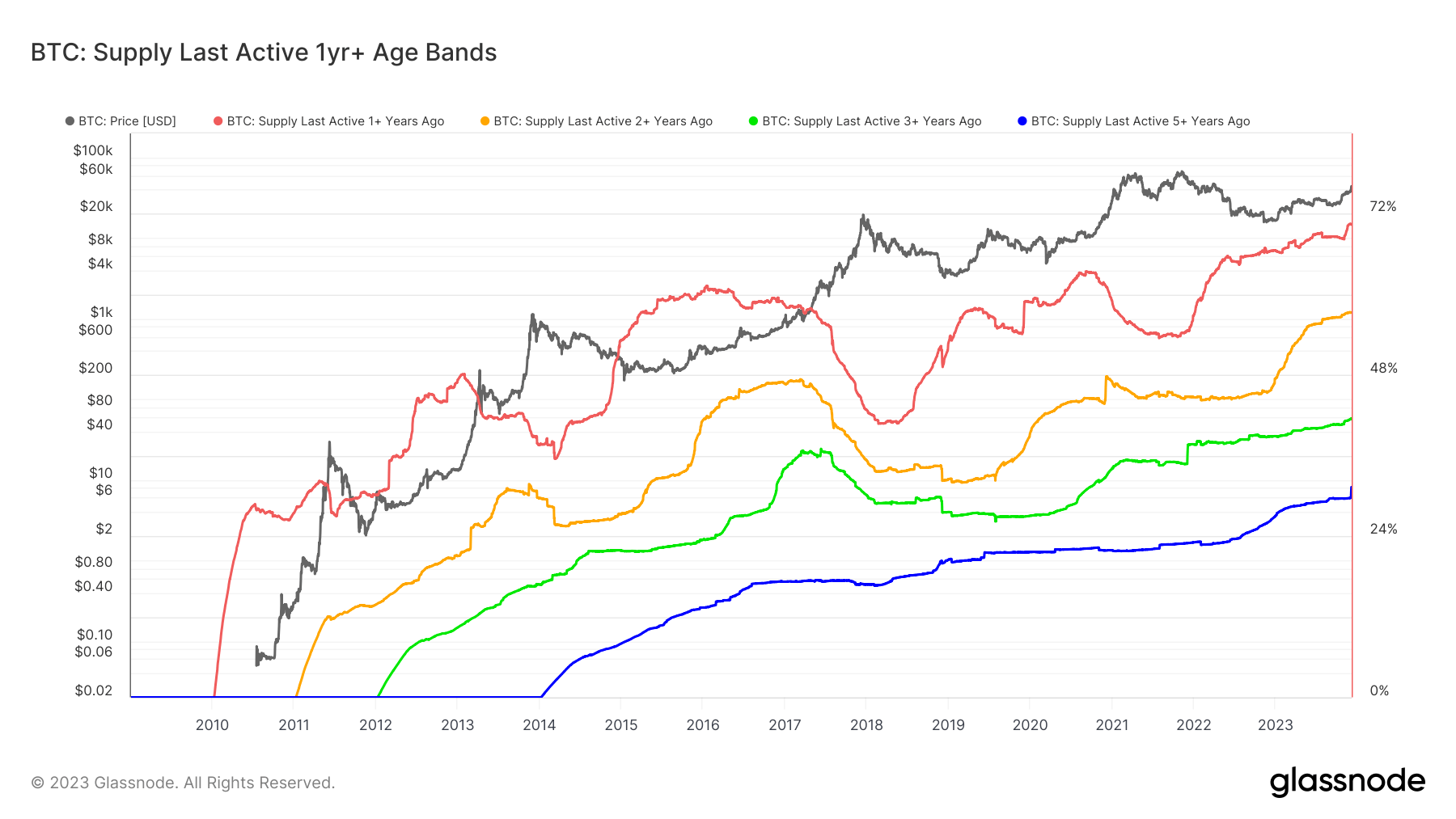

Historical data has shown a growing trend among Bitcoin investors towards long-term holding. Since Bitcoin’s creation in 2009, coins have been circulating through various processes such as mining, purchasing, and selling. However, there is a significant amount of Bitcoin that has not moved on-chain for an extended period of time.

This trend of holding onto Bitcoin for the long term has become particularly evident in recent years, with a record 31% of Bitcoin supply remaining dormant for over five years. This means that a large portion of Bitcoin holders are choosing to hodl onto their coins rather than actively trading or selling them.

The Rise of HODLing Culture

So what’s driving this shift towards long-term holding? Some believe it’s a sign of growing confidence in Bitcoin as a store of value, while others see it as a way to ride out the ups and downs of the volatile cryptocurrency market.

Whatever the reasons may be, one thing is clear – the hodling culture is here to stay. Whether you’re a seasoned Bitcoin investor or just getting started, embracing the idea of holding onto your coins for the long term could be a smart move in today’s ever-changing financial landscape.

How This Trend Will Impact You

As a Bitcoin investor, the growing trend towards long-term holding could have significant implications for your investment strategy. By choosing to hodl onto your coins, you may be able to weather market volatility more effectively and potentially see greater long-term returns.

Additionally, the rise of hodling culture could lead to a more stable Bitcoin ecosystem overall, as more investors opt to hold onto their coins rather than constantly buying and selling. This could help to reduce market speculation and create a more sustainable investment environment for all involved.

How This Trend Will Impact the World

From a global perspective, the growing trend of long-term Bitcoin holding could have wide-reaching effects on the financial industry as a whole. As more investors embrace hodling as a viable investment strategy, we may see a shift towards more stable and less speculative markets.

This could potentially lead to greater adoption of Bitcoin and other cryptocurrencies as legitimate stores of value, ultimately driving mainstream acceptance and integration into traditional financial systems. The implications of this trend could be far-reaching and transformative for the world of finance as we know it.

In Conclusion

So whether you’re a die-hard hodler or just dipping your toes into the world of Bitcoin investing, it’s clear that the trend towards long-term holding is something to keep an eye on. By embracing this culture of hodling, you may be positioning yourself for success in the ever-evolving world of cryptocurrency.