EUR/USD Near Parity: A Sticky Situation

The Situation

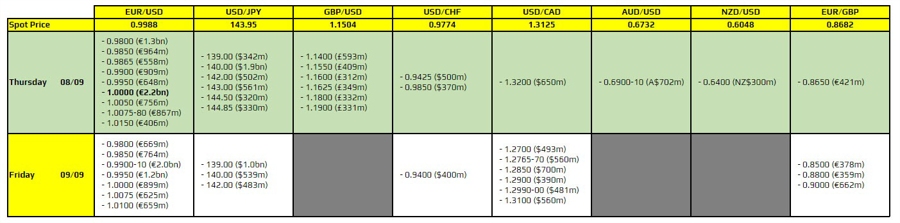

There is just one thing to take note of, as highlighted in bold. That being for EUR/USD near parity, so that is likely to keep price action more sticky around current levels before the ECB policy decision later in the day. Besides that, just be wary of talk of knock out options for USD/J…

What Does This Mean?

The concept of EUR/USD nearing parity is a significant event in the world of forex trading. When two major currencies like the Euro and the US Dollar are close to being equal in value, it can have far-reaching implications for traders and investors alike. The sticky price action around this level indicates that there is a level of uncertainty and hesitation in the market, as traders wait for the ECB policy decision to provide clarity on the future direction of the currencies.

For traders, this situation means that there could be increased volatility and potential trading opportunities as the market reacts to any new information from the ECB. It also highlights the importance of staying informed and being cautious of any sudden movements in the market.

On a global scale, the proximity of EUR/USD to parity can have ripple effects on various economies and financial markets around the world. The relationship between these two currencies is a key driver of international trade and investment, so any significant changes in their value can impact global economic stability.

How Will This Affect Me?

As an individual investor or trader, the near parity of EUR/USD could impact your portfolio and trading decisions. The sticky price action indicates a level of uncertainty in the market, which could lead to increased volatility and potential trading opportunities. It is important to stay informed and cautious of any sudden movements in the market to protect your investments.

How Will This Affect the World?

On a global scale, the proximity of EUR/USD to parity can have far-reaching implications for economies and financial markets worldwide. The relationship between these two major currencies is crucial for international trade and investment, so any significant changes in their value can impact global economic stability. The uncertainty in the market could lead to increased volatility and potential risks for investors and businesses operating on a global scale.

Conclusion

In conclusion, the near parity of EUR/USD is a significant event in the world of forex trading with potential implications for individual traders and the global economy. It is crucial to stay informed and cautious in the face of increased volatility and uncertainty in the market. The sticky price action around this level highlights the importance of being prepared for any sudden movements and adapting your trading strategy accordingly.