Market eyes max pain prices as $6.6 billion BTC and $3.4 billion ETH options expiry nears

June expiration of Bitcoin and Ethereum options could spell volatility

With June coming to an end, market watchers are closely monitoring the expiration of significant Bitcoin (BTC) and Ethereum (ETH) options, as it has the potential to impact market conditions. On June 28, BTC options amounting to $6.6 billion are set to expire, while ETH options worth $3.4 billion will also reach their expiration date around the same time. This impending event has left many investors speculating on the possible outcomes and preparing for potential market volatility.

Bitcoin options show bullish sentiment

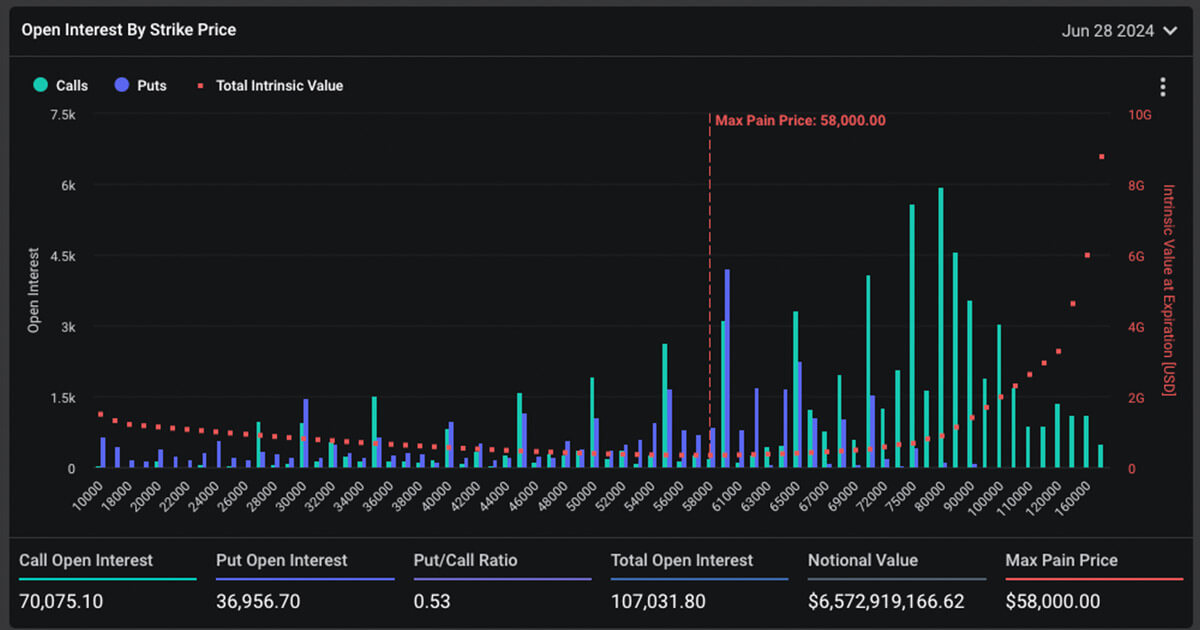

Data from Deribit indicates that the put/call ratio for BTC options stands at 0.53, suggesting a bullish sentiment among traders. The total open interest for BTC options is estimated to be around 107,000 BTC, with 70,000 BTC in calls and 37,000 BTC in puts. This data indicates that market participants are leaning towards a positive outlook for Bitcoin leading up to the expiration date.

Impact on traders

For individual traders and investors, the expiration of such large numbers of options contracts could lead to increased volatility and potential price swings in the cryptocurrency market. Traders must stay vigilant and be prepared to manage their positions effectively to navigate through the uncertainty that comes with such significant events.

Global implications

On a global scale, the expiration of these options contracts could have repercussions on the broader financial markets. As cryptocurrencies continue to gain mainstream adoption, events like these are closely watched by institutional investors, regulators, and policymakers. Market reactions to the expiration of BTC and ETH options could have far-reaching effects on the overall sentiment towards digital assets.

Conclusion

As the expiration of $6.6 billion BTC and $3.4 billion ETH options approaches, market participants are bracing themselves for potential price movements and volatility. Traders need to stay informed and adapt their strategies accordingly to navigate through the uncertainty that comes with such significant events. The global impact of these expirations could shape the future direction of cryptocurrency markets and influence the perception of digital assets in the broader financial landscape.