Australian Inflation Data Analysis

Last month’s data sends shockwaves through Australian financial markets

Last month, Australian private survey of inflation soared by 1% m/m in December, marking the most significant increase in 17 months. This unexpected jump sent shivers through Australian financial markets, causing speculation and concern among investors and economists alike.

Subdued official data follows the initial surge

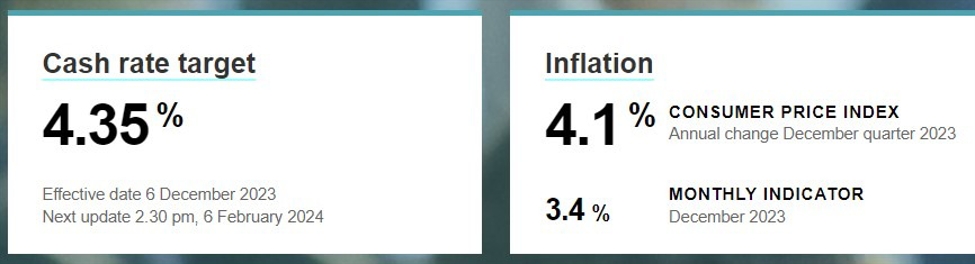

Since the initial private survey data, more subdued official data has been released. In the fourth quarter, Australian headline CPI came in at 4.1% y/y, slightly below the expected 4.3%. The January headline rates also showed a more tempered growth compared to the previous month.

Here is a breakdown of the latest inflation data:

For January, headline rates:

+0.3% m/m (prior +1.0%)

4.6% y/y (prior 5.2%)

Trimmed mean (a measure of core inflation):

+0.2% m/m (prior +0.9%)

4.4% y/y (prior 5.2%)

What to expect from the upcoming RBA statement

The Reserve Bank of Australia’s statement for February is due tomorrow, and it is widely expected to keep the cash rate unchanged. The RBA will likely continue to closely monitor the inflation data and other economic indicators to determine the best course of action for monetary policy moving forward.

How will this impact individuals like me?

The recent inflation data may have various effects on individuals in Australia. If inflation continues to rise, it could lead to higher prices for goods and services, potentially impacting the cost of living for consumers. Additionally, the RBA’s monetary policy decisions in response to the inflation data could influence interest rates and borrowing costs for individuals, affecting decisions related to saving, investing, and spending.

Global implications of the Australian inflation data

Australia’s inflation data can also have broader implications for the global economy. As a major exporter of commodities, changes in Australian inflation rates can impact global trade and financial markets. Investors and policymakers around the world will be closely watching the RBA’s actions in response to the inflation data, as they may signal broader trends in economic growth and monetary policy strategies.

Conclusion

In conclusion, the recent inflation data in Australia has sparked a wave of speculation and analysis in financial markets. While the initial jump in private survey data caused concern, the more subdued official data and upcoming RBA statement offer a more nuanced perspective on the current economic outlook. Individuals in Australia may see impacts on their cost of living and financial decisions, while the global implications of the inflation data could influence broader economic trends. It will be crucial to monitor future developments and policy responses to understand the full extent of the effects of the inflation data on both Australia and the world.