Goldman Sachs Raises April Inflation Forecast

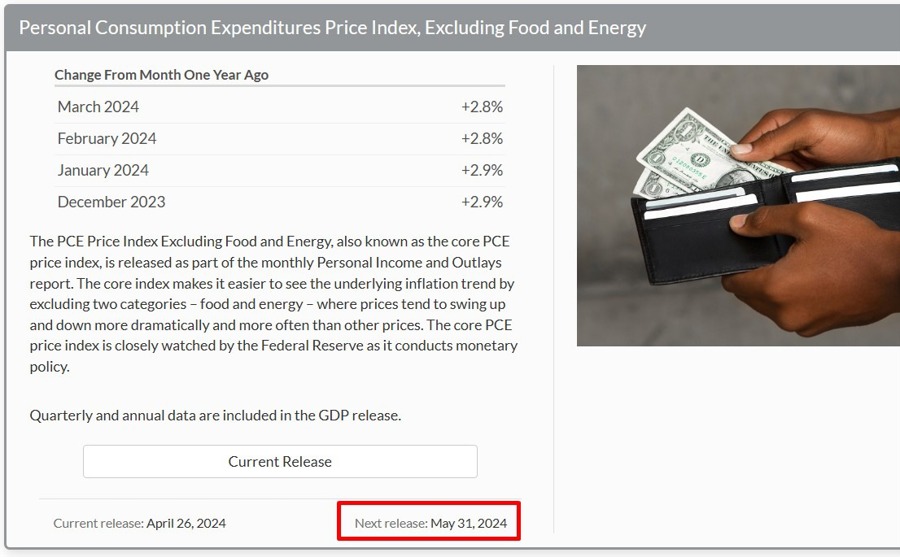

Goldman Sachs has recently increased their forecast for April core and headline PCE (Personal Consumption Expenditures) estimates by 1 basis point each. The new estimates are 0.26% for core PCE and 0.27% for headline PCE, up from the previous forecast of 0.3% for both.

What Does This Mean?

Just last week, the CPI (Consumer Price Index) report showed a slight improvement. While it may seem premature to be looking ahead to the PCE report, which is the Federal Reserve’s preferred inflation gauge, Goldman Sachs is already analyzing the data. While some traders like myself are still busy doodling lines on charts, the experts at Goldman Sachs are making bold predictions based on import prices and other economic factors.

How Will This Affect Me?

For consumers, an increase in inflation can mean higher prices for goods and services, which could impact your purchasing power. If inflation continues to rise, you may see an increase in the cost of living, including higher prices for everyday items like groceries, gas, and housing.

How Will This Affect the World?

The global economy could also feel the effects of rising inflation. With increased prices for goods and services, businesses may need to adjust their pricing strategies, which could impact international trade. Central banks around the world may also need to adjust their monetary policies in response to changing inflation rates.

Conclusion

Goldman Sachs’ updated forecast for April inflation signals a potential uptick in consumer prices, which could have implications for both individuals and the global economy. Keeping an eye on inflation trends and understanding how they may impact your finances is crucial in navigating uncertain economic times.