Volatile trend in Ethereum millionaire addresses highlights market dynamics in 2024

Onchain Highlights

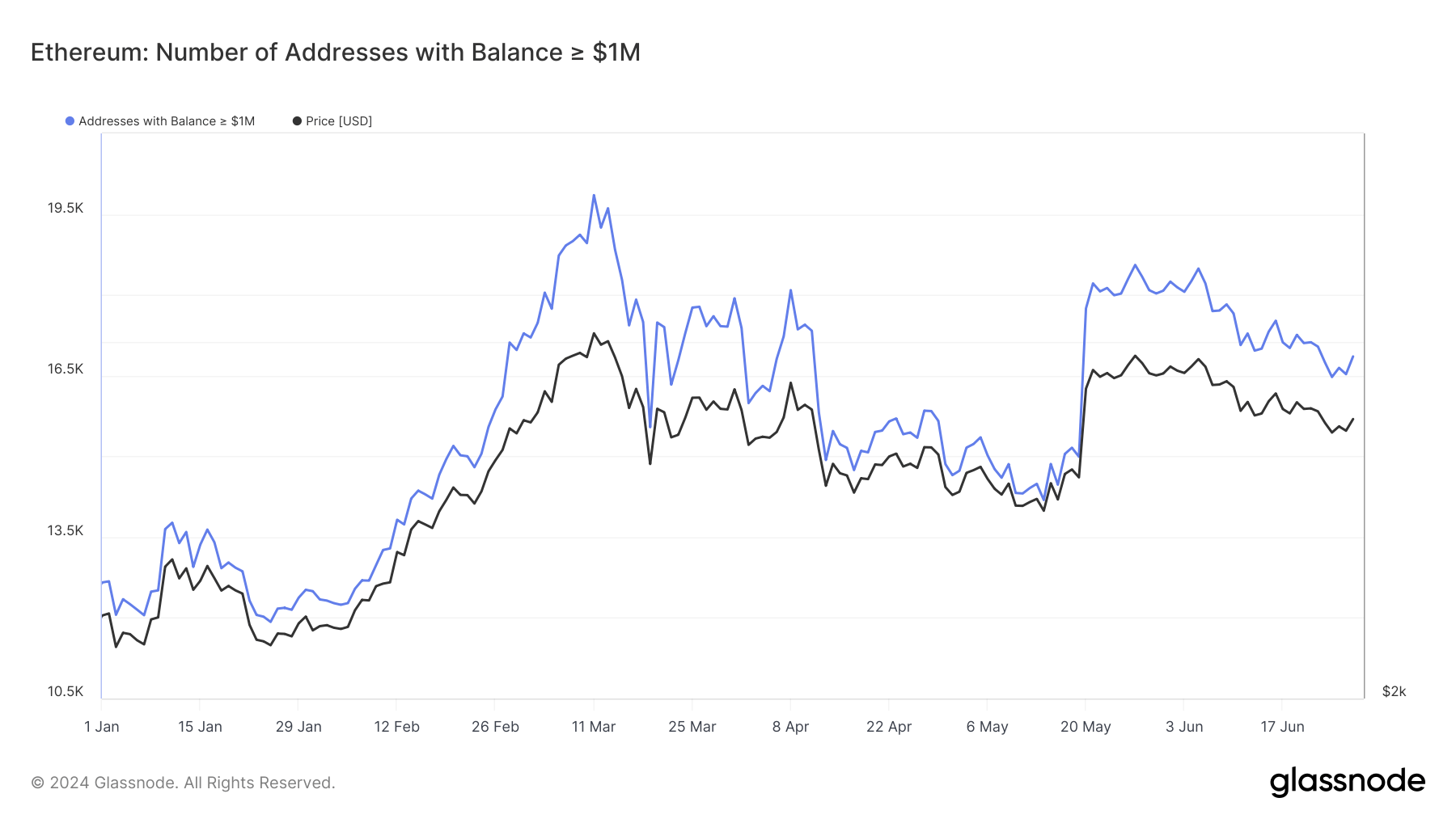

DEFINITION: The number of unique addresses holding at least a value of $1M USD. Ethereum addresses with balances exceeding $1 million have shown considerable fluctuation over the past six months. The number of such addresses increased sharply from mid-January to mid-March, peaking above 19,500. This period coincided with a significant rise in Ethereum’s price and market capitalization. However, since then, there has been a noticeable decline in the number of millionaire addresses, indicating a volatile trend in the market.

Market Dynamics

The fluctuation in the number of Ethereum millionaire addresses highlights the dynamic nature of the cryptocurrency market. As prices soar, more investors are able to amass wealth and reach the millionaire status. However, as prices correct, some investors may fall below the $1 million mark, leading to a decrease in the number of millionaire addresses. This ebb and flow of wealth distribution within the Ethereum network underscores the speculative nature of the market.

Investors should be cautious when interpreting the number of millionaire addresses as a sole indicator of market health. While a high number of millionaire addresses may indicate growing wealth and interest in Ethereum, a rapid decline could signal potential market instability and sell-offs. It is essential for investors to consider a variety of factors when making investment decisions, including market trends, technological developments, and regulatory changes.

Impact on Individuals

For individual investors, the volatile trend in Ethereum millionaire addresses may have a direct impact on their wealth and investment portfolio. Those who hold Ethereum and have reached the millionaire status may experience fluctuations in their net worth as the market ebbs and flows. It is crucial for individuals to monitor their investments closely and consider diversifying their holdings to mitigate risks associated with market volatility.

Global Implications

On a global scale, the fluctuation in Ethereum millionaire addresses reflects broader trends in the cryptocurrency market. As the number of millionaire addresses rises and falls, it can influence investor sentiment, market liquidity, and overall market stability. Governments and regulatory bodies may also monitor these trends closely to assess the potential impact on their economies and financial systems.

Conclusion

In conclusion, the volatile trend in Ethereum millionaire addresses highlights the dynamic and speculative nature of the cryptocurrency market in 2024. Investors should approach their investment decisions with caution and consider a range of factors beyond the number of millionaire addresses. The ebb and flow of wealth within the Ethereum network underscores the need for diversification and risk management strategies to navigate market uncertainties.