It’s finally the US CPI Day: What to Expect

The Moment Market’s Have Been Waiting For

Markets around the world have been eagerly awaiting the release of the US CPI data. This data is crucial as it will likely lead to a more sustained trend in the financial markets. Along with the CPI data, the US Retail Sales figures will also be released at the same time, but unless there are any huge surprises, they may not have as much of an impact.

US CPI Release Time

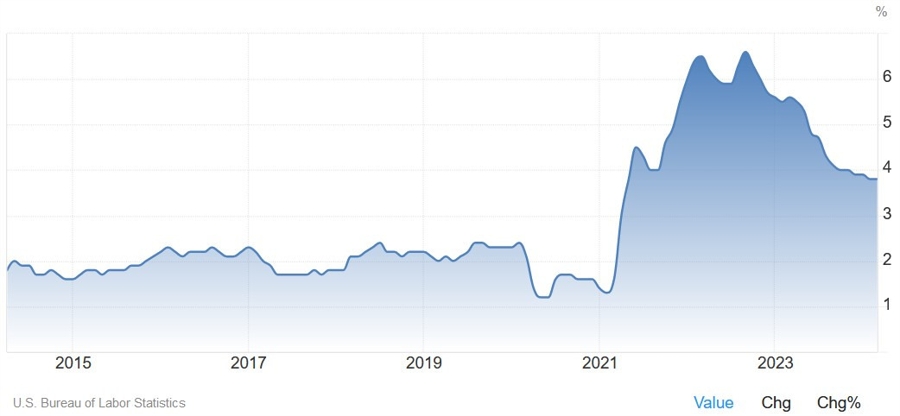

The US CPI data is set to be released at 12:30 GMT (08:30 ET). Analysts are expecting the Year-over-Year CPI to come in at 3.4%, slightly below the previous figure of 3.5%. The Month-over-Month CPI measure is forecasted to remain steady at 0.4%. The Core CPI Year-over-Year is expected to be at 3.6%, lower than the previous reading of 3.8%. The Month-over-Month Core CPI is expected to come in at 0.3%.

Investors and traders will be closely watching these numbers as they can have a significant impact on the financial markets. Any deviation from the expected figures could lead to increased volatility in the markets.

Overall, the US CPI data is a key economic indicator that provides insight into the level of inflation in the country. It is closely monitored by the Federal Reserve and can influence their decisions on monetary policy.

Impact on Me

The US CPI data can have a direct impact on my personal finances. If inflation is higher than expected, it could mean that the cost of goods and services will increase, leading to higher expenses for me as a consumer. On the other hand, if inflation is lower than expected, it could signal a weaker economy, which may affect my job security and overall financial well-being.

Impact on the World

The US CPI data not only affects the domestic economy but also has a ripple effect on the global financial markets. As the world’s largest economy, any significant changes in the US inflation rate can impact international trade, investment flows, and currency exchange rates. This can have far-reaching consequences for countries around the world.

Conclusion

In conclusion, the release of the US CPI data is a highly anticipated event that can have a significant impact on the financial markets and the global economy. Investors and traders will be closely monitoring the numbers to gauge the level of inflation in the US and its potential implications. It is important to stay informed about these economic indicators and their potential impact on personal finances and the broader economy.