Welcome to our latest blog post!

The Bank of Canada Holds Interest Rates Steady at 5%

In case you missed it, the Bank of Canada recently announced that they will be keeping the interest rates unchanged at 5%, which was in line with market expectations. This decision comes as the central bank continues to monitor the economic landscape and assess the ongoing impact of the global pandemic on the Canadian economy.

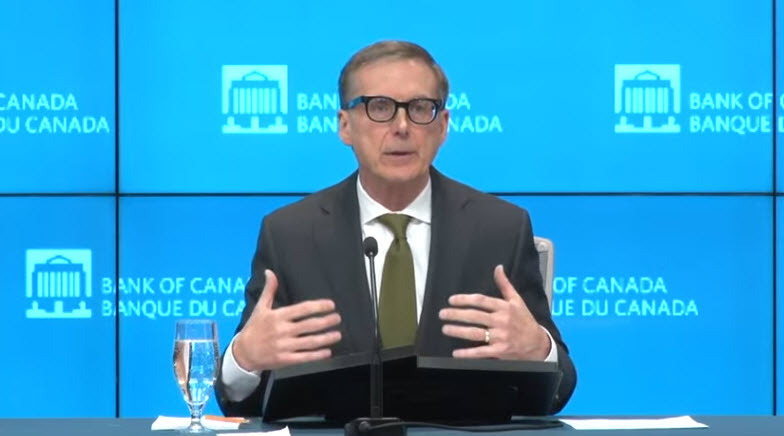

Insights from BOC’s Macklem

Bank of Canada Governor, Tiff Macklem, provided some key insights during a recent press conference following the rate decision. He emphasized that if core inflation remains stable, the bank may not meet its inflation forecast. Additionally, he highlighted that when looking beyond the impact of shelter costs, underlying inflation continues to persist.

The full statement from the Bank of Canada’s March interest rate decision outlined the rationale behind their decision to maintain the current interest rate. The central bank cited various factors influencing their decision, including ongoing global economic uncertainties and the need to support continued economic recovery in Canada.

Following the rate decision, Scotia Bank responded by noting that the market expectations for rate cuts in the upcoming months have been adjusted. The pricing for a potential rate cut in April has been reduced, with only a minimal chance of a cut being factored in. This trend suggests that the bank may be taking a more cautious approach to future monetary policy adjustments.

Impact on Individuals

For individuals, the Bank of Canada’s decision to hold interest rates steady can have both positive and negative implications. On one hand, stable interest rates can help keep borrowing costs low, making it more affordable for consumers to access credit for major purchases such as homes or cars. However, stagnant interest rates may also limit the returns on savings and investments, affecting individuals who rely on interest income for their financial goals.

Global Implications

The Bank of Canada’s decision to maintain interest rates at the current level can have broader implications for the global economy. As one of the major central banks, the Bank of Canada’s monetary policy decisions can influence the direction of global interest rates and the overall economic outlook. A stable interest rate environment in Canada may signal confidence in the country’s economic recovery, which could have a positive spillover effect on other economies around the world.

Conclusion

In conclusion, the Bank of Canada’s decision to hold interest rates steady at 5% reflects the central bank’s cautious approach to monetary policy amid ongoing economic uncertainties. While the decision may have varying impacts on individuals and the global economy, it underscores the importance of maintaining stability and supporting economic recovery in the face of external challenges.