The Impact of the European Central Bank’s Rate Cut Decision

What to Expect

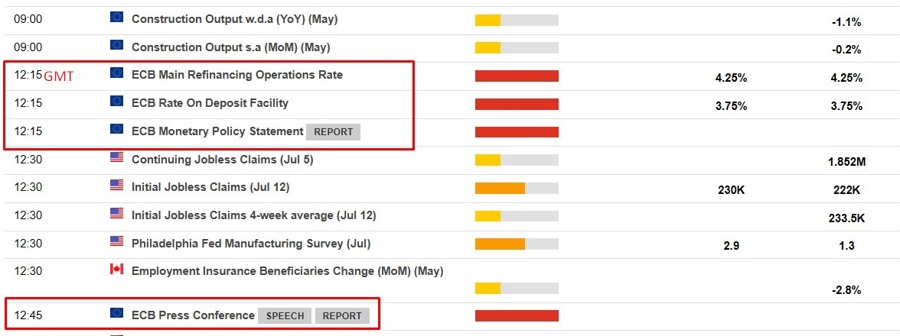

In June, the European Central Bank made the decision to decrease interest rates which were at a record high. However, for this month they are expected to maintain the current rates. While there is speculation about a potential rate cut in September, the guidance provided by the ECB is likely to be non-committal and may include certain conditions. The ECB’s announcement is scheduled for 0815 US Eastern time, followed by a press conference by Christine Lagarde half an hour later.

According to a Reuters report, the ECB is likely to emphasize their stance on decreasing inflation and their readiness to further ease monetary policy.

How This Decision Could Impact You

As a consumer or investor, the ECB’s rate cut decision can have several implications for you. If interest rates are lowered, borrowing costs may decrease, making it more affordable to take out loans for big purchases such as homes or cars. On the flip side, lower interest rates could mean lower returns on savings accounts and other investments. Additionally, a cut in rates could stimulate economic growth, potentially leading to increased job opportunities and overall prosperity.

Global Implications

The European Central Bank’s decision to cut rates can have a ripple effect on the global economy. Changes in interest rates in the Eurozone can impact exchange rates, trade flows, and investment decisions worldwide. As one of the major central banks, the ECB’s actions are closely watched by financial markets and policymakers around the world. Any shifts in monetary policy by the ECB can influence the economic outlook for both developed and emerging economies.

Conclusion

Overall, the European Central Bank’s rate cut decision has the potential to shape economic conditions both locally and globally. As we await the ECB’s announcement, the financial markets are poised for any signals or indications of future policy directions. The effects of the ECB’s decision will be closely monitored by individuals, businesses, and governments alike, as they navigate through the evolving landscape of monetary policy and its impacts on the economy.