Is Volvo AB Overvalued? Let’s Dive into the Numbers

The Current State of Volvo AB

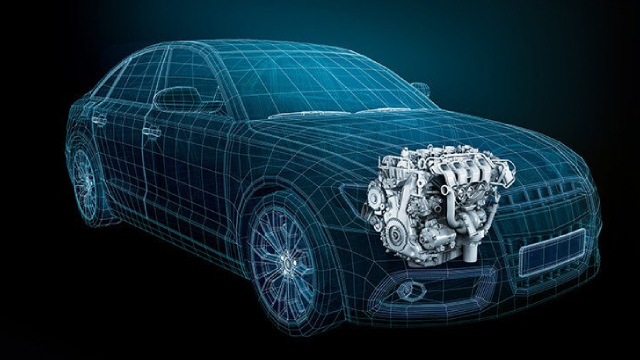

Volvo AB, a leading truck and machinery manufacturer, has been a staple in the industry for years. However, recent market analysis shows that the company may be overvalued at 270 SEK/share. This has led many investors to rethink their positions on the stock, with some even considering selling.

Should You “Hold” or “Sell”?

According to experts, Volvo AB is currently a “Hold” with a target price of 255 SEK/share. While the company has strong fundamentals and an excellent credit rating, recent Q3 2024 results show negative sales growth and declining margins. This indicates a downcycle trend, which justifies the current “Hold” rating.

For those looking to invest in Volvo AB, it may be wise to wait for a lower valuation before purchasing. This could provide significant upside potential in the long run, especially if the company is able to bounce back from its recent downturn.

How Does This Affect You?

As an investor, the current valuation of Volvo AB may have an impact on your portfolio. If you already own shares in the company, it may be a good idea to hold onto them for now and wait for a better opportunity to sell. If you were considering buying, it might be worth waiting for a lower valuation before making a decision.

How Does This Affect the World?

Volvo AB is a major player in the truck and machinery manufacturing industry, so any changes in its valuation can have ripple effects throughout the market. If the company is able to turn around its negative sales growth and margins, it could signal a positive shift for the industry as a whole. However, if Volvo AB continues to struggle, it could lead to increased competition and consolidation within the market.

Conclusion

While Volvo AB may be currently overvalued, there is still hope for the company to bounce back and regain its footing in the market. As an investor, it’s important to stay informed about the company’s performance and make decisions based on thorough analysis. By keeping an eye on the stock and waiting for a more favorable valuation, you may be able to capitalize on potential upside in the future.