Quarter-End Options Expiry: What to Watch For

The Significance of Key Option Expiries

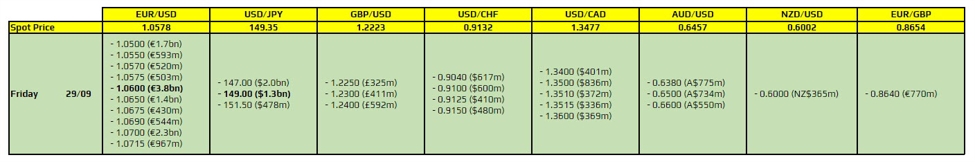

When it comes to trading in the forex market, there are certain events that traders need to be aware of in order to make informed decisions. One such event is the options expiry date, which can have a significant impact on price action. This is particularly true for major currency pairs like EUR/USD, where large expiries can act as key levels of support or resistance.

EUR/USD Options Expiries

For EUR/USD, one of the key option expiries to watch out for is at 1.0600. This is a relatively large expiry, which means that it could act as a strong level of defense at the figure level. Additionally, there are expiries at 1.0500 which could help to keep price action within a certain range before rolling off later in the month.

Overall, while there aren’t too many significant option expiries to be wary of at month-end and quarter-end, it is still important for traders to keep an eye on these levels as they can influence market sentiment and provide trading opportunities.

How This Impacts Traders

For traders in the forex market, being aware of key option expiries like the ones at 1.0600 and 1.0500 for EUR/USD is crucial. These levels can act as barriers to price movement and help traders anticipate potential reversals or breakouts. By understanding the significance of these expiries, traders can make more informed trading decisions and maximize profitability.

Global Impact

While individual traders may focus on specific currency pairs like EUR/USD, the impact of key option expiries extends beyond individual trades. Market participants around the world are watching these levels closely, as they can signal shifts in market sentiment and influence trading strategies on a larger scale. This interconnectedness highlights the importance of understanding and monitoring option expiries in the forex market.

Conclusion

In conclusion, quarter-end options expiries like the ones at 1.0600 and 1.0500 for EUR/USD play a crucial role in shaping market dynamics and trader behavior. By staying informed and attentive to these key levels, traders can navigate market volatility with more confidence and seize profitable opportunities.