The People’s Bank of China’s Influence on the Yuan Exchange Rate

Introduction

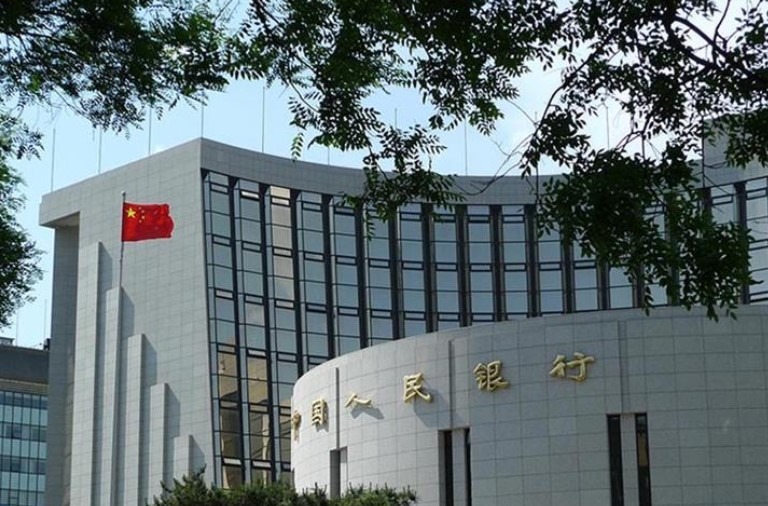

The People’s Bank of China (PBOC) plays a crucial role in determining the onshore yuan (CNY) reference rate, which sets the tone for trading sessions ahead. The exchange rate between the USD/CNY is closely monitored, as it is allowed to fluctuate within a 2% range of the daily reference rate. In contrast, the offshore yuan, known as CNH, has no trading restrictions in place. A significant deviation from the expected exchange rate is usually interpreted as a signal from the PBOC, indicating its stance on the yuan’s value.

Market Operations

During open market operations, the PBOC injected 235 billion yuan through a 7-day reverse repurchase agreement, setting the rate at 1.7%.

As we await further developments from the PBOC, it is essential to analyze the potential implications of their actions on the yuan exchange rate and global markets.

Impact on Individuals

For individuals, particularly those involved in international trade or investment, fluctuations in the yuan exchange rate can have significant consequences. A stronger or weaker yuan can impact the cost of imported goods, the value of overseas investments, and even travel expenses. Keeping a close eye on the PBOC’s actions and signals can help individuals make informed decisions regarding their financial strategies.

Global Implications

The PBOC’s influence on the yuan exchange rate extends far beyond China’s borders. As one of the largest economies in the world, China’s monetary policies have the power to influence global markets. A sudden shift in the yuan’s value could impact international trade, currency markets, and investor sentiment worldwide. It is essential for global players to stay informed about developments related to the yuan exchange rate and the PBOC’s actions.

Conclusion

In conclusion, the People’s Bank of China’s decisions regarding the yuan exchange rate have far-reaching implications both domestically and internationally. By closely monitoring the PBOC’s actions and signals, individuals and global markets can better navigate the ever-changing landscape of the foreign exchange market.