National Australia Bank Inflation Data Preview

Implications for the Reserve Bank of Australia

Overview

On Wednesday, 26 April 2023, at 11:30 am Sydney time, Australia will release its latest inflation data for the first quarter. This data is highly anticipated as it will provide insights into the state of the economy and potentially impact the Reserve Bank of Australia’s decision-making at their upcoming meeting on May 2.

Expectations

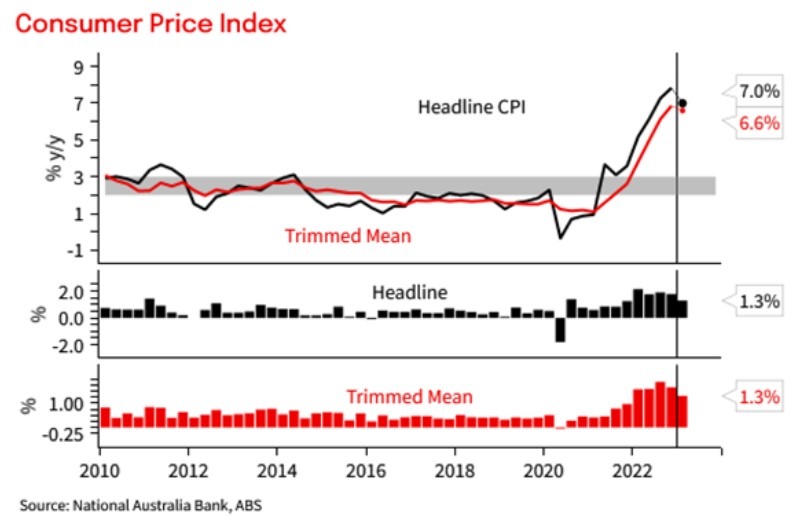

We expect the Q1 CPI to confirm that inflation peaked in Q4 2022 and has since decelerated more than what was initially projected by the RBA in February. Specifically, we anticipate trimmed mean inflation to come in at 1.3% q/q (6.6% y/y), slightly softer than the RBA’s previous forecasts. This indicates a gradual easing of price pressures in the Australian economy.

Implications

The lower-than-expected inflation figures could influence the RBA’s monetary policy decisions in the near future. If inflation remains subdued, the central bank may choose to maintain its current accommodative stance to support economic growth. However, a significant deviation from the expected numbers could prompt the RBA to consider adjusting interest rates or other policy measures to manage inflation expectations.

How Will This Affect Me?

Personal Finance

For individual consumers, lower inflation typically translates to stable or even decreasing prices for goods and services. This can be beneficial for households as it helps preserve the purchasing power of their income. However, if inflation remains persistently low, it could also signal weaker overall economic activity, potentially impacting job opportunities and wage growth in the long run.

How Will This Affect the World?

Global Economy

The trends in Australian inflation data are closely watched by international investors and policymakers as they can signal broader economic conditions. A decrease in inflation rates could indicate a slowdown in global demand or a shift in commodity prices, which could have ripple effects on financial markets worldwide. It may also influence central banks in other countries to reconsider their own monetary policy strategies based on the outcomes in Australia.

Conclusion

Key Takeaways

The upcoming release of Australia’s inflation data is expected to show a moderation in price pressures, indicating a gradual return to more sustainable levels of inflation. This has implications for the Reserve Bank of Australia’s future policy decisions and could potentially impact personal finances and the global economy. As investors await the results, it will be crucial to monitor the data closely for signs of any unexpected shifts in inflation dynamics.