The Impact of the UK CPI Report on Monetary Policy Decision

Introduction

And this is one of, if not arguably the key report in settling that debate. Because the next UK CPI report for May will only come a day before the June monetary policy decision. So, what is the backdrop like as we head into the key release later?

Data Analysis

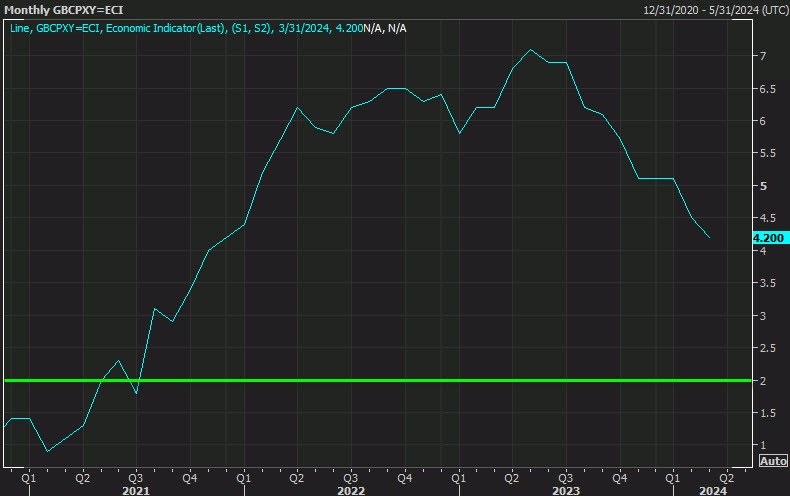

Let’s start off with the data itself. The expectations for the release shows that headline annual inflation is estimated to come in at 2.1% in April. That will mark the lowest reading since July 2021. The March reading was 3.2%, so that is a steep drop. H…

How will this affect me?

As a consumer, a lower inflation rate can be positive news for you. It means that the prices of goods and services are not rising as quickly, which can help stretch your budget further. This could lead to increased purchasing power and potentially lower interest rates on loans.

How will this affect the world?

The UK CPI report can have global implications as well. A lower inflation rate in the UK could signal a slowing economy, which may impact global trade and investment. It could also influence the decisions of other central banks around the world, as they assess their own monetary policies in response to economic trends.

Conclusion

In conclusion, the upcoming UK CPI report for May will play a crucial role in the June monetary policy decision. The expected decrease in inflation could have varying effects on individuals and the global economy, making it a report worth keeping a close eye on.