The US Dollar Rises as Treasury Yields Increase

The US dollar is currently trading at its highest levels of the day due to rising Treasury yields which are fueling demand for the currency. There has been a consistent 5 basis points move across the US curve, with US 10-year yields climbing up to 4.23%. This surge in yields could be seen as a rejection of the drop below 4.20% that occurred on Friday, or it could be a sign of skepticism following a decrease in yields from second-tier US economic data.

This week, investors are eagerly awaiting the release of top-tier economic numbers including ISM services and non-farm payrolls. These data points will provide valuable insights into the state of the US economy and could potentially impact the direction of the US dollar in the near future.

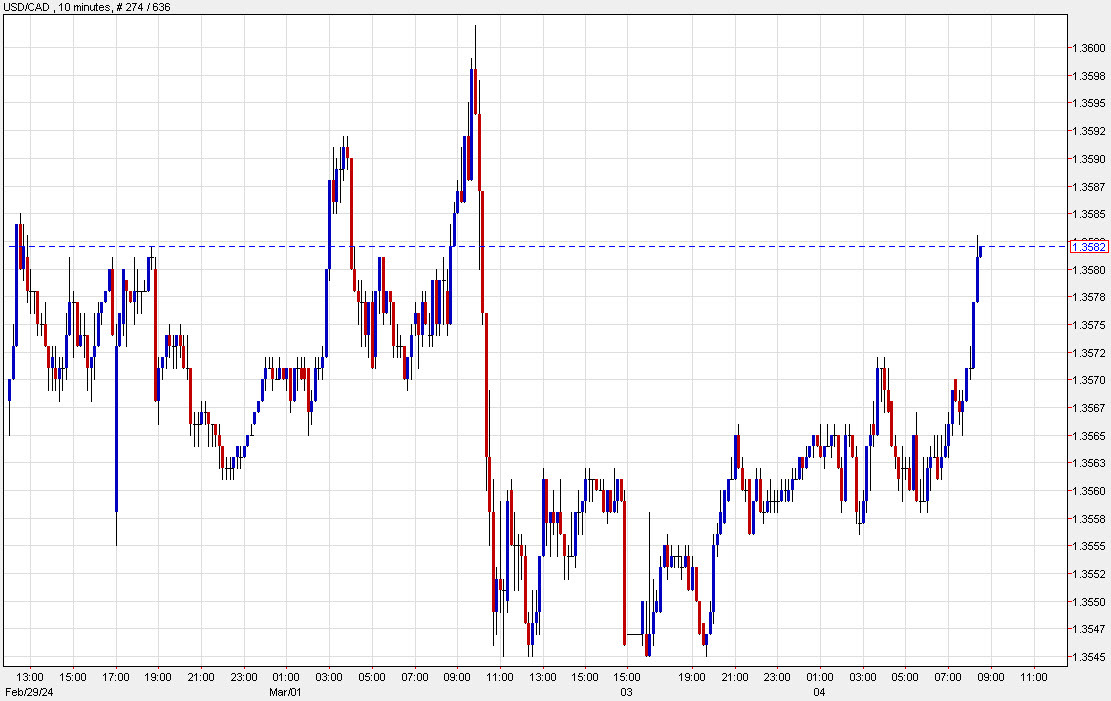

One particular currency pair that is showing strength at the start of North American trading is USD/CAD, as oil prices have dropped by 36 cents despite OPEC+ extending production cuts. This divergence in the movements of the US dollar and oil prices highlights the influence of various factors on currency trading.

Impact on Individuals

For individual traders and investors, the strengthening of the US dollar could have mixed implications. On one hand, a strong dollar can make imports cheaper and boost the purchasing power of consumers. However, for those holding foreign investments or planning international travel, a strong dollar could result in lower returns and increased costs.

Global Implications

The rise in the US dollar could have broader implications for the global economy. A strong dollar may put pressure on emerging market currencies and lead to capital outflows from these regions. Additionally, it could impact the competitiveness of US exports and potentially contribute to trade imbalances with other countries.

Conclusion

In conclusion, the current uptick in the US dollar driven by rising Treasury yields reflects the complex interplay of economic data and market sentiment. As investors await key economic indicators this week, the direction of the US dollar will continue to be influenced by a variety of factors both domestically and globally.